- Sweden

- /

- Telecom Services and Carriers

- /

- OM:BRE2

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets navigate the complexities of trade negotiations and slowing inflation, the pan-European STOXX Europe 600 Index has shown resilience, ending slightly higher amid these challenges. In such an environment, dividend stocks can offer a stable income stream and potential for growth, making them an attractive component of a diversified portfolio.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Bredband2 i Skandinavien (OM:BRE2) | 4.22% | ★★★★★★ |

| Julius Bär Gruppe (SWX:BAER) | 4.89% | ★★★★★★ |

| Zurich Insurance Group (SWX:ZURN) | 4.42% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.39% | ★★★★★★ |

| Rubis (ENXTPA:RUI) | 7.02% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.67% | ★★★★★★ |

| St. Galler Kantonalbank (SWX:SGKN) | 3.93% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.76% | ★★★★★★ |

| OVB Holding (XTRA:O4B) | 4.39% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.65% | ★★★★★★ |

Click here to see the full list of 235 stocks from our Top European Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Directa Sim (BIT:D)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Directa Sim S.p.A. is an Italian company that offers online trading services, with a market cap of €102.75 million.

Operations: Directa Sim S.p.A. generates its revenue primarily from brokerage services, amounting to €43.06 million.

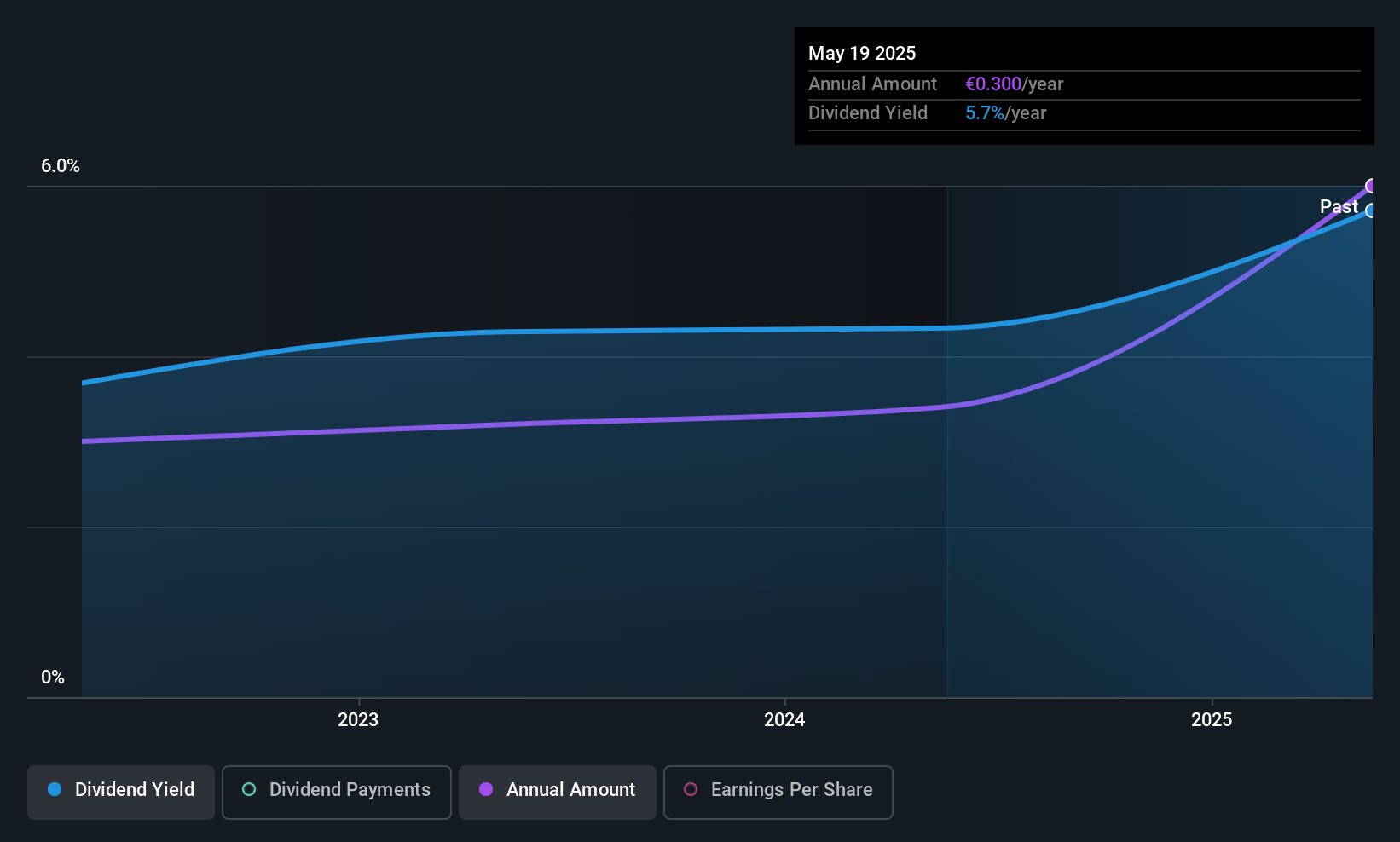

Dividend Yield: 5.5%

Directa Sim S.p.A. recently announced a dividend increase to €0.30 per share, reflecting its commitment to returning value to shareholders despite only three years of dividend history. The company's earnings grew significantly by 37.3% last year, supporting a sustainable payout ratio of 50%. Its price-to-earnings ratio of 9.1x suggests good value compared to the broader Italian market's 15.8x average. However, investors should note Directa Sim's high debt level when considering its financial position for dividends.

- Navigate through the intricacies of Directa Sim with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Directa Sim shares in the market.

Bredband2 i Skandinavien (OM:BRE2)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Bredband2 i Skandinavien AB (publ) offers data communication and security solutions to individuals and companies in Sweden with a market cap of SEK2.27 billion.

Operations: Bredband2 i Skandinavien AB (publ) generates its revenue primarily from its National Broadband Service, which amounts to SEK1.77 billion.

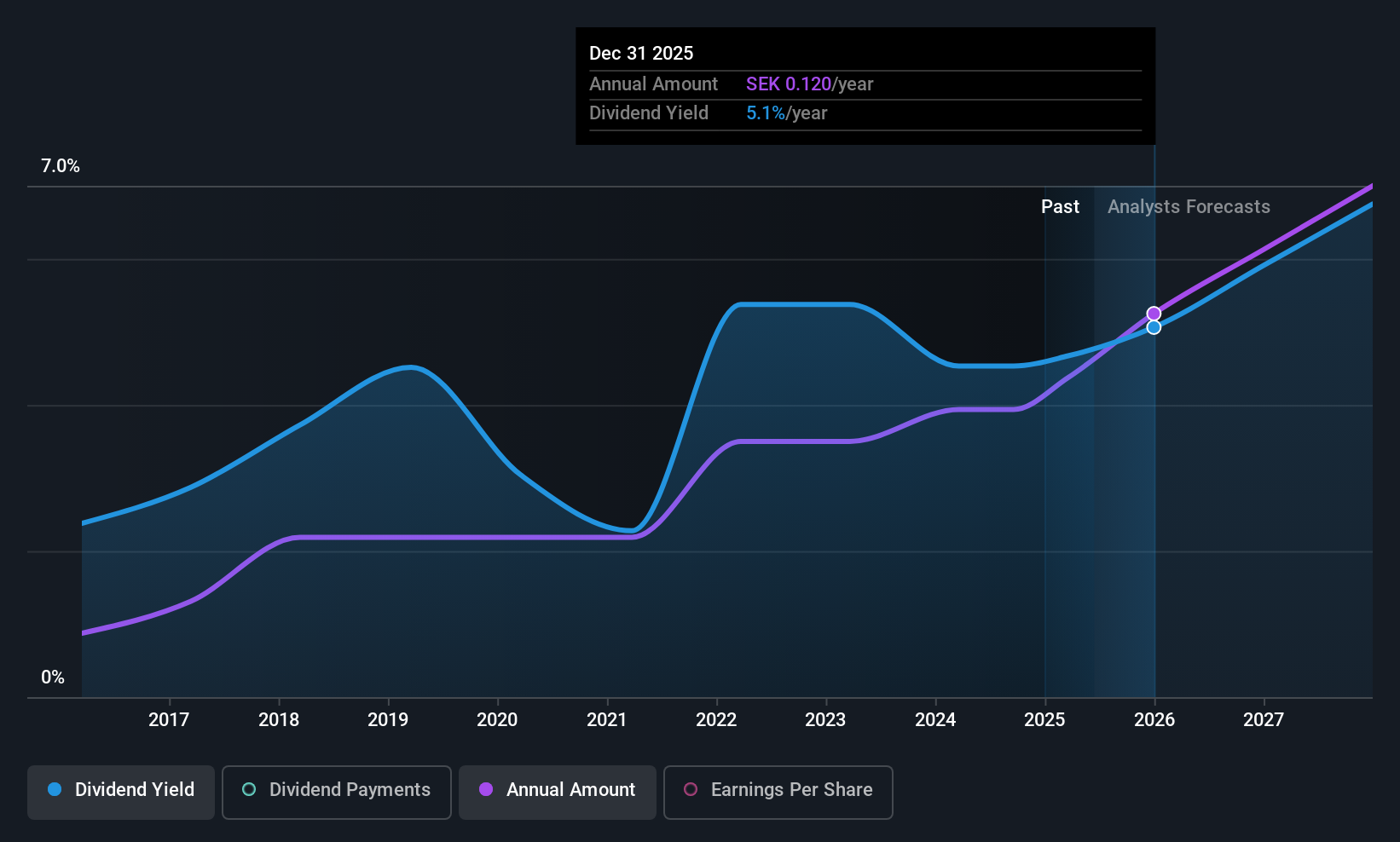

Dividend Yield: 4.2%

Bredband2 i Skandinavien AB offers a compelling dividend profile, with a stable and growing dividend history over the past decade. Despite significant insider selling recently, the company's dividends remain well-covered by both earnings and cash flows, with payout ratios of 87.7% and 40.2%, respectively. The recent earnings report showed steady sales growth to SEK 456.21 million, supporting its high dividend yield of 4.22%, which ranks in the top quartile among Swedish stocks.

- Dive into the specifics of Bredband2 i Skandinavien here with our thorough dividend report.

- According our valuation report, there's an indication that Bredband2 i Skandinavien's share price might be on the cheaper side.

Mensch und Maschine Software (XTRA:MUM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE solutions, product data management, and building information modeling/management services in Germany and globally, with a market cap of €949.04 million.

Operations: Mensch und Maschine Software SE generates revenue through its M+M Software segment, which accounts for €111.29 million, and its M+M Digitization segment, contributing €179.71 million.

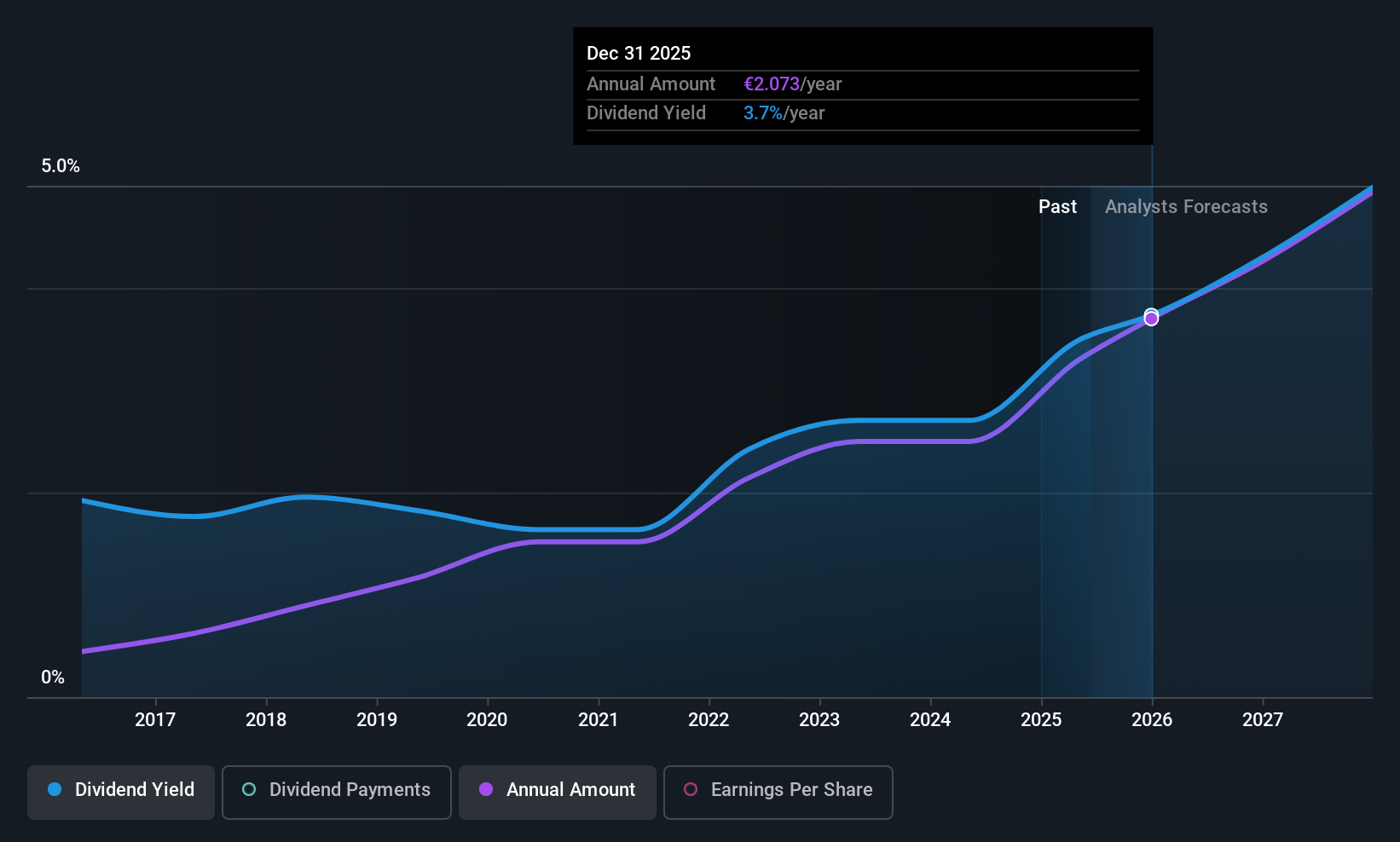

Dividend Yield: 3.2%

Mensch und Maschine Software SE's dividend yield of 3.25% is below the top quartile in Germany, and its high payout ratio of 104.8% suggests dividends are not well-covered by earnings, although cash flows provide some support with a 73.8% cash payout ratio. Despite a recent decrease to €0.31 per share, dividends have been stable and growing over the past decade. The company reported first-quarter sales of €66.02 million, down from €100.87 million year-over-year, impacting dividend sustainability concerns further.

- Unlock comprehensive insights into our analysis of Mensch und Maschine Software stock in this dividend report.

- In light of our recent valuation report, it seems possible that Mensch und Maschine Software is trading beyond its estimated value.

Make It Happen

- Click through to start exploring the rest of the 232 Top European Dividend Stocks now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bredband2 i Skandinavien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BRE2

Bredband2 i Skandinavien

Provides data communication and security solutions to individuals and companies in Sweden.

Outstanding track record 6 star dividend payer.

Market Insights

Community Narratives