- Finland

- /

- Paper and Forestry Products

- /

- HLSE:STERV

Global Market Stocks Estimated To Be Trading At A Discount In October 2025

Reviewed by Simply Wall St

As global markets navigate through a period of cautious optimism, driven by mixed economic signals and hawkish commentary from central banks, investors are keenly assessing the landscape for opportunities. In this environment of fluctuating indices and tempered expectations for monetary policy easing, identifying stocks that may be undervalued becomes crucial for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Tibet GaoZheng Explosive (SZSE:002827) | CN¥38.57 | CN¥76.88 | 49.8% |

| Samyang Foods (KOSE:A003230) | ₩1512000.00 | ₩3006664.22 | 49.7% |

| Midsummer (OM:MIDS) | SEK2.76 | SEK5.45 | 49.3% |

| LINK Mobility Group Holding (OB:LINK) | NOK30.15 | NOK59.61 | 49.4% |

| Kolmar Korea (KOSE:A161890) | ₩77300.00 | ₩153922.72 | 49.8% |

| E-Globe (BIT:EGB) | €0.665 | €1.31 | 49.4% |

| Devsisters (KOSDAQ:A194480) | ₩48200.00 | ₩95431.37 | 49.5% |

| Dajin Heavy IndustryLtd (SZSE:002487) | CN¥47.21 | CN¥93.18 | 49.3% |

| Cosmax (KOSE:A192820) | ₩209000.00 | ₩413310.48 | 49.4% |

| Chanjet Information Technology (SEHK:1588) | HK$10.87 | HK$21.51 | 49.5% |

Here's a peek at a few of the choices from the screener.

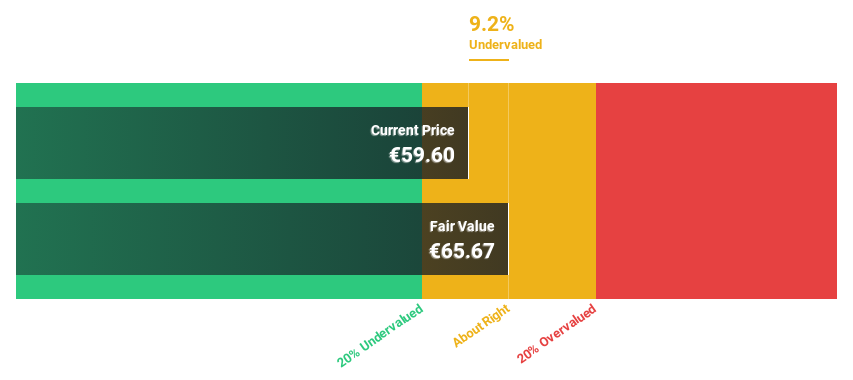

Recordati Industria Chimica e Farmaceutica (BIT:REC)

Overview: Recordati Industria Chimica e Farmaceutica S.p.A. is a pharmaceutical company that researches, develops, produces, and sells its products across various international markets including Italy and the United States, with a market cap of €10.93 billion.

Operations: Recordati generates revenue from two main segments: Rare Diseases, contributing €950.29 million, and Specialty & Primary Care, which brings in €1.53 billion.

Estimated Discount To Fair Value: 17.7%

Recordati Industria Chimica e Farmaceutica is trading at €53, below its estimated fair value of €64.38, indicating potential undervaluation based on cash flows. The company's earnings are forecast to grow 14.13% annually, outpacing the Italian market's 9.3%. Despite a high debt level and a dividend not well covered by free cash flows, revenue growth is expected to surpass the Italian market rate at 7.1% per year.

- The growth report we've compiled suggests that Recordati Industria Chimica e Farmaceutica's future prospects could be on the up.

- Click here to discover the nuances of Recordati Industria Chimica e Farmaceutica with our detailed financial health report.

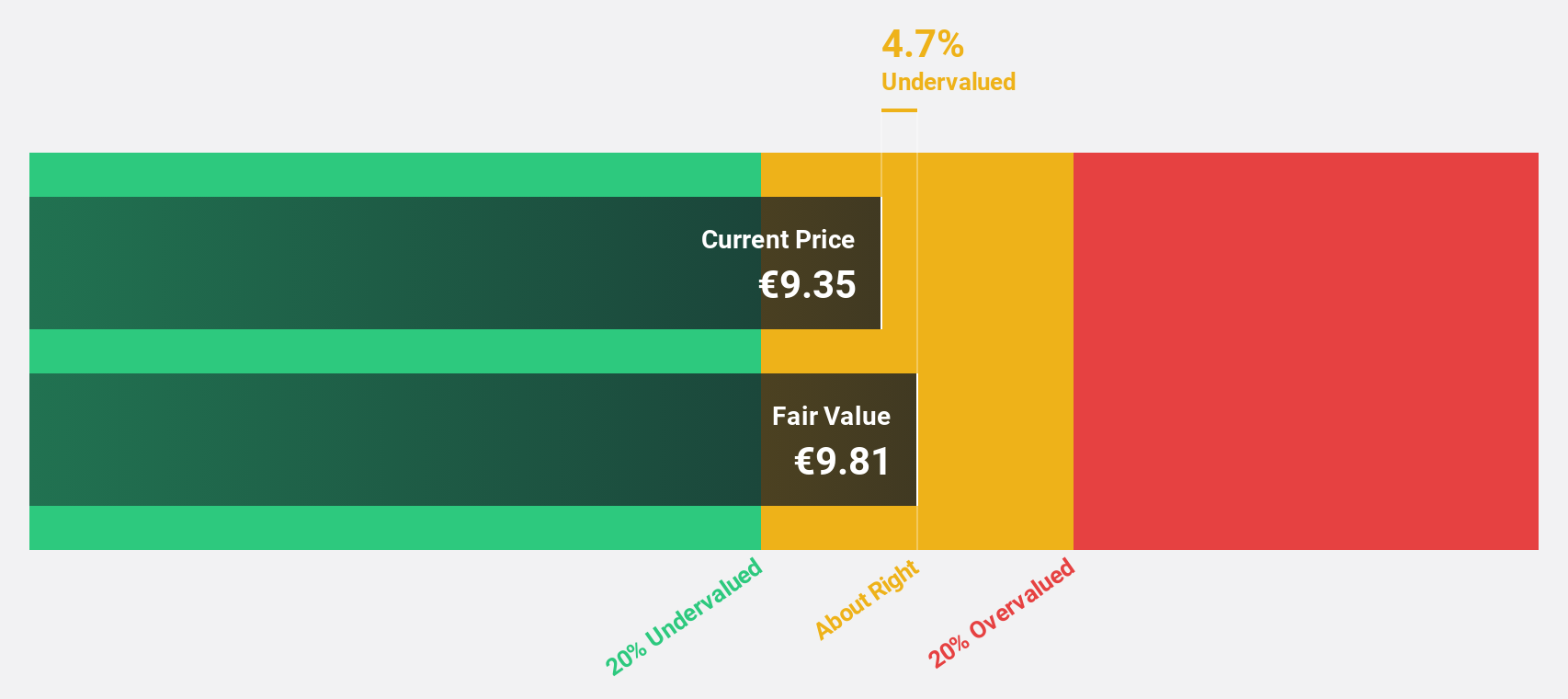

Stora Enso Oyj (HLSE:STERV)

Overview: Stora Enso Oyj offers renewable solutions for the packaging, biomaterials, wooden constructions, and paper industries both in Finland and internationally, with a market cap of €7.59 billion.

Operations: The company's revenue segments include Forest (€3.15 billion), Biomaterials (€1.57 billion), Wood Products (€1.67 billion), Packaging Materials (€4.58 billion), and Packaging Solutions (€1.02 billion).

Estimated Discount To Fair Value: 22.1%

Stora Enso Oyj, trading at €9.57, is below its estimated fair value of €12.29, suggesting it may be undervalued based on cash flows. Although revenue growth is projected to outpace the Finnish market at 4% annually, profitability remains a concern with low forecasted return on equity and dividends not well covered by earnings or free cash flows. Recent board changes include Marcus Wallenberg's election as Chair of the Shareholders’ Nomination Board.

- Upon reviewing our latest growth report, Stora Enso Oyj's projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Stora Enso Oyj's balance sheet health report.

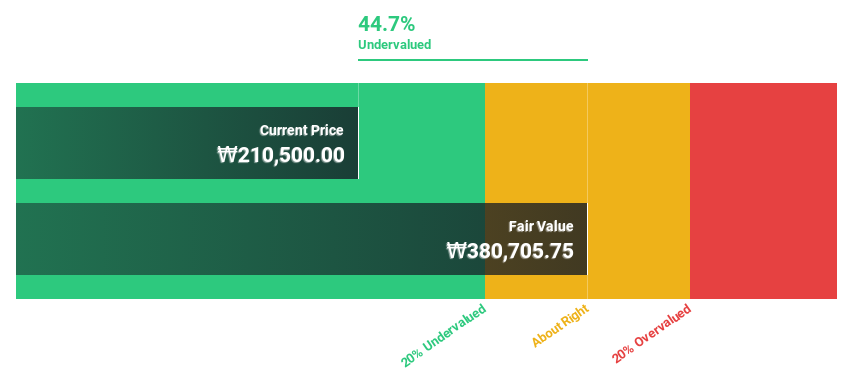

LS ELECTRIC (KOSE:A010120)

Overview: LS ELECTRIC Co., Ltd. offers smart energy solutions both in South Korea and internationally, with a market cap of ₩8.58 trillion.

Operations: The company's revenue is primarily derived from the Power Sector at ₩4.46 trillion, followed by the Metal Sector at ₩638.68 billion, the Automation Division at ₩577.30 billion, and the IT Sector at ₩127.55 billion.

Estimated Discount To Fair Value: 17.3%

LS ELECTRIC, priced at ₩290,500, is trading below its estimated fair value of ₩351,262.56. Despite this undervaluation based on cash flows, the stock isn't significantly below fair value. Earnings are expected to grow significantly at 27.4% annually over the next three years, outpacing both revenue growth and market averages in Korea. However, return on equity is forecasted to remain modest at 18.8%, which may temper investor expectations for profitability improvements.

- In light of our recent growth report, it seems possible that LS ELECTRIC's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of LS ELECTRIC stock in this financial health report.

Where To Now?

- Access the full spectrum of 536 Undervalued Global Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:STERV

Stora Enso Oyj

Provides renewable solutions for the packaging, biomaterials, wooden constructions, and paper industries in Finland and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion