- United States

- /

- Banks

- /

- NasdaqGS:CBSH

Have Commerce Bancshares, Inc. (NASDAQ:CBSH) Insiders Been Selling Their Stock?

Some Commerce Bancshares, Inc. (NASDAQ:CBSH) shareholders may be a little concerned to see that the President, John Kemper, recently sold a whopping US$771k worth of stock at a price of US$63.85 per share. However, that sale only accounted for 7.8% of their holding, so arguably it doesn't say much about their conviction.

See our latest analysis for Commerce Bancshares

Commerce Bancshares Insider Transactions Over The Last Year

Over the last year, we can see that the biggest insider sale was by the Director, Jonathan Kemper, for US$5.0m worth of shares, at about US$64.63 per share. That means that an insider was selling shares at around the current price of US$63.88. While we don't usually like to see insider selling, it's more concerning if the sales take place at a lower price. In this case, the big sale took place at around the current price, so it's not too bad (but it's still not a positive).

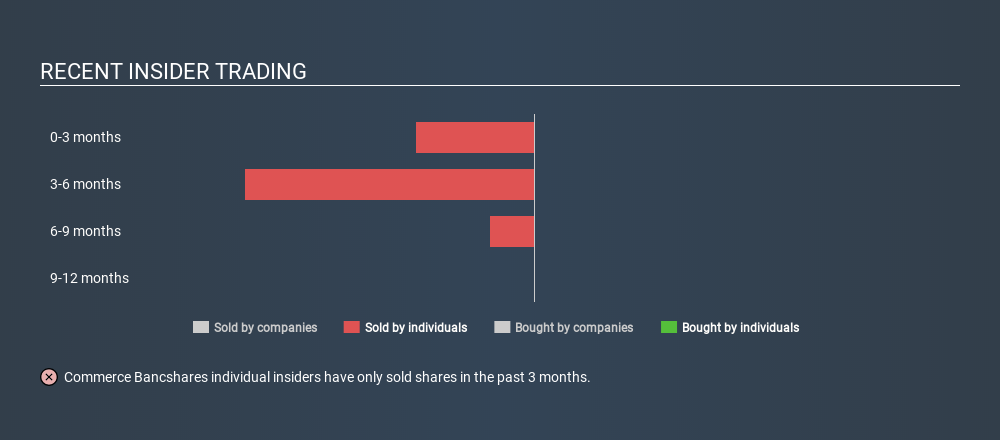

Commerce Bancshares insiders didn't buy any shares over the last year. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

If you are like me, then you will not want to miss this free list of growing companies that insiders are buying.

Insider Ownership of Commerce Bancshares

Many investors like to check how much of a company is owned by insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. It's great to see that Commerce Bancshares insiders own 3.1% of the company, worth about US$223m. This kind of significant ownership by insiders does generally increase the chance that the company is run in the interest of all shareholders.

So What Does This Data Suggest About Commerce Bancshares Insiders?

Insiders sold stock recently, but they haven't been buying. And there weren't any purchases to give us comfort, over the last year. While insiders do own a lot of shares in the company (which is good), our analysis of their transactions doesn't make us feel confident about the company. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. In terms of investment risks, we've identified 1 warning sign with Commerce Bancshares and understanding this should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NasdaqGS:CBSH

Commerce Bancshares

Operates as the bank holding company for Commerce Bank that provides retail, mortgage banking, corporate, investment, trust, and asset management products and services to individuals and businesses in the United States.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)