- United States

- /

- Entertainment

- /

- NYSE:WWE

Earnings Not Telling The Story For World Wrestling Entertainment, Inc. (NYSE:WWE)

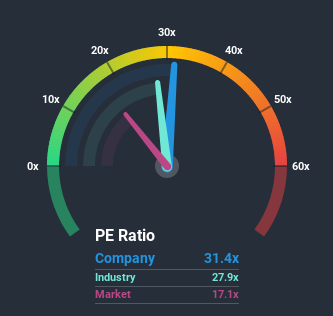

When close to half the companies in the United States have price-to-earnings ratios (or "P/E's") below 17x, you may consider World Wrestling Entertainment, Inc. (NYSE:WWE) as a stock to avoid entirely with its 31.4x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

Recent times have been pleasing for World Wrestling Entertainment as its earnings have risen in spite of the market's earnings going into reverse. It seems that many are expecting the company to continue defying the broader market adversity, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for World Wrestling Entertainment

Is There Enough Growth For World Wrestling Entertainment?

World Wrestling Entertainment's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 46%. Pleasingly, EPS has also lifted 424% in aggregate from three years ago, thanks to the last 12 months of growth. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 8.2% per year as estimated by the analysts watching the company. Meanwhile, the rest of the market is forecast to expand by 11% per year, which is noticeably more attractive.

In light of this, it's alarming that World Wrestling Entertainment's P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of earnings growth is likely to weigh heavily on the share price eventually.

The Bottom Line On World Wrestling Entertainment's P/E

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of World Wrestling Entertainment's analyst forecasts revealed that its inferior earnings outlook isn't impacting its high P/E anywhere near as much as we would have predicted. Right now we are increasingly uncomfortable with the high P/E as the predicted future earnings aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for World Wrestling Entertainment that you should be aware of.

If these risks are making you reconsider your opinion on World Wrestling Entertainment, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you’re looking to trade World Wrestling Entertainment, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if World Wrestling Entertainment might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NYSE:WWE

World Wrestling Entertainment

World Wrestling Entertainment, Inc., an integrated media and entertainment company, engages in the sports entertainment business in North America, Europe, the Middle East, Africa, the Asia Pacific, and Latin America.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives