- United States

- /

- Semiconductors

- /

- NasdaqGM:ENPH

Enphase Energy (NasdaqGM:ENPH) Soars 18% in One Week

Reviewed by Simply Wall St

Enphase Energy (NasdaqGM:ENPH) has recently gained attention following its addition to the Russell 2500 Growth Index and Russell 2500 Index, as well as the launch of its IQ Battery 5P targeting several European markets. These developments, along with promising projects in the U.S., fortify its standing in the renewable energy sector. Over the past week, the company's stock rose by 18%, likely buoyed by these encouraging updates. This move outpaces the broader market's 3% climb, suggesting added investor confidence in its growth trajectory, while the overall positive sentiment in the market likely added weight to this upward trend.

Every company has risks, and we've spotted 2 warning signs for Enphase Energy you should know about.

The recent addition of Enphase Energy to key indices and the launch of its IQ Battery 5P in European markets could significantly influence the company’s growth narrative. These developments are expected to enhance its market visibility and bolster investor confidence, potentially impacting revenue and earnings forecasts. Enphase's strategic focus on artificial intelligence, expanded product offerings, and diversified supply chains in Europe align with these initiatives, suggesting a promising outlook for revenue retention and growth.

Over the past five years, Enphase Energy's total return, including both share price and dividends, fell by 18.50%. This decline raises questions about its long-term performance and investor sentiment. Interestingly, while the stock has seen recent short-term gains, it underperformed both the broader U.S. market and the U.S. Semiconductor industry over the past year.

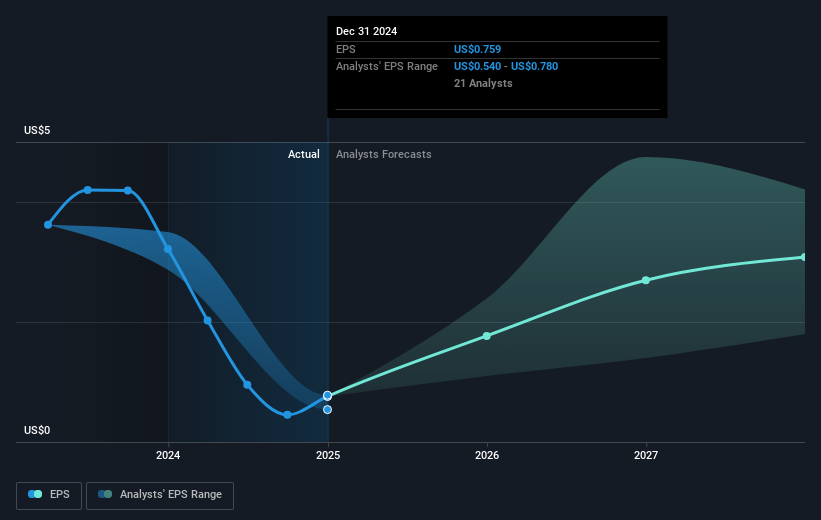

Analysts are projecting a substantial growth in earnings, with expectations of reaching US$325.3 million by mid-2028. This positive sentiment may influence future price movements and help close the gap between the current share price of US$38.38 and the consensus analyst price target of US$52.93. However, the analysts' forecast reflects a variety of assumptions about profit margins and market conditions, indicating that there is room for variance in outcomes. Investors should remain aware of these potential risks and insights as they assess their positions.

Examine Enphase Energy's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enphase Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:ENPH

Enphase Energy

Designs, develops, manufactures, and sells home energy solutions for the solar photovoltaic industry in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives