- France

- /

- Semiconductors

- /

- ENXTPA:STMPA

European Value Stocks: STMicroelectronics And Two More Priced Below Estimated Worth

Reviewed by Simply Wall St

As European markets experience a boost from strong corporate earnings and optimism surrounding geopolitical tensions, investors are increasingly on the lookout for stocks that are trading below their intrinsic value. In this environment, identifying undervalued stocks like STMicroelectronics can offer potential opportunities for those seeking to capitalize on discrepancies between market price and estimated worth.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK178.50 | NOK354.42 | 49.6% |

| Robit Oyj (HLSE:ROBIT) | €1.135 | €2.25 | 49.5% |

| Pluxee (ENXTPA:PLX) | €17.50 | €34.12 | 48.7% |

| Norconsult (OB:NORCO) | NOK44.70 | NOK87.62 | 49% |

| Lingotes Especiales (BME:LGT) | €6.00 | €11.69 | 48.7% |

| Hanza (OM:HANZA) | SEK111.00 | SEK219.77 | 49.5% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.383 | €0.76 | 49.6% |

| Atea (OB:ATEA) | NOK141.40 | NOK282.51 | 49.9% |

| Aquila Part Prod Com (BVB:AQ) | RON1.48 | RON2.92 | 49.4% |

| ams-OSRAM (SWX:AMS) | CHF10.59 | CHF20.83 | 49.1% |

Let's explore several standout options from the results in the screener.

STMicroelectronics (ENXTPA:STMPA)

Overview: STMicroelectronics N.V. is a company that designs, develops, manufactures, and sells semiconductor products across Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €20.03 billion.

Operations: The company's revenue segments include Power and Discrete Products at $2.76 billion and Analog, MEMS & Sensors Group at $4.22 billion.

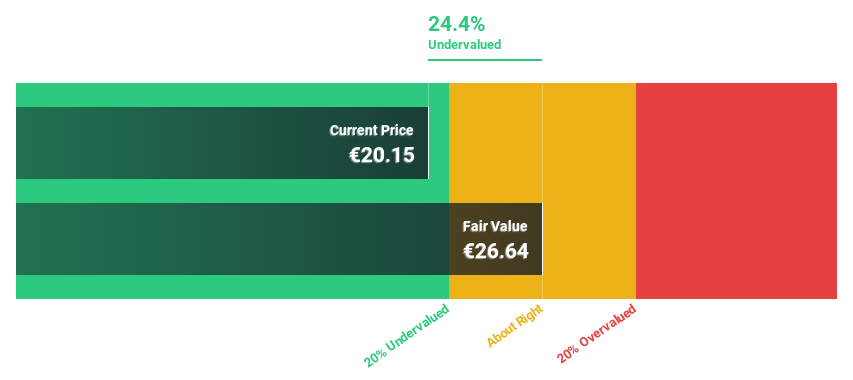

Estimated Discount To Fair Value: 42.7%

STMicroelectronics is trading at €22.42, significantly below its estimated fair value of €39.15, suggesting it may be undervalued based on cash flows. Despite a recent net loss of US$97 million in Q2 2025, the company's earnings are forecast to grow substantially at 34.9% annually over the next three years, outpacing the French market's growth rate. Recent strategic moves include acquiring NXP’s MEMS sensors business and expanding capabilities through a license agreement with Metalenz for advanced metasurface optics production.

- Upon reviewing our latest growth report, STMicroelectronics' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in STMicroelectronics' balance sheet health report.

Lerøy Seafood Group (OB:LSG)

Overview: Lerøy Seafood Group ASA is involved in the production, processing, marketing, sales, and distribution of seafood products and has a market cap of NOK29.46 billion.

Operations: The company's revenue segments include Farming at NOK14.41 billion, Wildcatch at NOK2.61 billion, and VAP, Sales and Distribution at NOK30.66 billion.

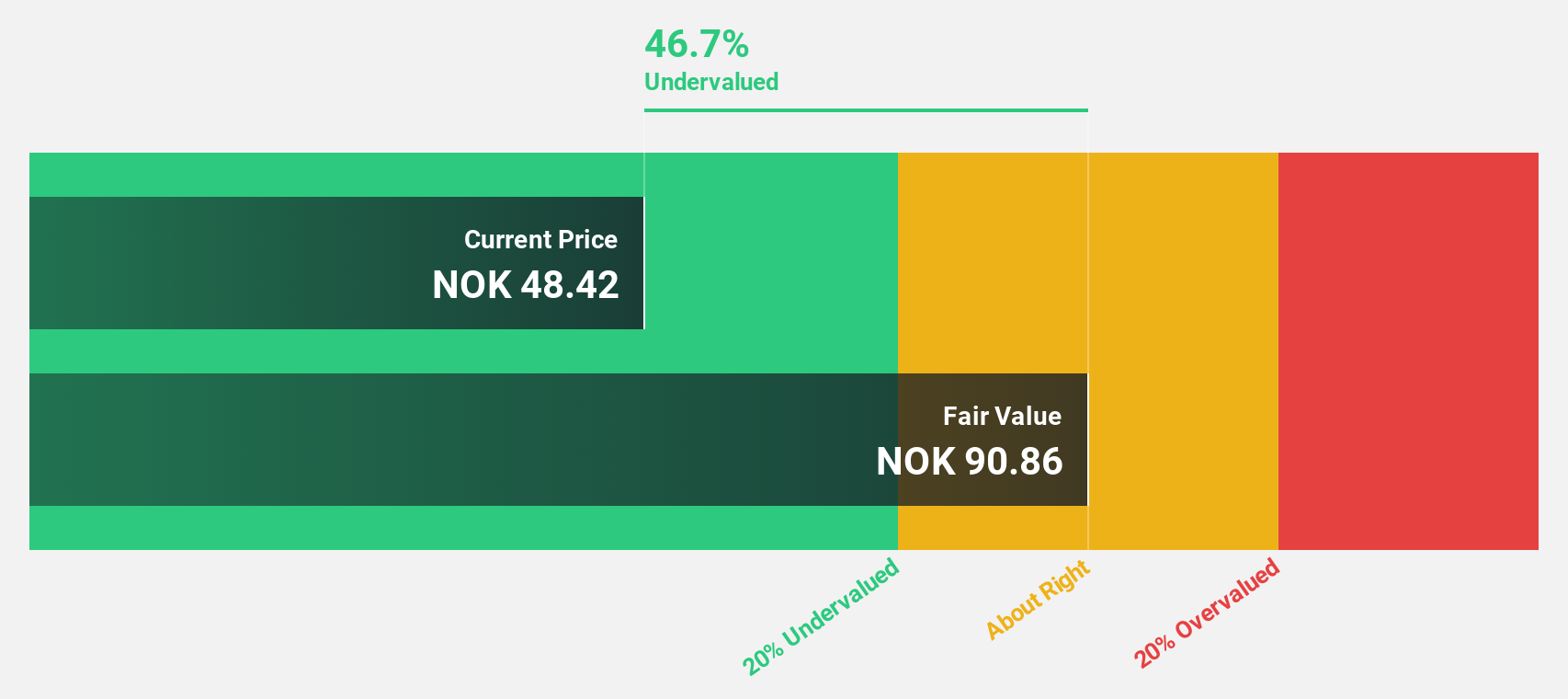

Estimated Discount To Fair Value: 47.1%

Lerøy Seafood Group, trading at NOK 49.48, is significantly below its estimated fair value of NOK 93.47, highlighting potential undervaluation based on cash flows. Despite a recent net loss of NOK 383.06 million in Q1 2025, earnings are projected to grow substantially at 30.4% annually over the next three years, surpassing the Norwegian market's growth rate. However, its dividend yield of 5.05% isn't well covered by free cash flows and return on equity remains modestly forecasted at 14.5%.

- Insights from our recent growth report point to a promising forecast for Lerøy Seafood Group's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Lerøy Seafood Group.

Norconsult (OB:NORCO)

Overview: Norconsult ASA offers consultancy services specializing in community planning, engineering design, and architecture across the Nordics and internationally, with a market cap of NOK13.87 billion.

Operations: The company's revenue segments include Norway Regions (NOK2.93 billion), Norway Head Office (NOK3.14 billion), Sweden (NOK1.90 billion), Digital and Techno-Garden (NOK1.16 billion), Denmark (NOK891 million), and Renewable Energy (NOK947 million).

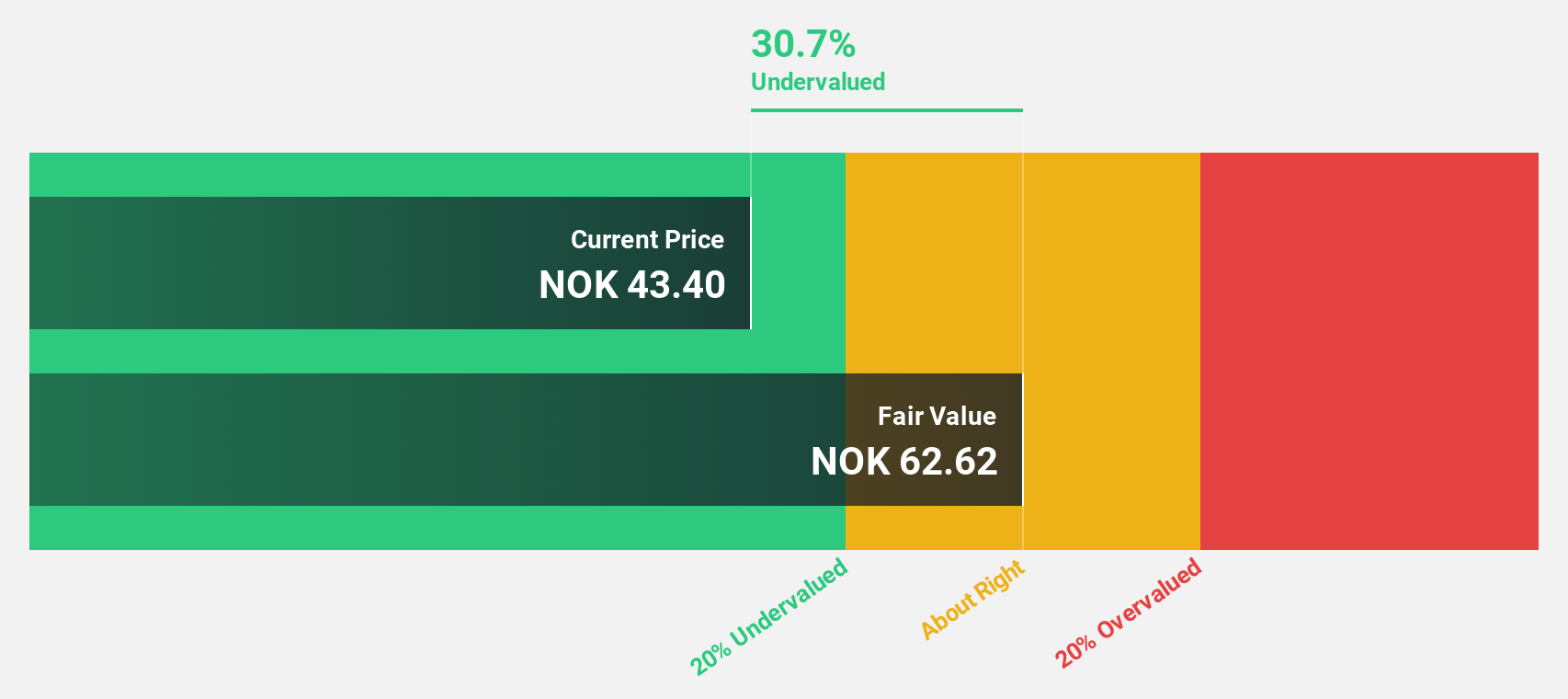

Estimated Discount To Fair Value: 49%

Norconsult ASA is trading at NOK 44.7, significantly below its estimated fair value of NOK 87.62, suggesting undervaluation based on cash flows. Recent earnings show robust growth with net income rising to NOK 257 million from NOK 103 million a year prior. The company secured major contracts like the NRK media house and Bergen Light Rail projects, enhancing its revenue prospects amidst forecasted annual earnings growth of 12.7%, outpacing the Norwegian market's average growth rate.

- Our growth report here indicates Norconsult may be poised for an improving outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of Norconsult.

Key Takeaways

- Unlock more gems! Our Undervalued European Stocks Based On Cash Flows screener has unearthed 190 more companies for you to explore.Click here to unveil our expertly curated list of 193 Undervalued European Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:STMPA

STMicroelectronics

Designs, develops, manufactures, and sells semiconductor products in Europe, the Middle East, Africa, the Americas, and the Asia Pacific.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives