Getting In Cheap On Spin Master Corp. (TSE:TOY) Might Be Difficult

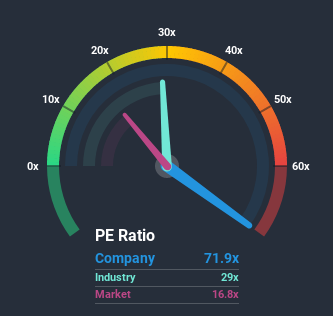

When close to half the companies in Canada have price-to-earnings ratios (or "P/E's") below 16x, you may consider Spin Master Corp. (TSE:TOY) as a stock to avoid entirely with its 71.9x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Spin Master has been struggling lately as its earnings have declined faster than most other companies. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. If not, then existing shareholders may be very nervous about the viability of the share price.

See our latest analysis for Spin Master

How Is Spin Master's Growth Trending?

In order to justify its P/E ratio, Spin Master would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 69%. As a result, earnings from three years ago have also fallen 72% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest earnings should grow by 48% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 28% per annum, which is noticeably less attractive.

With this information, we can see why Spin Master is trading at such a high P/E compared to the market. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Spin Master's P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Spin Master maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Unless these conditions change, they will continue to provide strong support to the share price.

There are also other vital risk factors to consider before investing and we've discovered 4 warning signs for Spin Master that you should be aware of.

If these risks are making you reconsider your opinion on Spin Master, explore our interactive list of high quality stocks to get an idea of what else is out there.

When trading Spin Master or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:TOY

Spin Master

A children’s entertainment company, engages in the creation, design, manufacture, licensing, and marketing of various toys, entertainment products, and digital games in North America, Europe, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives