European Stocks That Might Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the European markets experience a positive shift with major stock indexes rising on the back of slowed inflation and eased monetary policy by the European Central Bank, investors are increasingly eyeing opportunities that may be trading below their estimated value. In such an environment, identifying stocks that are potentially undervalued can provide investors with promising prospects to explore, especially when economic indicators suggest stability and growth in key regions.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| VIGO Photonics (WSE:VGO) | PLN530.00 | PLN1023.60 | 48.2% |

| Trøndelag Sparebank (OB:TRSB) | NOK113.90 | NOK223.35 | 49% |

| Sparebank 68° Nord (OB:SB68) | NOK179.38 | NOK357.63 | 49.8% |

| Lectra (ENXTPA:LSS) | €24.10 | €46.69 | 48.4% |

| doValue (BIT:DOV) | €2.27 | €4.46 | 49.1% |

| DigiTouch (BIT:DGT) | €1.865 | €3.66 | 49% |

| Airbus (ENXTPA:AIR) | €165.34 | €325.34 | 49.2% |

| adidas (XTRA:ADS) | €211.40 | €415.23 | 49.1% |

| Absolent Air Care Group (OM:ABSO) | SEK211.00 | SEK416.55 | 49.3% |

| ABO Energy GmbH KGaA (XTRA:AB9) | €37.70 | €73.01 | 48.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

CVC Capital Partners (ENXTAM:CVC)

Overview: CVC Capital Partners plc is a private equity and venture capital firm that focuses on middle market secondaries, infrastructure and credit, management buyouts, leveraged buyouts, growth equity, mature investments, recapitalizations, strip sales and spinouts with a market cap of €17.42 billion.

Operations: The firm's revenue segments include €135.64 million from credit, €94.99 million from secondaries, €89.56 million from infrastructure, and €861.04 million from private equity.

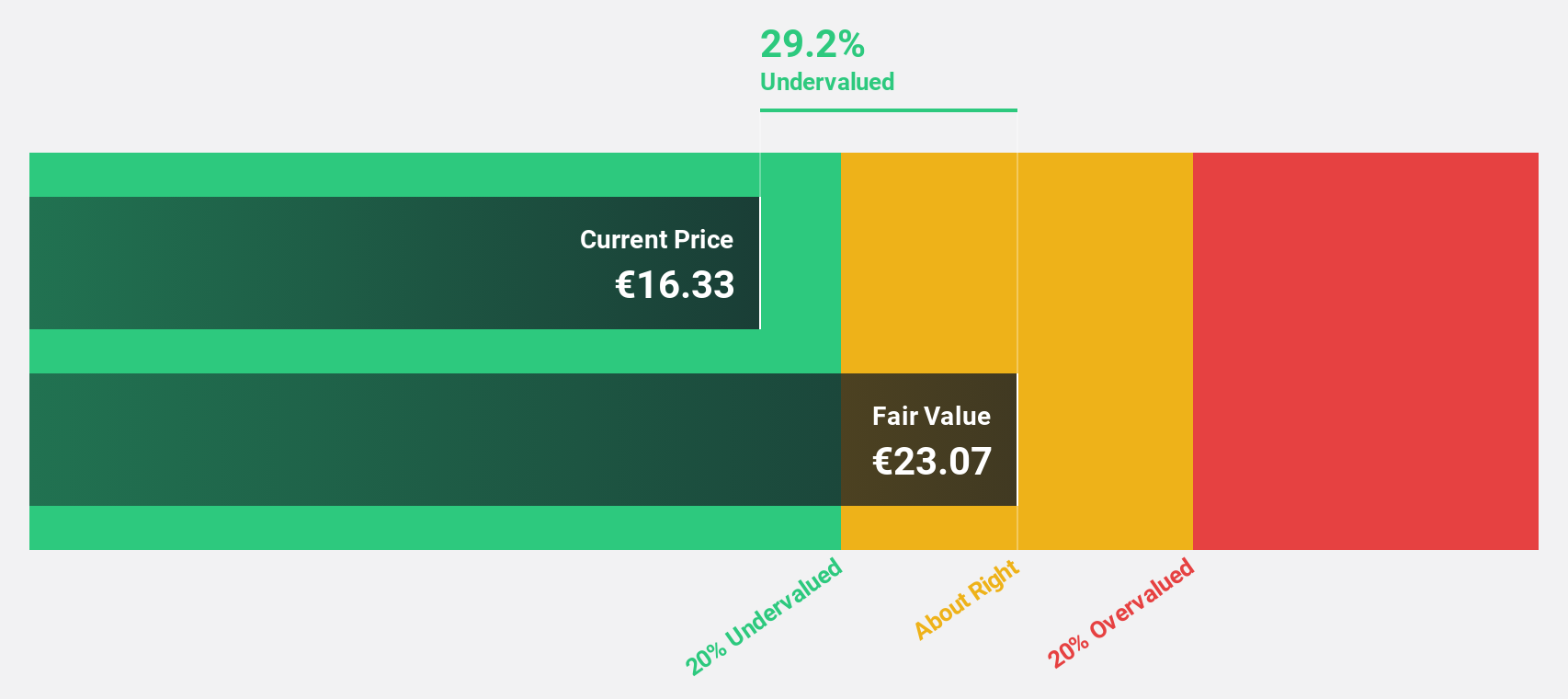

Estimated Discount To Fair Value: 28.9%

CVC Capital Partners is trading at €16.39, significantly below its estimated fair value of €23.06, presenting a potential opportunity for investors focusing on undervalued stocks based on cash flows. Despite recent volatility and high debt levels, CVC's earnings are forecast to grow significantly at 31% annually over the next three years, outpacing the Dutch market's growth rate. Recent M&A interest in BASF SE’s coatings business indicates active strategic positioning which could impact future cash flows positively.

- The growth report we've compiled suggests that CVC Capital Partners' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of CVC Capital Partners.

Comet Holding (SWX:COTN)

Overview: Comet Holding AG, with a market cap of CHF1.79 billion, offers X-ray and radio frequency power technology solutions across Europe, North America, Asia, and other international markets through its subsidiaries.

Operations: The company's revenue is derived from its X-Ray Systems (CHF115.89 million), Industrial X-Ray Modules (CHF94.57 million), and Plasma Control Technologies (CHF247.39 million) segments.

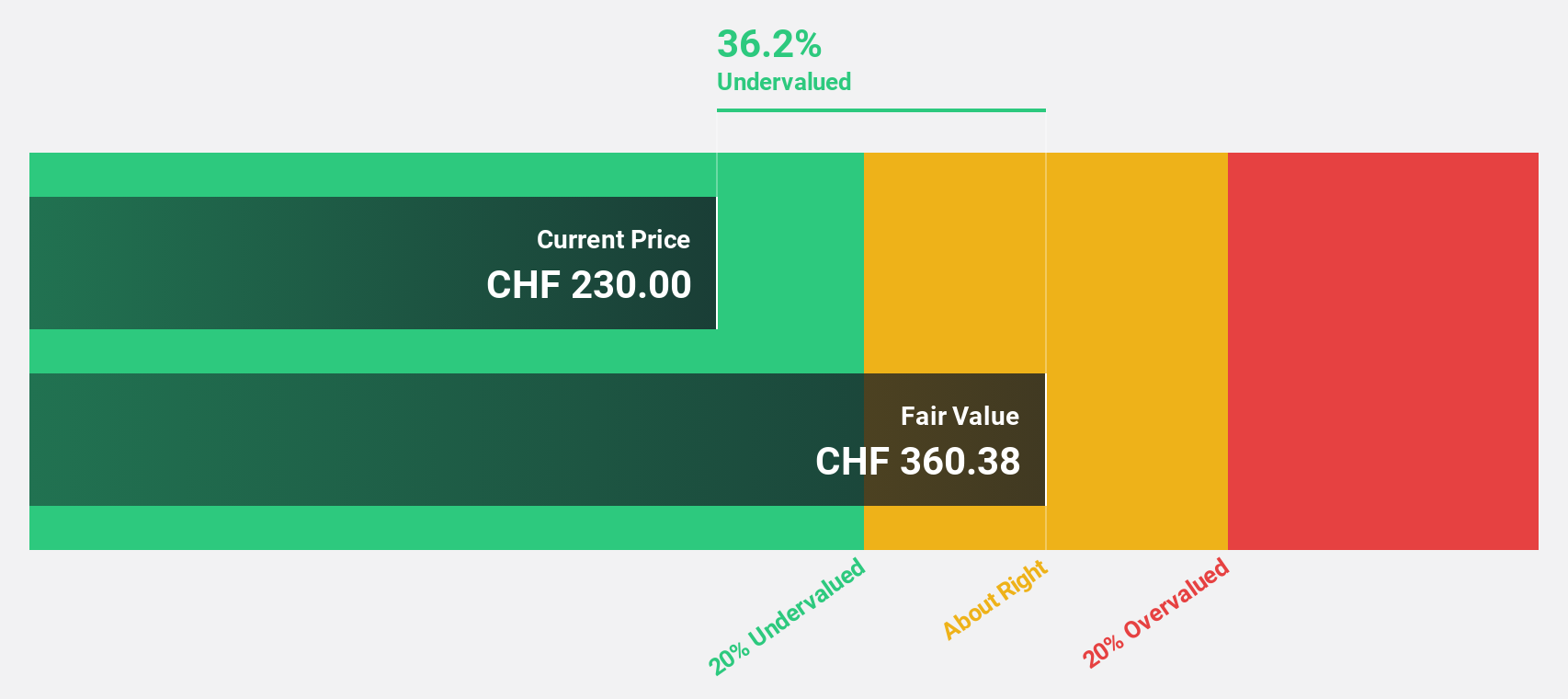

Estimated Discount To Fair Value: 36%

Comet Holding AG, trading at CHF 231, is significantly undervalued with a fair value estimate of CHF 361.15. The company's earnings grew by 128.2% last year and are forecast to grow at an impressive rate of 37.3% annually, outpacing the Swiss market's growth rate. Recent sales results show a robust increase to CHF 111.2 million for Q1 2025, up from CHF 80.9 million in Q1/24, reinforcing its strong cash flow position despite recent board changes.

- Our growth report here indicates Comet Holding may be poised for an improving outlook.

- Dive into the specifics of Comet Holding here with our thorough financial health report.

Rosenbauer International (WBAG:ROS)

Overview: Rosenbauer International AG provides systems for preventive firefighting and disaster protection technology globally, with a market cap of €418.20 million.

Operations: The company's revenue is primarily derived from Europe (€675.84 million), followed by the Americas (€362.28 million), Asia-Pacific (€150.11 million), and the Middle East & Africa (€125.11 million), with additional income from Preventive Fire Protection systems (€30.67 million).

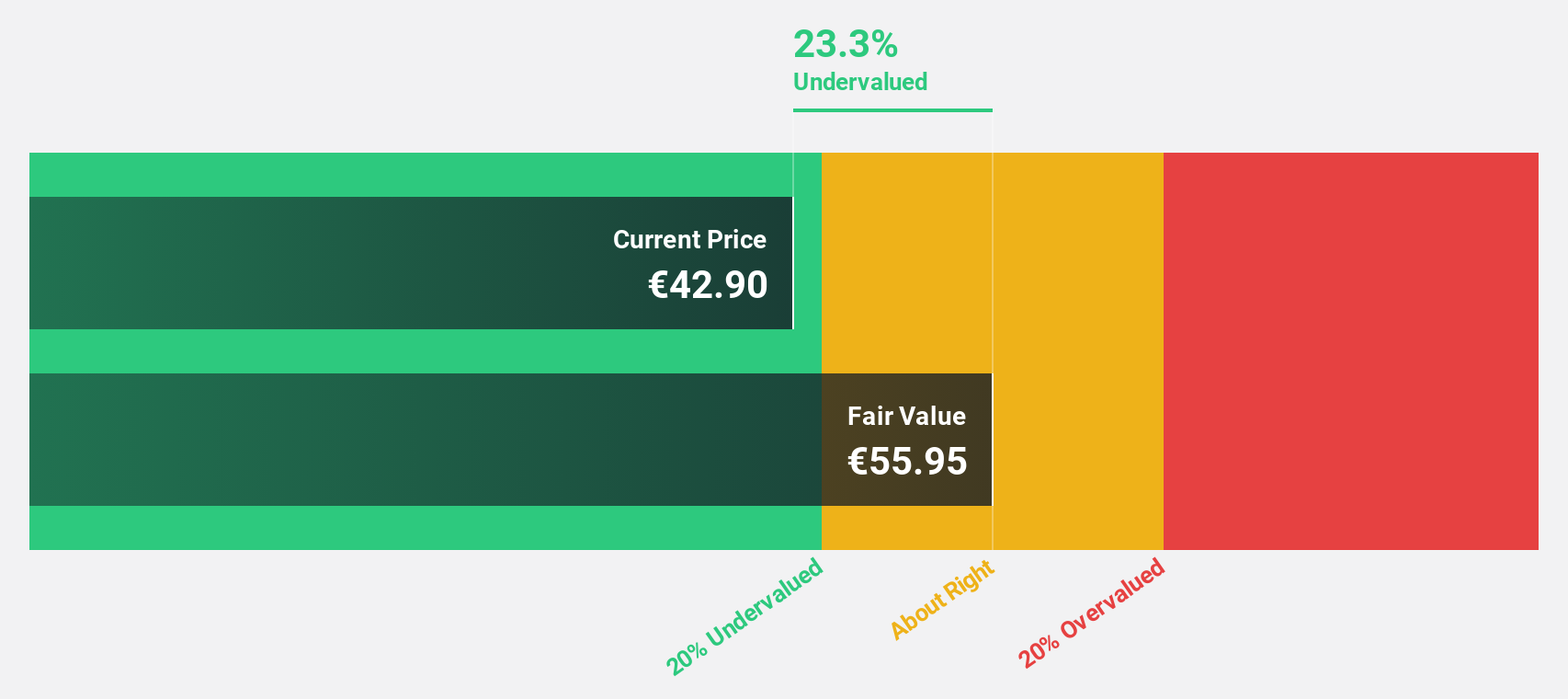

Estimated Discount To Fair Value: 25.9%

Rosenbauer International AG is trading at €41, notably below its estimated fair value of €55.33, suggesting it is significantly undervalued based on cash flows. Recent earnings reports show a strong turnaround from a net loss to a net income of €26.96 million in 2024, with expected annual earnings growth of 22.9%, surpassing the Austrian market's rate. However, interest payments remain inadequately covered by earnings despite revenue growth projections outpacing the local market.

- Our expertly prepared growth report on Rosenbauer International implies its future financial outlook may be stronger than recent results.

- Get an in-depth perspective on Rosenbauer International's balance sheet by reading our health report here.

Next Steps

- Discover the full array of 184 Undervalued European Stocks Based On Cash Flows right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SWX:COTN

Comet Holding

Provides X-ray and radio frequency (RF) power technology solutions in Europe, North America, Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives