As European markets face renewed uncertainty due to escalating geopolitical tensions in the Middle East and fluctuating trade policies, the pan-European STOXX Europe 600 Index recently ended lower, reflecting broader economic challenges. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.54% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 4.01% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.45% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.42% | ★★★★★★ |

| Mapfre (BME:MAP) | 4.88% | ★★★★★★ |

| Les Docks des Pétroles d'Ambès -SA (ENXTPA:DPAM) | 5.51% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.98% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.81% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.92% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.55% | ★★★★★★ |

Click here to see the full list of 238 stocks from our Top European Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

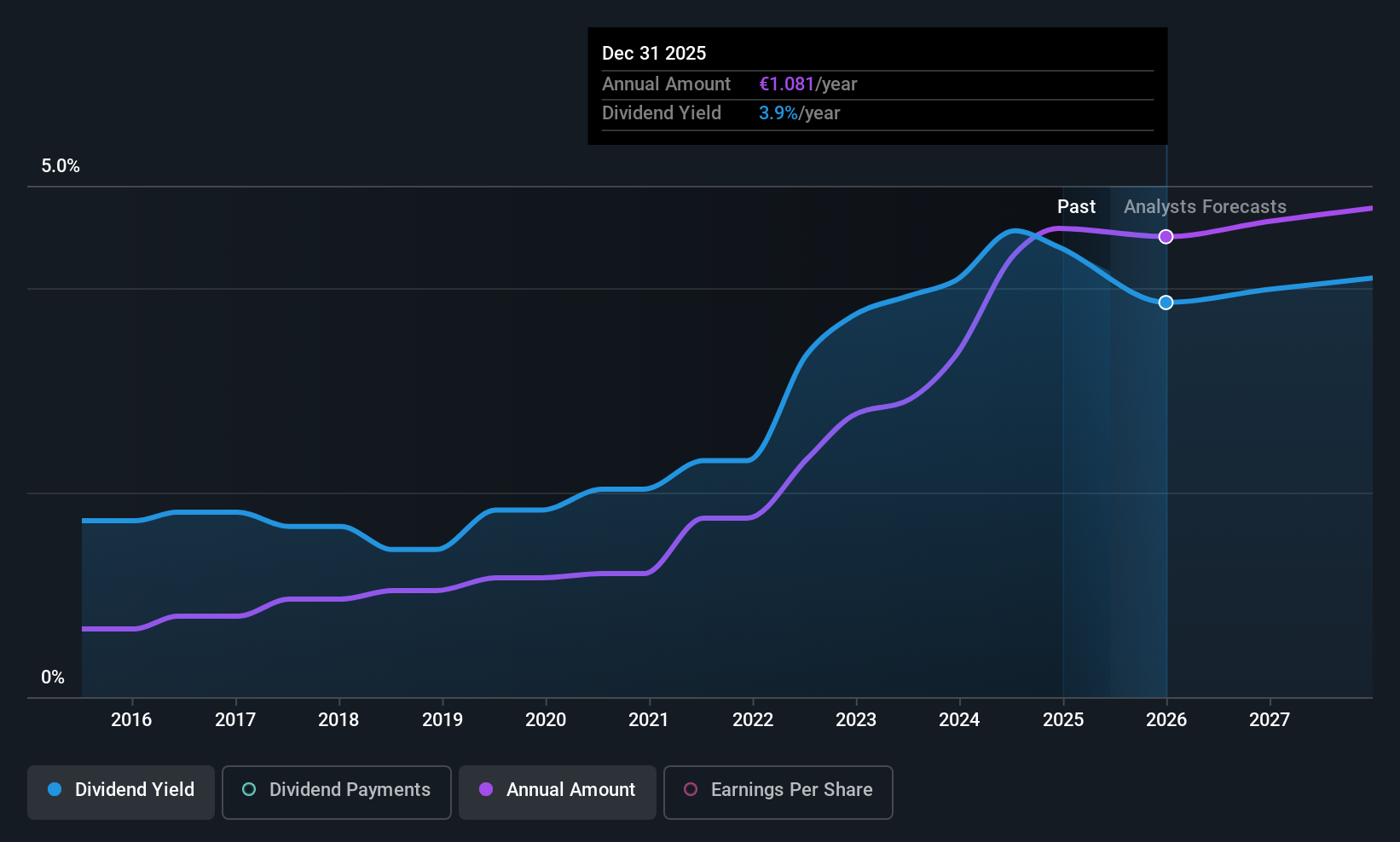

Cementos Molins (BDM:CMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cementos Molins, S.A. is a company that manufactures and sells cement, lime, precast concrete, and other construction materials across various countries including Spain and several others in Latin America, Asia, Europe, and Africa; it has a market cap of approximately €1.77 billion.

Operations: Cementos Molins, S.A. generates revenue through the production and sale of cement, lime, precast concrete, and various construction materials across multiple international markets including Spain, Latin America, Asia, Europe, and Africa.

Dividend Yield: 3.9%

Cementos Molins offers a stable dividend profile with a payout ratio of 38.2%, indicating dividends are well covered by earnings and cash flows, despite an 82% cash payout ratio. Over the past decade, dividends have been reliable and growing, though the yield of 3.92% is below Spain's top tier. A low price-to-earnings ratio of 10x suggests potential value compared to the broader market, amidst recent earnings growth of 9.1%.

- Unlock comprehensive insights into our analysis of Cementos Molins stock in this dividend report.

- In light of our recent valuation report, it seems possible that Cementos Molins is trading beyond its estimated value.

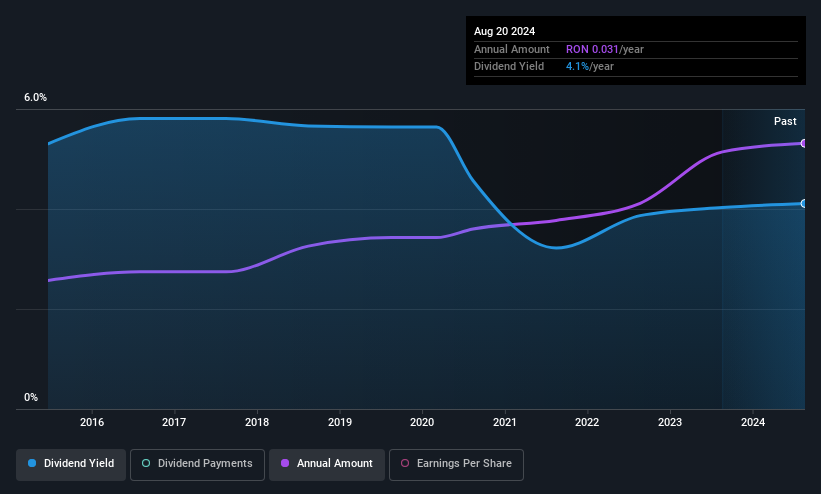

Biofarm (BVB:BIO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Biofarm S.A. is a Romanian company that manufactures and sells medicines, with a market cap of RON739.03 million.

Operations: Biofarm S.A.'s revenue primarily comes from its Pharmaceuticals segment, totaling RON310.33 million.

Dividend Yield: 4.1%

Biofarm's dividend profile is supported by a low payout ratio of 35.5%, indicating strong coverage by earnings and cash flows, with a cash payout ratio of 48.4%. The company has maintained stable and growing dividends over the past decade, although its yield of 4.13% falls short compared to Romania's top tier. Recent earnings growth, with net income rising to RON 32.33 million for Q1 2025, underscores its financial health amidst trading at significant value below fair estimates.

- Click here and access our complete dividend analysis report to understand the dynamics of Biofarm.

- The valuation report we've compiled suggests that Biofarm's current price could be quite moderate.

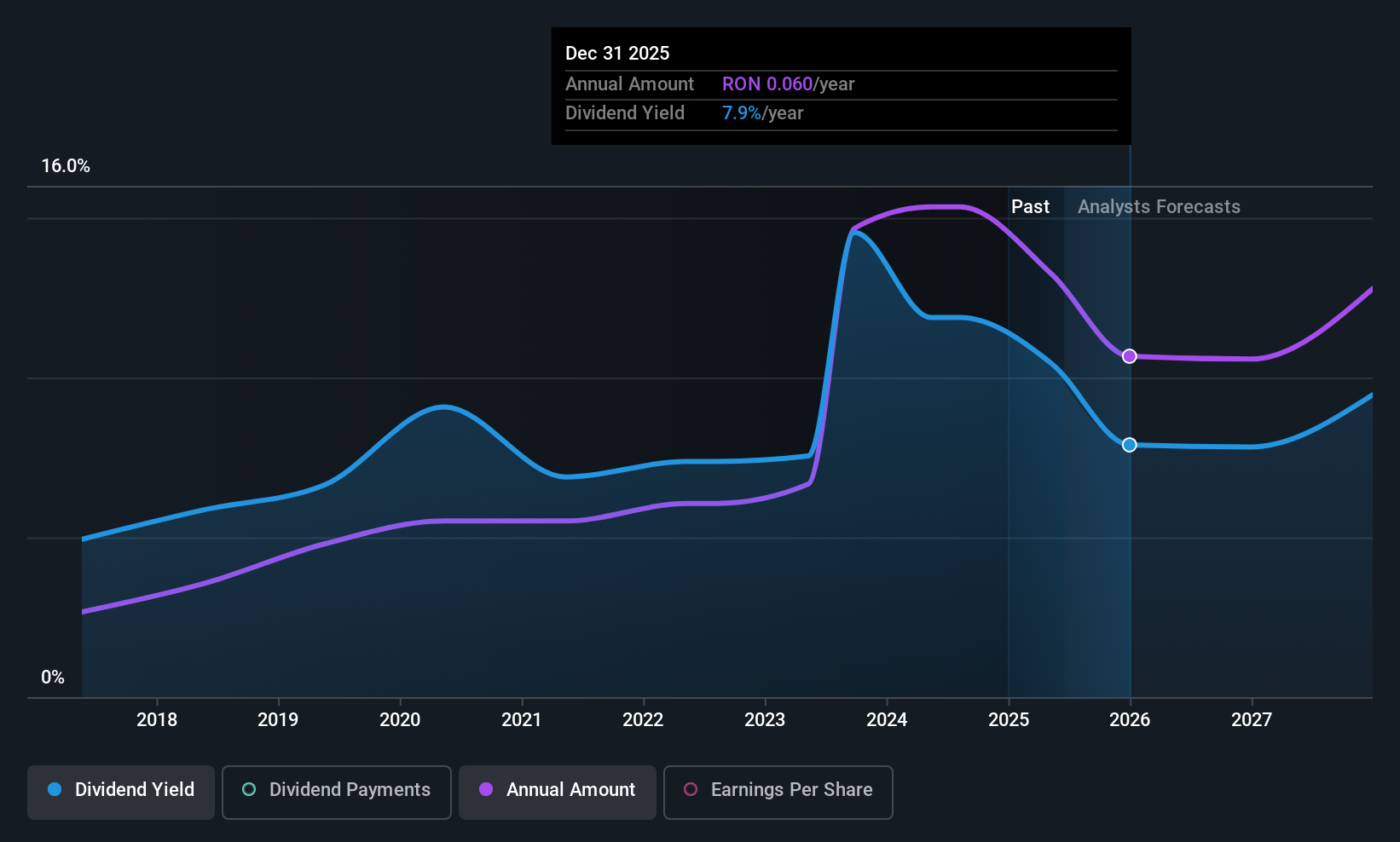

OMV Petrom (BVB:SNP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: OMV Petrom S.A. is an energy company involved in the exploration and production of oil and gas in Southeastern Europe, with a market capitalization of RON47.57 billion.

Operations: OMV Petrom S.A.'s revenue segments include Refining and Marketing at RON26.32 billion, Exploration and Production at RON10.75 billion, and Gas and Power at RON10.18 billion.

Dividend Yield: 9.7%

OMV Petrom's dividend yield of 9.74% ranks in the top 25% for Romania, yet its sustainability is questionable due to a high cash payout ratio of over RON 55 billion, indicating dividends are not well-covered by free cash flow. While earnings cover the payout with a reasonable ratio of 71.7%, dividend reliability has been inconsistent over the past decade. Recent Q1 earnings showed net income at RON 1.07 billion, down from RON 1.40 billion year-on-year, reflecting potential challenges ahead for maintaining stable dividends amidst fluctuating financial performance.

- Dive into the specifics of OMV Petrom here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of OMV Petrom shares in the market.

Key Takeaways

- Take a closer look at our Top European Dividend Stocks list of 238 companies by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Biofarm might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BVB:BIO

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Thomson Reuters Stock: When Legal Intelligence Becomes Mission-Critical Infrastructure

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion