- India

- /

- Household Products

- /

- NSEI:EVEREADY

Eveready Industries India Limited's (NSE:EVEREADY) Shares Not Telling The Full Story

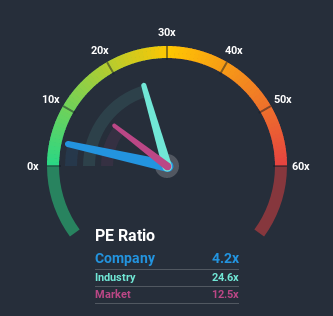

Eveready Industries India Limited's (NSE:EVEREADY) price-to-earnings (or "P/E") ratio of 4.2x might make it look like a strong buy right now compared to the market in India, where around half of the companies have P/E ratios above 13x and even P/E's above 30x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Recent times have been quite advantageous for Eveready Industries India as its earnings have been rising very briskly. One possibility is that the P/E is low because investors think this strong earnings growth might actually underperform the broader market in the near future. If that doesn't eventuate, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

See our latest analysis for Eveready Industries India

How Is Eveready Industries India's Growth Trending?

In order to justify its P/E ratio, Eveready Industries India would need to produce anemic growth that's substantially trailing the market.

Retrospectively, the last year delivered an exceptional 274% gain to the company's bottom line. The latest three year period has also seen an excellent 91% overall rise in EPS, aided by its short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to decline by 6.5% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's quite peculiar that Eveready Industries India's P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

What We Can Learn From Eveready Industries India's P/E?

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Eveready Industries India revealed its growing earnings over the medium-term aren't contributing to its P/E anywhere near as much as we would have predicted, given the market is set to shrink. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. One major risk is whether its earnings trajectory can keep outperforming under these tough market conditions. At least the risk of a price drop looks to be subdued, but investors think future earnings could see a lot of volatility.

We don't want to rain on the parade too much, but we did also find 4 warning signs for Eveready Industries India (1 is concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

When trading Eveready Industries India or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Eveready Industries India might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:EVEREADY

Eveready Industries India

Manufactures and markets dry cell batteries, flashlights, and lighting and electrical products in India and internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives