- Saudi Arabia

- /

- Energy Services

- /

- SASE:2381

Global Value Stock Picks For October 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by cautious Federal Reserve commentary and mixed economic signals, investors are keenly assessing the implications of steady inflation rates and modest GDP growth. In this environment, identifying undervalued stocks can be an attractive strategy for those looking to capitalize on potential market inefficiencies and price discrepancies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| XTPL (WSE:XTP) | PLN68.70 | PLN135.56 | 49.3% |

| Xiamen Amoytop Biotech (SHSE:688278) | CN¥84.05 | CN¥165.09 | 49.1% |

| Truecaller (OM:TRUE B) | SEK41.48 | SEK82.27 | 49.6% |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.87 | 49.8% |

| Takara Bio (TSE:4974) | ¥931.00 | ¥1829.46 | 49.1% |

| GigaVis (KOSDAQ:A420770) | ₩40800.00 | ₩81551.52 | 50% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥93.80 | 49.7% |

| Cosmax (KOSE:A192820) | ₩208500.00 | ₩414794.54 | 49.7% |

| Chanjet Information Technology (SEHK:1588) | HK$10.87 | HK$21.51 | 49.5% |

| Atea (OB:ATEA) | NOK143.80 | NOK282.14 | 49% |

We're going to check out a few of the best picks from our screener tool.

Arabian Drilling (SASE:2381)

Overview: Arabian Drilling Company is an onshore and offshore gas and oil rig drilling operator in Saudi Arabia with a market cap of SAR6.98 billion.

Operations: The company generates revenue from its operations primarily through Land Rigs, contributing SAR2.39 billion, and Off-Shore Rigs, contributing SAR1.10 billion.

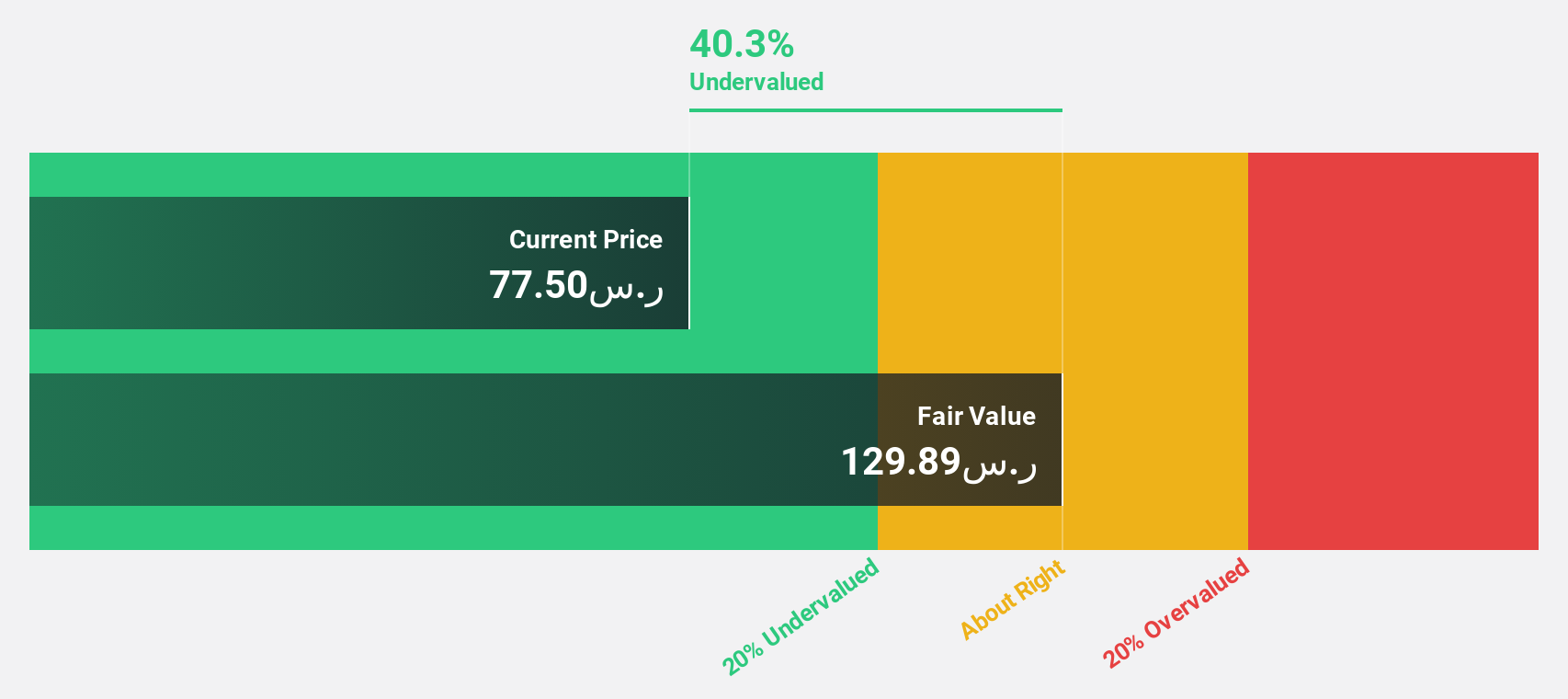

Estimated Discount To Fair Value: 37.4%

Arabian Drilling is trading significantly below its estimated fair value, presenting a potentially undervalued opportunity based on cash flows. Despite recent profit margin declines and paused dividends due to strategic investments, the company has secured substantial contract renewals and expansions, including a SAR 2.4 billion backlog intake. Earnings are expected to grow significantly over the next three years, outpacing the Saudi market's growth rate, although interest payments remain poorly covered by earnings.

- Our earnings growth report unveils the potential for significant increases in Arabian Drilling's future results.

- Get an in-depth perspective on Arabian Drilling's balance sheet by reading our health report here.

MBC Group (SASE:4072)

Overview: MBC Group is a media and entertainment company with operations in the United Arab Emirates, Saudi Arabia, Egypt, Iraq, North Africa, and internationally, boasting a market cap of SAR11.90 billion.

Operations: The company's revenue is derived from three main segments: Shahid, contributing SAR1.22 billion; M&E Initiatives, generating SAR988.82 million; and Broadcasting and Other Commercial Activities, which accounts for SAR2.82 billion.

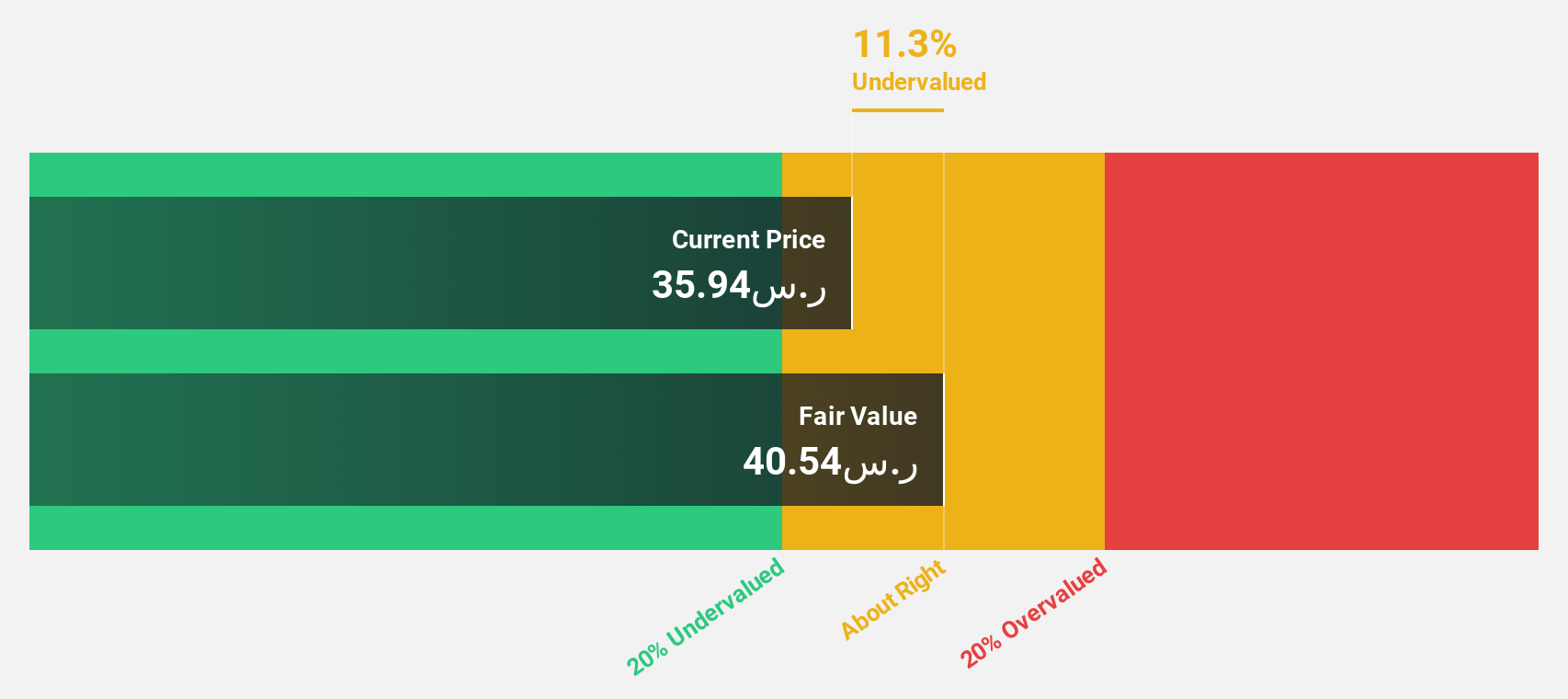

Estimated Discount To Fair Value: 10.3%

MBC Group is trading at SAR 36.36, slightly below its estimated fair value of SAR 40.54, indicating a modest undervaluation based on cash flows. Despite recent earnings decline to SAR 71.91 million in Q2 from SAR 116.49 million last year, revenue growth is projected to outpace the Saudi market at 7.3% annually. The Public Investment Fund's recent acquisition of a majority stake could influence future strategic direction and financial performance positively or negatively depending on execution.

- Our comprehensive growth report raises the possibility that MBC Group is poised for substantial financial growth.

- Navigate through the intricacies of MBC Group with our comprehensive financial health report here.

Venustech Group (SZSE:002439)

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥18.95 billion.

Operations: The company's revenue primarily comes from its Information Network Security segment, which generated CN¥2.85 billion.

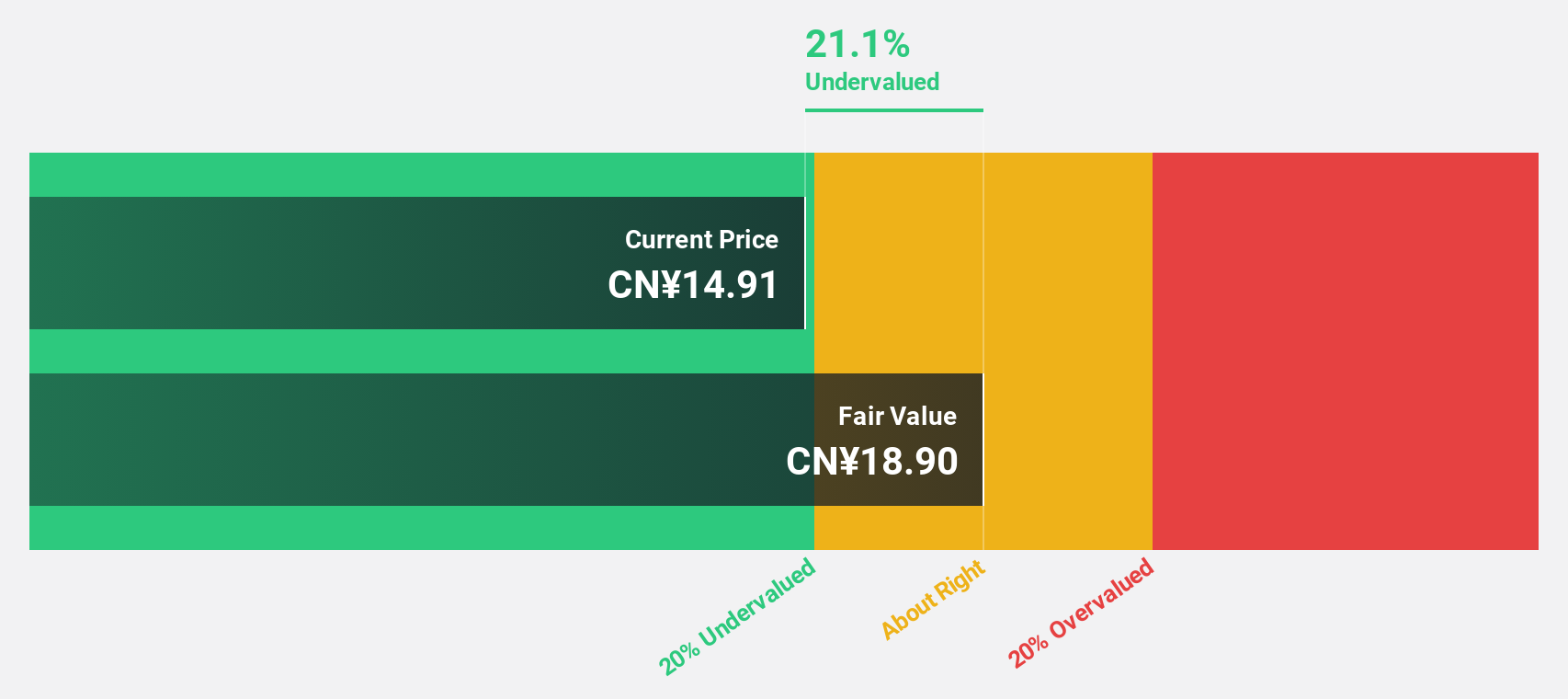

Estimated Discount To Fair Value: 21.9%

Venustech Group, trading at CN¥15.64, is significantly undervalued with an estimated fair value of CN¥20.03. Forecasts show earnings growth of 47.84% annually, with revenue expected to rise by 19.5% per year—outpacing the Chinese market's 14.1%. Despite its low projected return on equity of 3.5%, the company is set to become profitable within three years, reflecting above-average market growth potential based on cash flows.

- The growth report we've compiled suggests that Venustech Group's future prospects could be on the up.

- Unlock comprehensive insights into our analysis of Venustech Group stock in this financial health report.

Seize The Opportunity

- Gain an insight into the universe of 534 Undervalued Global Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:2381

Arabian Drilling

Operates as an onshore and offshore gas and oil rig drilling company in Saudi Arabia.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives