As the pan-European STOXX Europe 600 Index remains steady amid ongoing assessments of interest rate policies and trade concerns, investors are closely monitoring economic indicators for signs of market direction. In this environment, dividend stocks can offer a measure of stability and income potential, making them an attractive option for those looking to navigate the current economic landscape.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.76% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.40% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.66% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.65% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.92% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.78% | ★★★★★☆ |

| DKSH Holding (SWX:DKSH) | 4.36% | ★★★★★★ |

| Credito Emiliano (BIT:CE) | 5.51% | ★★★★★☆ |

| Cembra Money Bank (SWX:CMBN) | 4.65% | ★★★★★★ |

Click here to see the full list of 229 stocks from our Top European Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

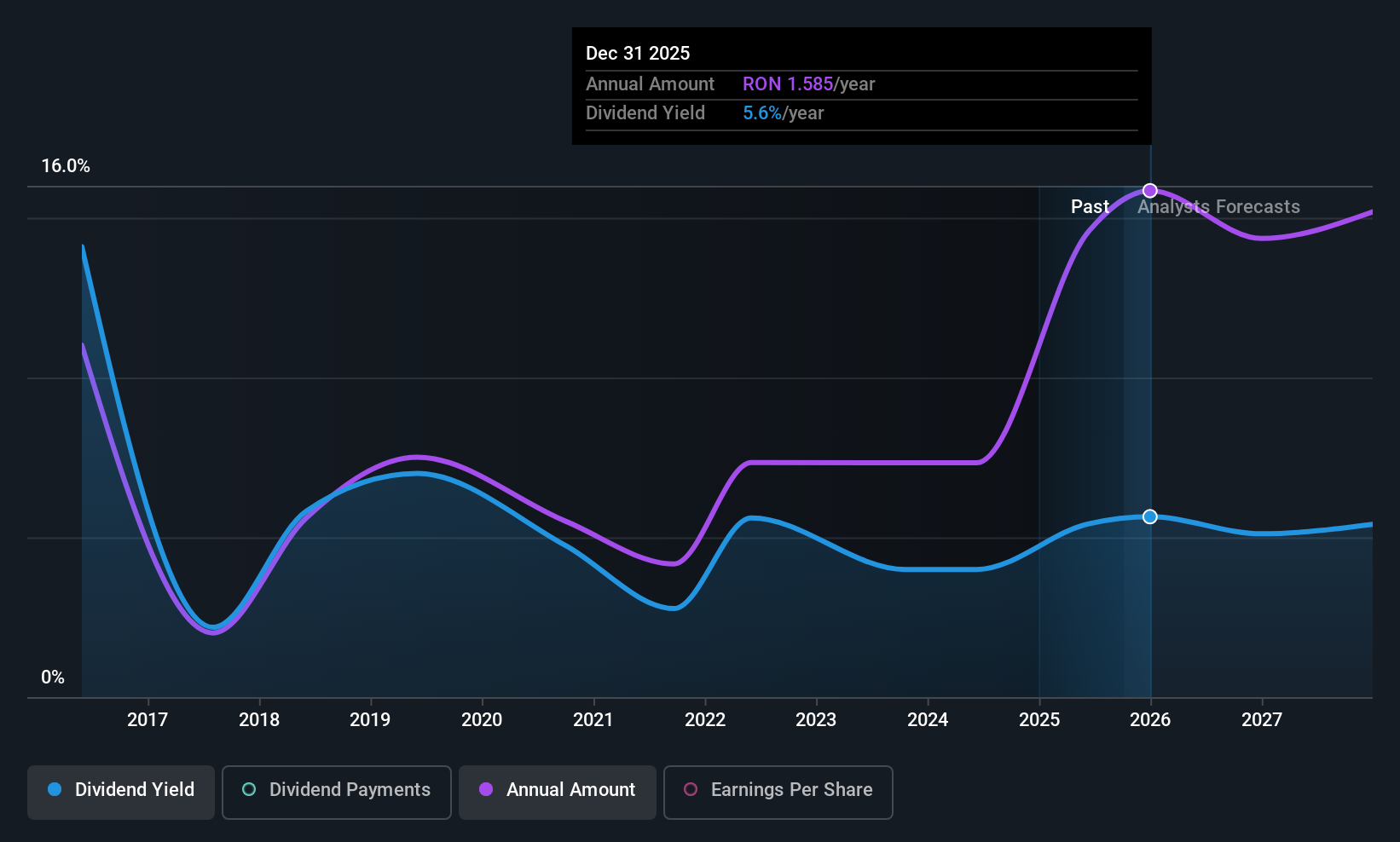

Banca Transilvania (BVB:TLV)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banca Transilvania S.A. offers a range of banking products and services in Romania, Italy, and the Republic of Moldova with a market cap of RON30.75 billion.

Operations: Banca Transilvania's revenue segments include Retail at RON3.74 billion, Micro at RON1.47 billion, Treasury at RON1.31 billion, Leasing and Consumer Loans Granted by Non-Bank Financial Institutions at RON826.52 million, Large Corporate at RON802.68 million, Mid Corporate at RON685.41 million, and SME at RON566.40 million.

Dividend Yield: 5.2%

Banca Transilvania's dividend yield of 5.17% is below the top 25% in Romania, but it maintains a sustainable payout ratio of 35.6%, forecasted to remain sustainable at 45.8% in three years. Despite earnings growth of 30.9% last year, dividends have been volatile over the past decade, raising concerns about reliability. Recent announcements confirm an annual dividend of RON 0.6420 per share for December, reflecting ongoing commitment despite historical volatility and high bad loans at 3.8%.

- Delve into the full analysis dividend report here for a deeper understanding of Banca Transilvania.

- The analysis detailed in our Banca Transilvania valuation report hints at an deflated share price compared to its estimated value.

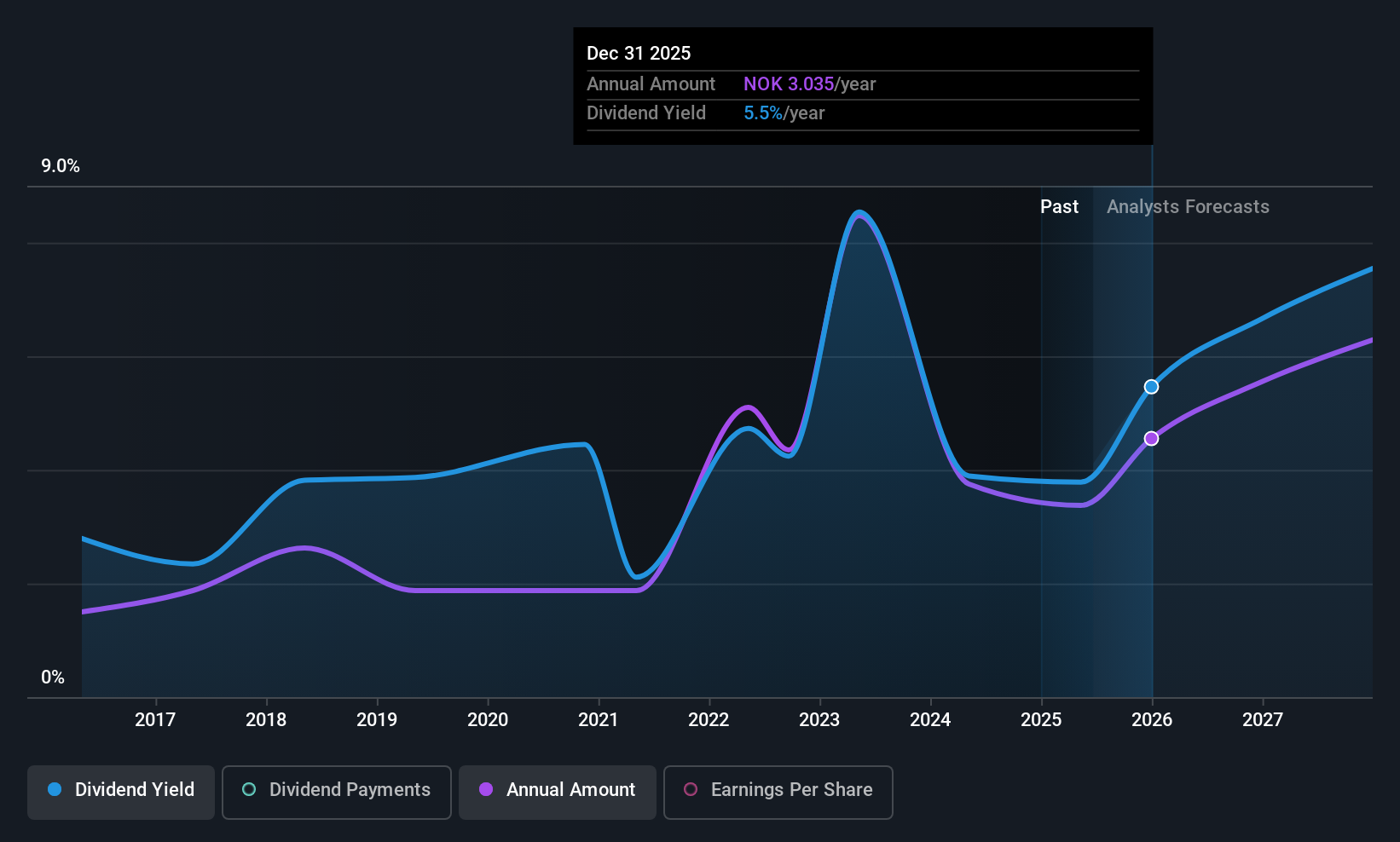

Norsk Hydro (OB:NHY)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Norsk Hydro ASA operates globally in power production, bauxite extraction, alumina refining, aluminium smelting, and recycling, with a market cap of NOK134.54 billion.

Operations: Norsk Hydro ASA generates revenue primarily through its segments, including Hydro Energy (NOK11.38 billion), Hydro Extrusions (NOK77.26 billion), Hydro Metal Markets (NOK85.56 billion), Hydro Aluminium Metal (NOK59.41 billion), and Hydro Bauxite & Alumina (NOK59.90 billion).

Dividend Yield: 3.3%

Norsk Hydro's dividend reliability is challenged by a volatile history, though recent payouts are covered by earnings and cash flows with payout ratios of 46.5% and 43.3%, respectively. Despite trading at a significant discount to estimated fair value, its yield of 3.31% falls short compared to Norway's top dividend payers. Recent cost-cutting measures aim to bolster long-term resilience, potentially impacting future dividends amidst fluctuating profits and revenue growth driven by strategic realignments.

- Take a closer look at Norsk Hydro's potential here in our dividend report.

- The valuation report we've compiled suggests that Norsk Hydro's current price could be quite moderate.

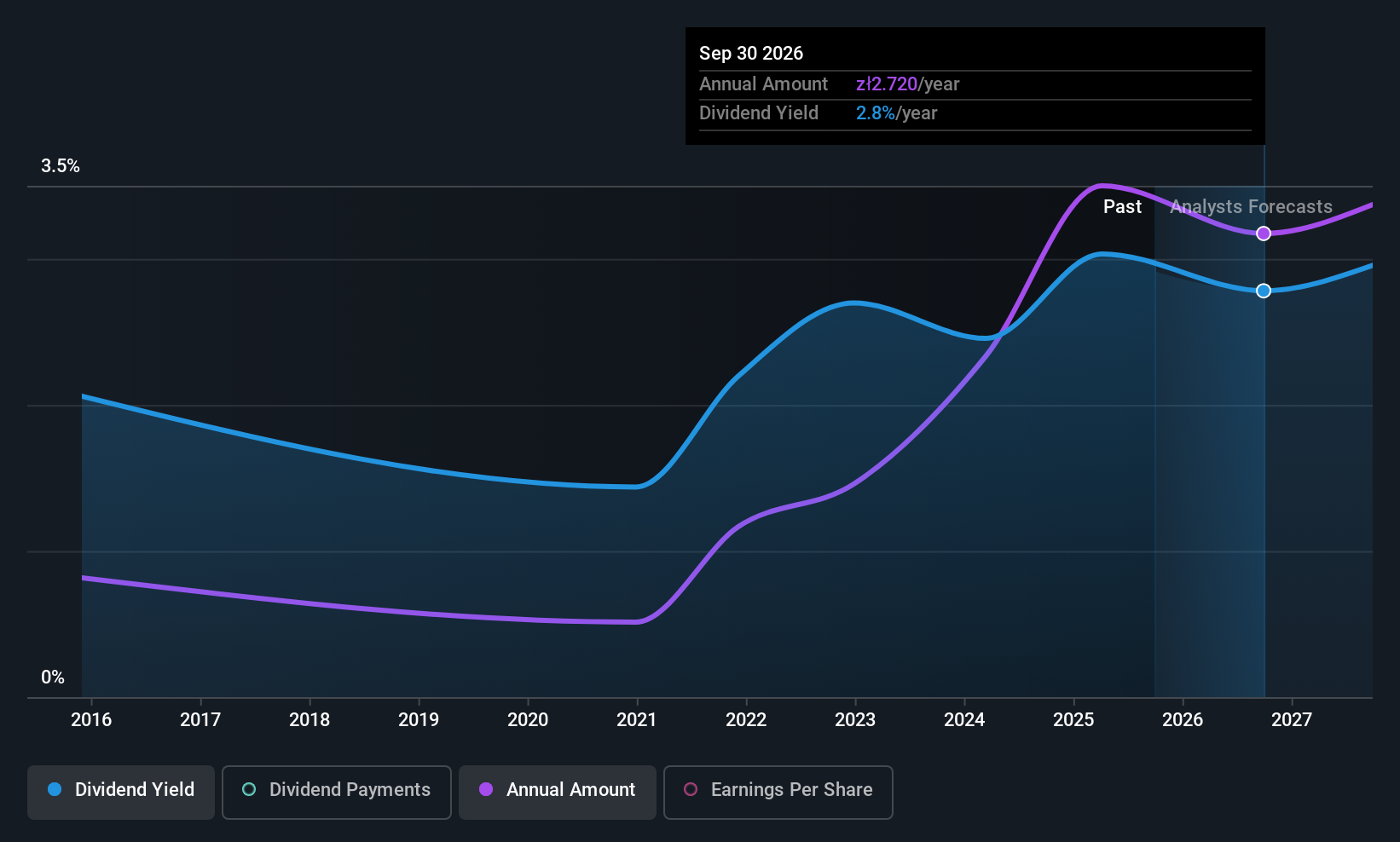

AB (WSE:ABE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AB S.A., with a market cap of PLN1.56 billion, distributes IT products across Poland, the Czech Republic, and Slovakia through its subsidiaries.

Operations: AB S.A.'s revenue is primarily derived from Wholesale Trade at PLN14.89 billion and Production at PLN45.53 million, while The Retail Trade segment posted a negative contribution of PLN27.97 million.

Dividend Yield: 3%

AB S.A.'s dividend payments, though covered by earnings and cash flows with payout ratios of 27.4% and 25.8%, have been volatile over the past decade, which raises concerns about reliability. The company's dividend yield of 3.03% is lower than the top Polish market payers, yet its price-to-earnings ratio of 9x suggests it trades at a discount compared to the market average. Recent earnings showed modest growth, indicating potential for future stability in payouts.

- Click here and access our complete dividend analysis report to understand the dynamics of AB.

- Our valuation report here indicates AB may be undervalued.

Make It Happen

- Delve into our full catalog of 229 Top European Dividend Stocks here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About WSE:ABE

AB

Distributes IT products primarily in Poland, the Czech Republic, and Slovakia.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives