- India

- /

- Specialty Stores

- /

- NSEI:FLFL

Future Lifestyle Fashions Limited's (NSE:FLFL) Shares May Have Run Too Fast Too Soon

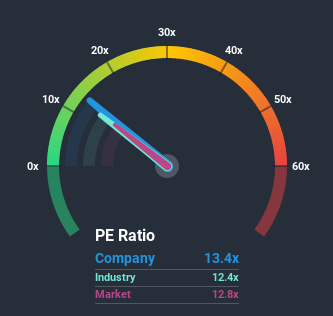

With a median price-to-earnings (or "P/E") ratio of close to 13x in India, you could be forgiven for feeling indifferent about Future Lifestyle Fashions Limited's (NSE:FLFL) P/E ratio of 13.4x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Future Lifestyle Fashions could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for Future Lifestyle Fashions

Does Future Lifestyle Fashions Have A Relatively High Or Low P/E For Its Industry?

We'd like to see if P/E's within Future Lifestyle Fashions' industry might provide some colour around the company's fairly average P/E ratio. The image below shows that the Specialty Retail industry as a whole also has a P/E ratio similar to the market. So it appears the company's ratio could be influenced considerably by these industry numbers currently. In the context of the Specialty Retail industry's current setting, most of its constituents' P/E's would be expected to be held back. Nonetheless, the greatest force on the company's P/E will be its own earnings growth expectations.

Does Growth Match The P/E?

Future Lifestyle Fashions' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 10.0%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 380% in total over the last three years. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Turning to the outlook, the next year should bring plunging returns, with earnings decreasing 85% as estimated by the four analysts watching the company. The market is also set to see earnings decline 4.3% but the stock is shaping up to perform materially worse.

With this information, it's perhaps strange that Future Lifestyle Fashions is trading at a fairly similar P/E in comparison. With earnings going quickly in reverse, it's not guaranteed that the P/E has found a floor yet. Maintaining these prices will be difficult to achieve as the weak outlook is likely to weigh down the shares eventually.

The Key Takeaway

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Future Lifestyle Fashions' analyst forecasts revealed that its even shakier outlook against the market isn't impacting its P/E as much as we would have predicted. When we see a weak earnings outlook, we suspect the share price is at risk of declining, sending the moderate P/E lower. We're also cautious about the company's ability to resist even greater pain to its business from the broader market turmoil. This places shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 4 warning signs with Future Lifestyle Fashions (at least 1 which shouldn't be ignored), and understanding these should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Future Lifestyle Fashions, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:FLFL

Future Lifestyle Fashions

Operates as an integrated fashion company in India.

Low with weak fundamentals.

Similar Companies

Market Insights

Community Narratives