- Netherlands

- /

- Machinery

- /

- ENXTAM:NXFIL

European Penny Stocks To Watch In September 2025

Reviewed by Simply Wall St

As the European markets experience a modest uptick, with major indices like the STOXX Europe 600 Index gaining ground amid expectations of U.S. interest rate cuts, investors are keenly observing how these developments might influence regional economic growth and inflation forecasts. Penny stocks, often representing smaller or newer companies, continue to capture attention due to their potential for growth at relatively low price points. Despite being considered a somewhat outdated term, penny stocks remain relevant as they can offer opportunities backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Rewards & Risks |

| Ariston Holding (BIT:ARIS) | €4.202 | €1.45B | ✅ 5 ⚠️ 2 View Analysis > |

| Mistral Iberia Real Estate SOCIMI (BME:YMIB) | €1.05 | €22.87M | ✅ 2 ⚠️ 5 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| Angler Gaming (DB:0QM) | €0.37 | €245.95M | ✅ 2 ⚠️ 2 View Analysis > |

| IMS (WSE:IMS) | PLN3.09 | PLN108.44M | ✅ 4 ⚠️ 2 View Analysis > |

| Siili Solutions Oyj (HLSE:SIILI) | €5.00 | €40.54M | ✅ 3 ⚠️ 3 View Analysis > |

| Euroland Société anonyme (ENXTPA:ALERO) | €3.02 | €9.58M | ✅ 2 ⚠️ 5 View Analysis > |

| ForFarmers (ENXTAM:FFARM) | €4.29 | €379.17M | ✅ 4 ⚠️ 1 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.10 | €290.26M | ✅ 4 ⚠️ 1 View Analysis > |

| Netgem (ENXTPA:ALNTG) | €0.918 | €30.96M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 334 stocks from our European Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

IRCE (BIT:IRC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IRCE S.p.A. manufactures and sells winding wires and electrical cables in Italy, the rest of the European Union, and internationally, with a market cap of €59.24 million.

Operations: IRCE S.p.A. has not reported specific revenue segments, but it operates in the manufacturing and sale of winding wires and electrical cables across Italy, the rest of the European Union, and international markets.

Market Cap: €59.24M

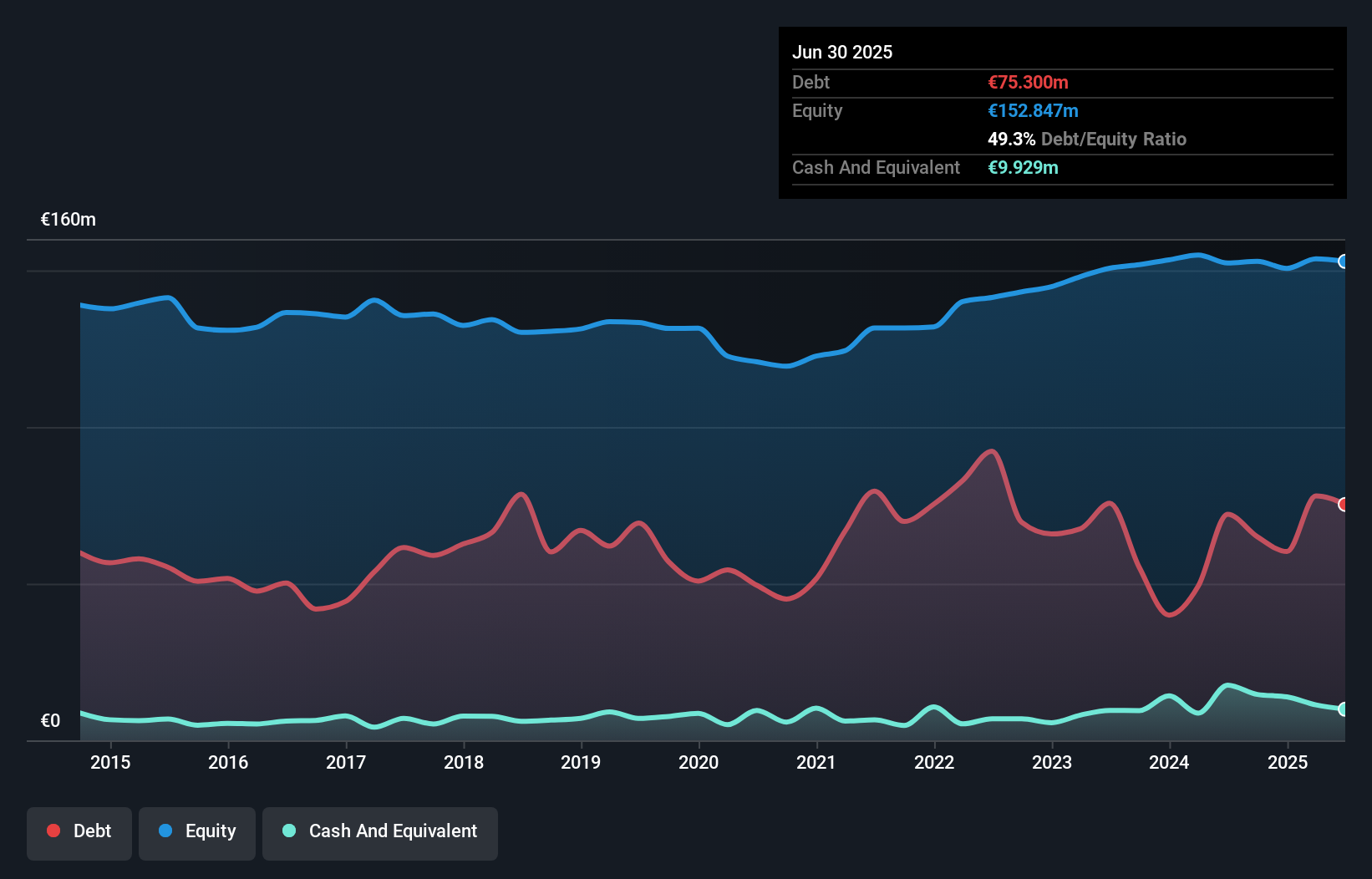

IRCE S.p.A., with a market cap of €59.24 million, operates in the manufacturing and sale of winding wires and electrical cables across Europe and internationally. Recently reported half-year earnings showed a slight decline in revenue to €205.39 million from the previous year. Despite negative earnings growth over the past year, IRCE has shown profitability over five years, with an 11.4% annual growth rate. The company maintains stable short-term financial health with assets exceeding liabilities, although it carries a high net debt to equity ratio of 43.2%. Its P/E ratio suggests good value compared to peers in Italy's market.

- Unlock comprehensive insights into our analysis of IRCE stock in this financial health report.

- Gain insights into IRCE's outlook and expected performance with our report on the company's earnings estimates.

NX Filtration (ENXTAM:NXFIL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: NX Filtration N.V. develops, produces, and sells hollow fiber membrane modules across various regions including the Netherlands, Europe, North America, and Asia with a market cap of €172.13 million.

Operations: The company's revenue segments consist of Clean Municipal Water, generating €3.85 million, and Sustainable Industrial Water, contributing €6.71 million.

Market Cap: €172.13M

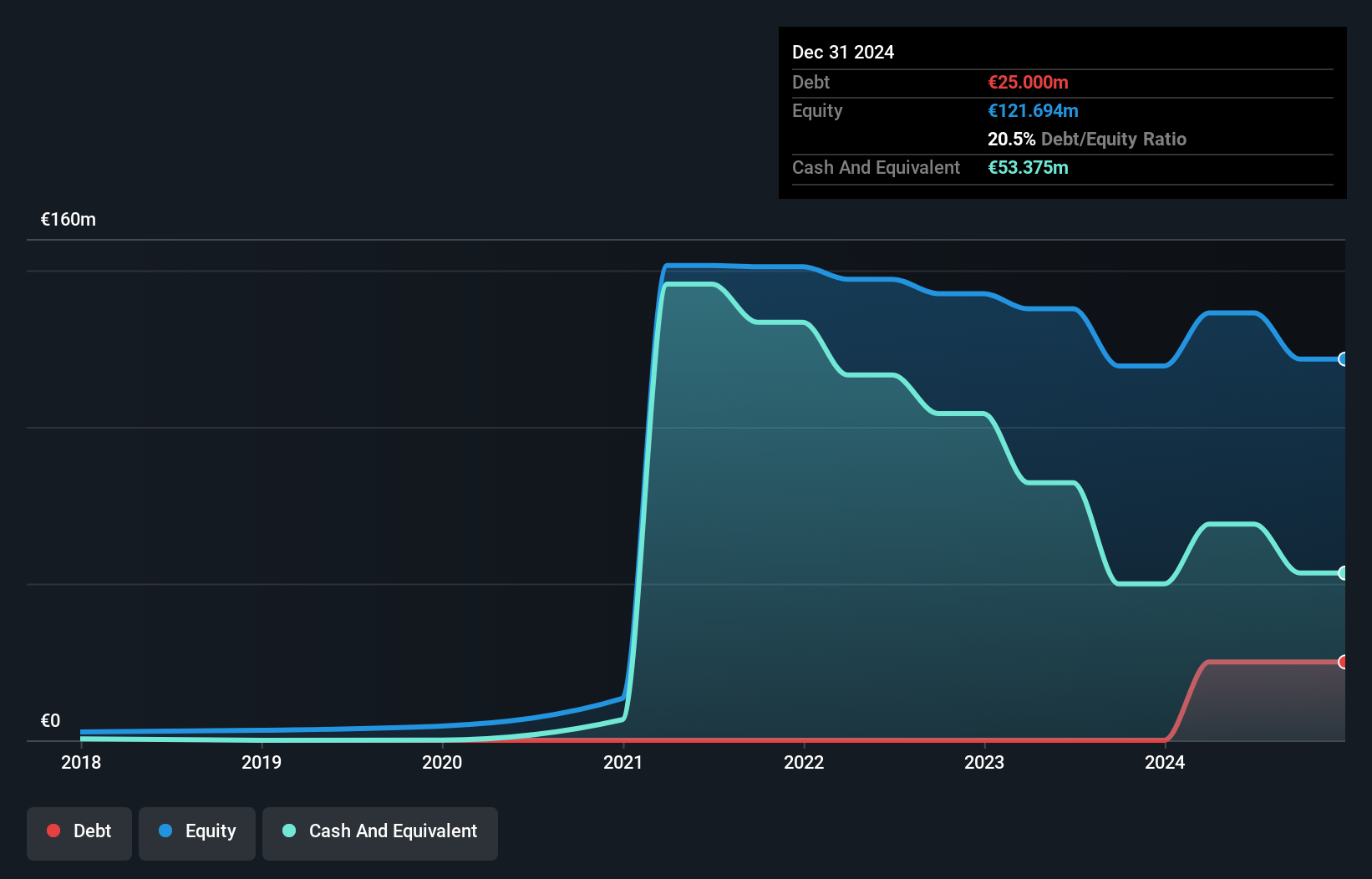

NX Filtration, with a market cap of €172.13 million, is experiencing revenue growth in its Clean Municipal Water and Sustainable Industrial Water segments, totaling €10.56 million for the first half of 2025. Despite this growth, the company remains unprofitable with increasing losses reported at €12.75 million compared to the previous year. It maintains a strong financial position with more cash than debt and sufficient short-term assets to cover liabilities. While not yet profitable or forecasted to be within three years, NX Filtration's cash runway exceeds three years if current free cash flow trends persist without significant shareholder dilution recently observed.

- Take a closer look at NX Filtration's potential here in our financial health report.

- Learn about NX Filtration's future growth trajectory here.

High (ENXTPA:HCO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: High Co. SA offers consumer engagement chain solutions in France, Belgium, and Spain with a market cap of €75.91 million.

Operations: The company's revenue is generated from its advertising segment, amounting to €143.31 million.

Market Cap: €75.91M

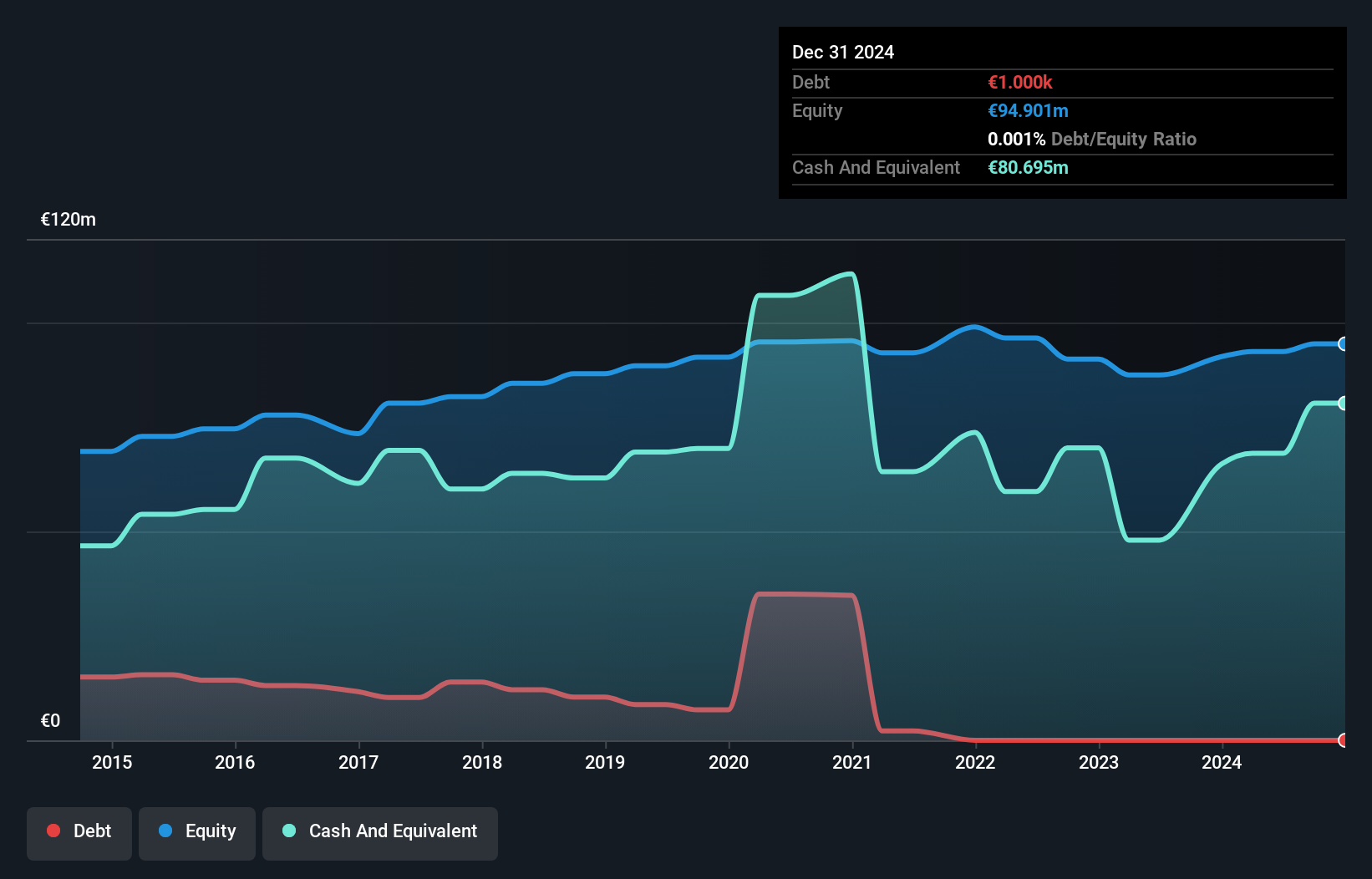

High Co. SA, with a market cap of €75.91 million, generates revenue primarily from its advertising segment, reporting sales of €45.03 million for the first half of 2025. Despite experiencing a decline in net income to €4.46 million compared to last year, the company maintains strong financial health with short-term assets exceeding liabilities and no significant debt burden. The board and management are experienced; however, earnings growth has been negative over the past year at -48.8%. Although trading below estimated fair value, High Co.'s share price remains volatile with an unstable dividend history and low return on equity at 7.6%.

- Click to explore a detailed breakdown of our findings in High's financial health report.

- Gain insights into High's future direction by reviewing our growth report.

Summing It All Up

- Click here to access our complete index of 334 European Penny Stocks.

- Looking For Alternative Opportunities? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NX Filtration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:NXFIL

NX Filtration

Develops, produces, and sells hollow fiber membrane modules in the Netherlands, Europe, North America, Asia, and internationally.

Excellent balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives