- United States

- /

- Logistics

- /

- NYSE:FDX

FedEx (NYSE:FDX) Increases Annual Dividend by 5% to US$5.80 Per Share

Reviewed by Simply Wall St

FedEx (NYSE:FDX) recently increased its annual dividend rate by 5%, highlighting its commitment to delivering shareholder value. Over the past month, the company's shares rose by 2%, in line with the broader market's positive movement. The dividend announcement likely reinforced FedEx's positive trajectory within the context of the company's ongoing privacy enhancements with clients. Meanwhile, the market was buoyed by optimism surrounding U.S.-China trade talks and strong corporate earnings reports, creating a favorable backdrop for FedEx's performance in conjunction with these broader trends.

Every company has risks, and we've spotted 1 warning sign for FedEx you should know about.

Find companies with promising cash flow potential yet trading below their fair value.

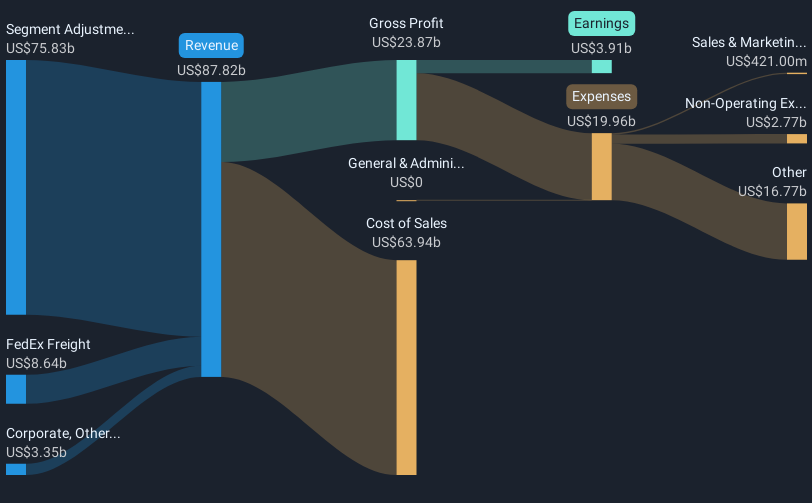

The recent dividend increase by FedEx underscores its commitment to enhancing shareholder value, which aligns with the company’s ongoing initiatives like the DRIVE, Network 2.0, and Tricolor strategies mentioned in the analysis. These efforts are geared toward cost-saving and network optimization, potentially improving margins and efficiency—factors that could significantly boost revenue and earnings forecasts. In turn, this might positively influence analysts’ earnings expectations and drive investor confidence, reinforcing the company's projected growth trajectory.

Over the last five years, FedEx has delivered a total return of 81.50%, inclusive of dividends, indicating strong longer-term performance. This contrasts with a recent one-year performance where FedEx exceeded the US Logistics industry's negative return of 20.4%, highlighting its resilience in challenging market conditions. Relative to the broader market, these numbers position FedEx as a stable performer in the logistics sector.

Despite recent share price movements, FedEx remains approximately 23.2% below the consensus analyst price target of US$277.78, reflecting potential upside as per market observers. The current share price, coupled with strategic efficiencies and revenue-enhancing measures underway, suggests that achieving the projected earnings increase to US$5.9 billion could help narrow this gap, supporting upward stock performance over the longer term.

Click here to discover the nuances of FedEx with our detailed analytical financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FDX

FedEx

Provides transportation, e-commerce, and business services in the United States and internationally.

Solid track record established dividend payer.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion