- Sweden

- /

- Healthtech

- /

- OM:MEDHLP

ForFarmers And 2 Other European Penny Stocks To Consider

Reviewed by Simply Wall St

The European market has recently experienced a boost, with the STOXX Europe 600 Index rising by 1.32% amid easing trade tensions and promises of economic stimulus in Germany. In this context, penny stocks—though an outdated term—remain a relevant area for investors seeking potential growth opportunities at lower price points. These stocks, often representing smaller or newer companies, can offer significant upside when they are backed by strong financials and strategic positioning in the market.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Orthex Oyj (HLSE:ORTHEX) | €4.52 | €80.27M | ✅ 4 ⚠️ 1 View Analysis > |

| Maps (BIT:MAPS) | €3.50 | €46.49M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Cellularline (BIT:CELL) | €2.81 | €59.27M | ✅ 4 ⚠️ 2 View Analysis > |

| Fondia Oyj (HLSE:FONDIA) | €4.63 | €17.31M | ✅ 2 ⚠️ 3 View Analysis > |

| Abak (WSE:ABK) | PLN4.22 | PLN11.37M | ✅ 2 ⚠️ 4 View Analysis > |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.545 | SEK2.44B | ✅ 4 ⚠️ 1 View Analysis > |

| Hifab Group (OM:HIFA B) | SEK3.74 | SEK227.54M | ✅ 2 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.11 | €291.32M | ✅ 3 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.988 | €33.32M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 326 stocks from our European Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ForFarmers (ENXTAM:FFARM)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: ForFarmers N.V. operates as a provider of feed solutions for both conventional and organic livestock farming across several countries including the Netherlands, the United Kingdom, Germany, Poland, and Belgium with a market cap of €353.98 million.

Operations: The company generates revenue of €2.75 billion from its food processing segment.

Market Cap: €353.98M

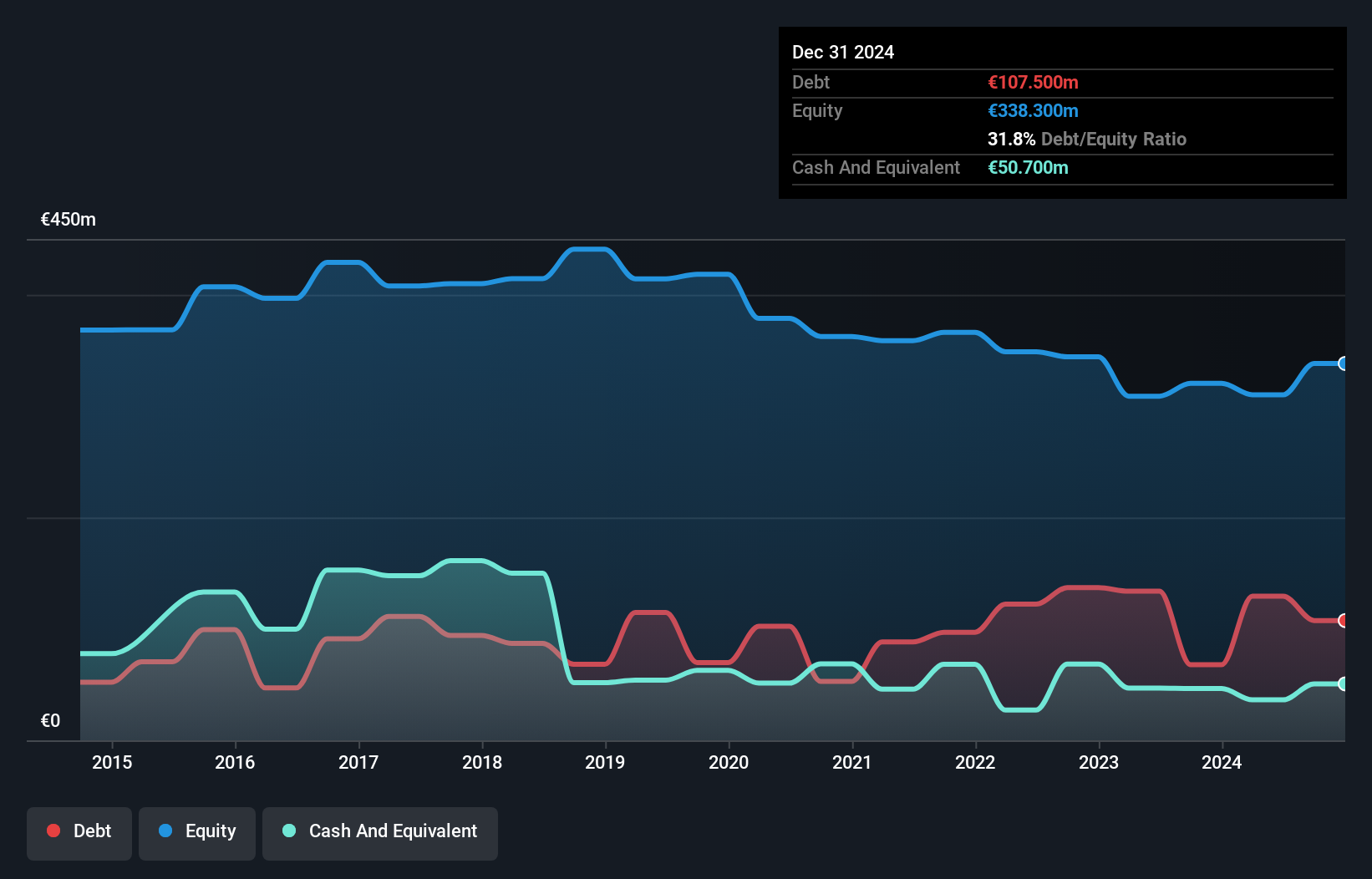

ForFarmers N.V. shows a mixed profile as a penny stock, with strengths in financial stability and challenges in profitability consistency. The company's debt is well managed, with operating cash flow covering 65.3% of its debt and interest payments covered 7.3 times by EBIT. Short-term assets exceed both short-term and long-term liabilities, suggesting solid liquidity management. However, the company has an unstable dividend history and low return on equity at 10.1%. Recent share buyback activities indicate efforts to enhance shareholder value amidst volatility concerns stabilized over the past year at 4%. Despite becoming profitable recently, earnings growth remains uncertain due to past declines.

- Unlock comprehensive insights into our analysis of ForFarmers stock in this financial health report.

- Examine ForFarmers' earnings growth report to understand how analysts expect it to perform.

Instabank (OB:INSTA)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Instabank ASA offers a range of banking products and services in Norway with a market capitalization of NOK 960.78 million.

Operations: Instabank ASA has not reported any specific revenue segments.

Market Cap: NOK960.78M

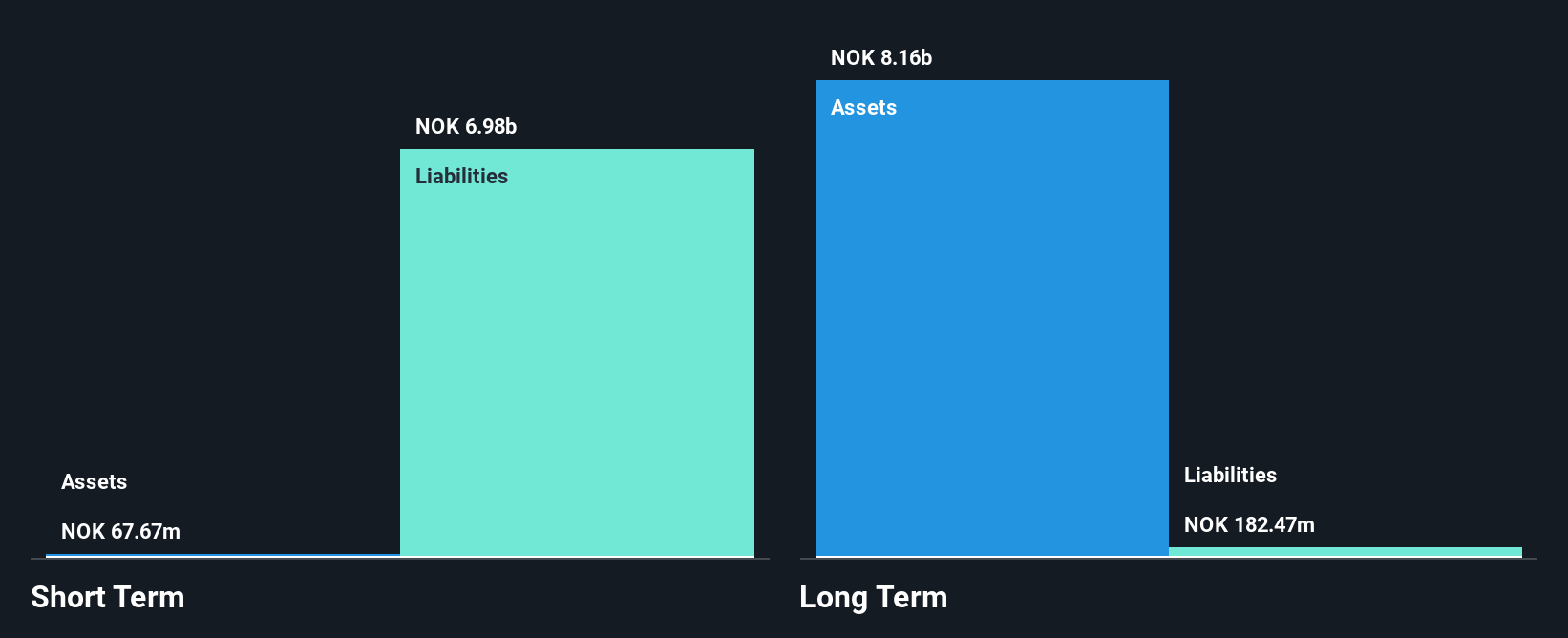

Instabank ASA presents a compelling case as a penny stock with its strategic expansion and solid financial metrics. The bank's recent partnership with smartmiete.de enhances its presence in Germany, aligning with its Northern European growth strategy. Financially, Instabank trades at a good value relative to peers, though it faces challenges like high non-performing loans at 8.4%. Despite this, earnings have grown by 8% over the past year and are forecasted to grow by 15.07% annually. With primarily low-risk funding from customer deposits and stable weekly volatility of 4%, Instabank maintains financial stability amidst market fluctuations.

- Click here and access our complete financial health analysis report to understand the dynamics of Instabank.

- Understand Instabank's earnings outlook by examining our growth report.

Medhelp Care Aktiebolag (OM:MEDHLP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Medhelp Care Aktiebolag (OM:MEDHLP) is a software-as-a-service company that operates a health platform focusing on data-driven corporate health support in Sweden and Denmark, with a market cap of SEK133.30 million.

Operations: The company's revenue is primarily generated from its healthcare software segment, which accounts for SEK91.31 million.

Market Cap: SEK133.3M

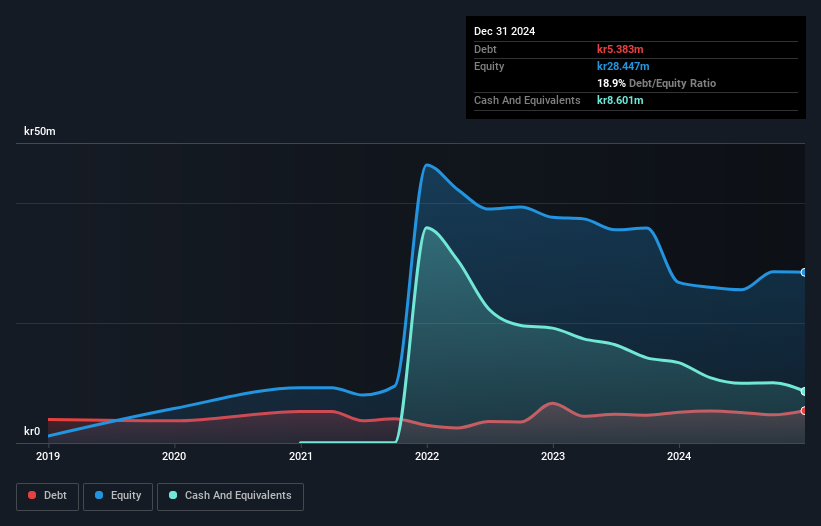

Medhelp Care Aktiebolag demonstrates potential within the penny stock arena, having recently transitioned to profitability with net income of SEK1.74 million for Q1 2025, compared to a loss last year. The company trades at a significant discount relative to its estimated fair value and has maintained high-quality earnings. Despite experiencing share price volatility, Medhelp's financial health is robust; it holds more cash than debt and covers interest payments comfortably with EBIT. The management and board are experienced, adding stability as the company forecasts strong earnings growth of 31.36% annually, outpacing industry trends in healthcare services.

- Click to explore a detailed breakdown of our findings in Medhelp Care Aktiebolag's financial health report.

- Assess Medhelp Care Aktiebolag's future earnings estimates with our detailed growth reports.

Next Steps

- Navigate through the entire inventory of 326 European Penny Stocks here.

- Ready To Venture Into Other Investment Styles? Outshine the giants: these 22 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:MEDHLP

Medhelp Care Aktiebolag

A software-as-a-service company, operates a health platform for data-driven corporate health and supports in Sweden and Denmark.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives