- Saudi Arabia

- /

- Renewable Energy

- /

- SASE:2082

Global's July 2025 Top Picks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets continue to experience robust growth, with U.S. indices like the S&P 500 and Nasdaq Composite reaching record highs, investors are increasingly focused on identifying opportunities that may be undervalued in this bullish environment. In such a setting, a good stock is often one that is priced below its intrinsic value, offering potential for appreciation as market conditions evolve and economic indicators remain favorable.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥37.17 | CN¥74.86 | 50.3% |

| Taiwan Union Technology (TPEX:6274) | NT$229.00 | NT$455.73 | 49.8% |

| Serko (NZSE:SKO) | NZ$3.14 | NZ$6.27 | 49.9% |

| Nanya New Material TechnologyLtd (SHSE:688519) | CN¥42.98 | CN¥85.68 | 49.8% |

| Livero (TSE:9245) | ¥1715.00 | ¥3416.31 | 49.8% |

| Lectra (ENXTPA:LSS) | €24.80 | €49.36 | 49.8% |

| Lai Yih Footwear (TWSE:6890) | NT$286.00 | NT$571.27 | 49.9% |

| HL Holdings (KOSE:A060980) | ₩40950.00 | ₩81496.11 | 49.8% |

| cottaLTD (TSE:3359) | ¥429.00 | ¥856.60 | 49.9% |

| APAC Realty (SGX:CLN) | SGD0.475 | SGD0.95 | 49.8% |

We're going to check out a few of the best picks from our screener tool.

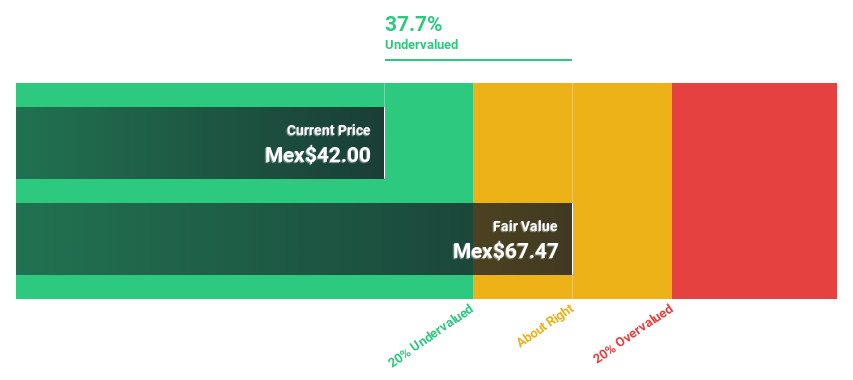

Megacable Holdings S. A. B. de C. V (BMV:MEGA CPO)

Overview: Megacable Holdings S. A. B. de C. V., along with its subsidiaries, operates in the installation, operation, and maintenance of cable television, internet, and telephone signal distribution systems and has a market cap of MX$47.82 billion.

Operations: The company's revenue segments include cable television, internet, and telephone signal distribution systems.

Estimated Discount To Fair Value: 21.3%

Megacable Holdings S.A.B. de C.V. is trading at MX$55.71, over 20% below its estimated fair value of MX$70.78, suggesting it may be undervalued based on cash flows despite a volatile share price. While earnings are forecast to grow significantly at 24.44% annually, faster than the Mexican market average, interest payments are not well covered by earnings and the dividend yield of 6% lacks coverage from current profits, highlighting potential financial vulnerabilities. Recent Q1 results showed increased sales but decreased net income year-over-year.

- Insights from our recent growth report point to a promising forecast for Megacable Holdings S. A. B. de C. V's business outlook.

- Dive into the specifics of Megacable Holdings S. A. B. de C. V here with our thorough financial health report.

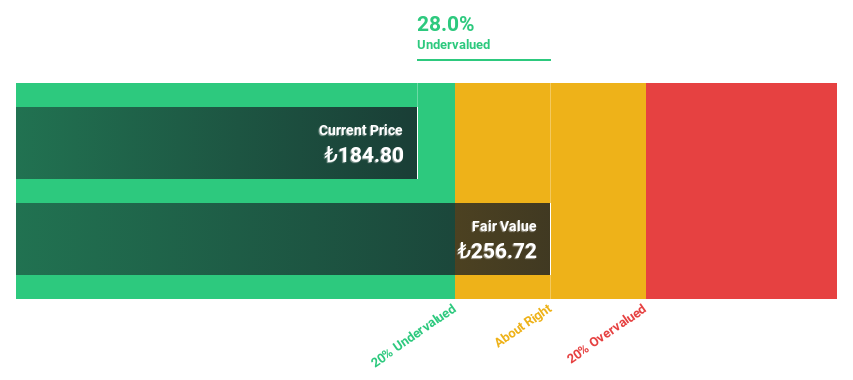

Dogus Otomotiv Servis ve Ticaret (IBSE:DOAS)

Overview: Dogus Otomotiv Servis ve Ticaret A.S. is an automotive importer and distributor in Turkey, with a market cap of TRY41.10 billion.

Operations: The company's revenue primarily comes from its automotive segment, generating TRY182.59 billion, with an additional contribution of TRY816.09 million from real estate activities.

Estimated Discount To Fair Value: 41.8%

Dogus Otomotiv Servis ve Ticaret, trading at TRY 186.8, is significantly undervalued compared to its estimated fair value of TRY 320.77. Despite a decline in Q1 net income to TRY 576.8 million from TRY 4,110.86 million last year and a reduced profit margin of 2.2%, revenue is expected to grow at an impressive rate of over 24% annually, outpacing the Turkish market average and indicating strong potential for future cash flow improvements.

- According our earnings growth report, there's an indication that Dogus Otomotiv Servis ve Ticaret might be ready to expand.

- Get an in-depth perspective on Dogus Otomotiv Servis ve Ticaret's balance sheet by reading our health report here.

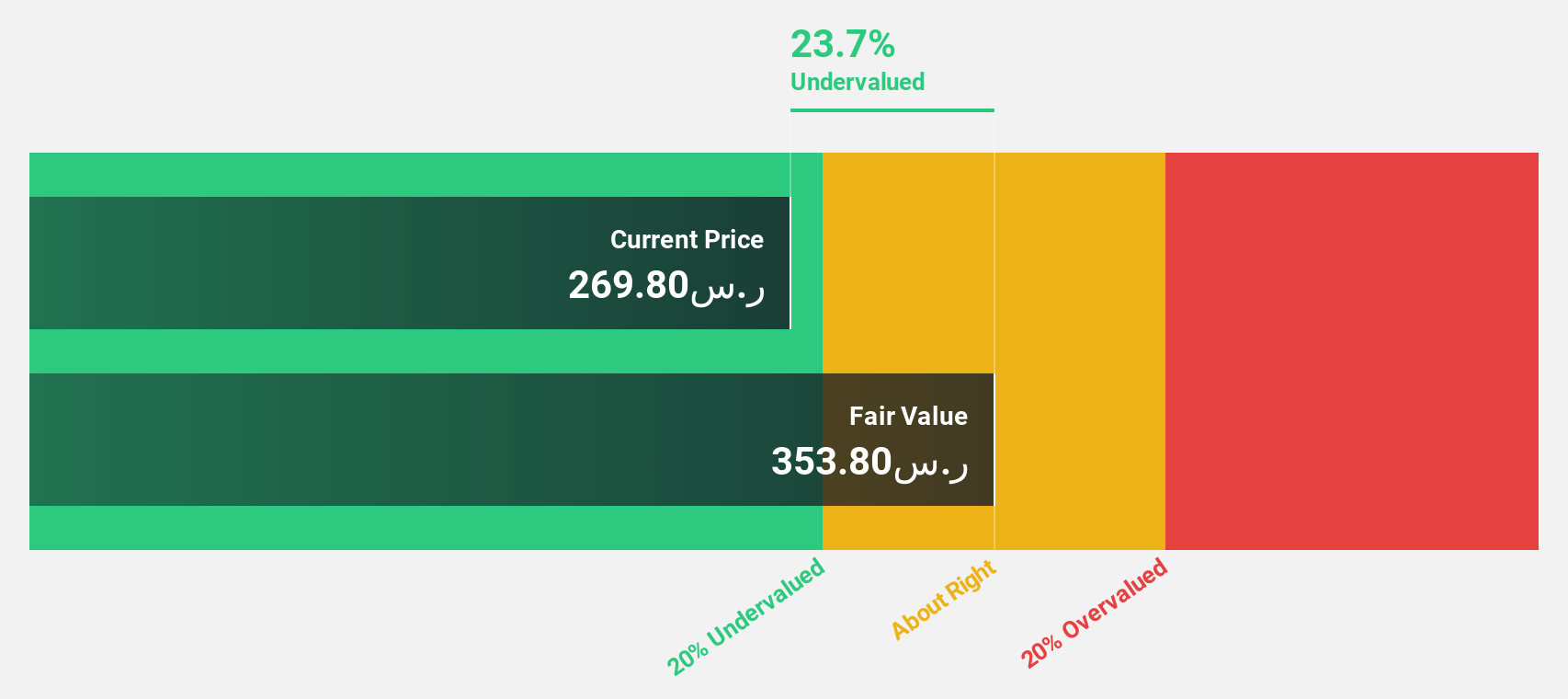

ACWA Power (SASE:2082)

Overview: ACWA Power Company, with a market cap of SAR180.21 billion, is involved in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants across the Kingdom of Saudi Arabia and regions including the Middle East, Asia, and Africa.

Operations: The company's revenue is primarily derived from its Thermal and Water Desalination segment, contributing SAR5.28 billion, followed by the Renewables segment at SAR1.72 billion.

Estimated Discount To Fair Value: 34.6%

ACWA Power is trading at SAR 265.6, significantly below its estimated fair value of SAR 406.29, indicating potential undervaluation based on cash flows. Despite recent share price volatility and interest payments not being well covered by earnings, the company's revenue and earnings are forecast to grow substantially at rates of 20.5% and 24.1% per year respectively, surpassing market averages in Saudi Arabia, highlighting strong future cash flow prospects amidst strategic partnerships in Southeast Asia's energy sector.

- Upon reviewing our latest growth report, ACWA Power's projected financial performance appears quite optimistic.

- Click here to discover the nuances of ACWA Power with our detailed financial health report.

Seize The Opportunity

- Take a closer look at our Undervalued Global Stocks Based On Cash Flows list of 473 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2082

ACWA Power

Engages in the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants in the Kingdom of Saudi Arabia, the Middle East, Asia, and Africa.

High growth potential low.

Similar Companies

Market Insights

Community Narratives