Great Wall Motor Company Limited's (HKG:2333) 28% Price Boost Is Out Of Tune With Earnings

Great Wall Motor Company Limited (HKG:2333) shares have continued their recent momentum with a 28% gain in the last month alone. The last 30 days bring the annual gain to a very sharp 93%.

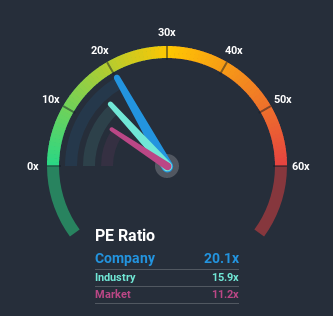

Following the firm bounce in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 11x, you may consider Great Wall Motor as a stock to avoid entirely with its 20.1x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Great Wall Motor has been doing quite well of late. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Great Wall Motor

Is There Enough Growth For Great Wall Motor?

The only time you'd be truly comfortable seeing a P/E as steep as Great Wall Motor's is when the company's growth is on track to outshine the market decidedly.

If we review the last year of earnings growth, the company posted a terrific increase of 35%. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 49% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 20% each year as estimated by the analysts watching the company. With the market predicted to deliver 19% growth per year, the company is positioned for a comparable earnings result.

In light of this, it's curious that Great Wall Motor's P/E sits above the majority of other companies. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Great Wall Motor's P/E?

Shares in Great Wall Motor have built up some good momentum lately, which has really inflated its P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Great Wall Motor currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Great Wall Motor that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

If you decide to trade Great Wall Motor, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:2333

Great Wall Motor

Engages in the manufacture and sale of automobiles, and automotive parts and components in the People's Republic of China, Europe, ASEAN countries, Latin America, the Middle East, Australia, South Africa, and internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives