- United States

- /

- Hospitality

- /

- NasdaqGS:DASH

DoorDash (DASH) Strengthens Partnerships With Ace Pickleball Club And McDonald's

Reviewed by Simply Wall St

DoorDash (DASH) captured attention with its recent 29% price movement, driven by its partnership with Ace Pickleball Club and the launch of a new McDelivery experience with McDonald's USA, bolstering its market position. During this period, the company's Q2 earnings report showcased revenue and net income growth, aligning favorably with market trends. DoorDash's involvement in drone and AI-driven delivery initiatives further highlighted its innovation-driven strategy, complementing the broader market's overall 19% annual rise. While inflation news affected general market mood, DoorDash's strategic initiatives likely helped support its upward momentum in a volatile economic climate.

We've discovered 1 warning sign for DoorDash that you should be aware of before investing here.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

The recent initiatives involving DoorDash's partnership with Ace Pickleball Club and the McDelivery launch with McDonald's USA may substantially influence the company's narrative of growing market presence and synergy-driven growth. These partnerships could potentially drive higher order volumes and enhance DoorDash's service offerings, aligning well with the emphasis on autonomous tech and DashPass growth mentioned in the narrative. As a consequence, the increased visibility and potentially higher market engagement could push both revenue and earnings upward, reinforcing forecasts that already anticipate substantial growth.

Over the past three years, DoorDash's total shareholder return, inclusive of share price appreciation and dividends, was 272.84%, highlighting significant investor returns during this period. Comparatively, over the past year, DoorDash's return exceeded both the US market and its industry, reinforcing its position as a front-runner in the hospitality sector. This impressive performance underscores the company's ability to effectively capitalize on expansion opportunities and strategic initiatives.

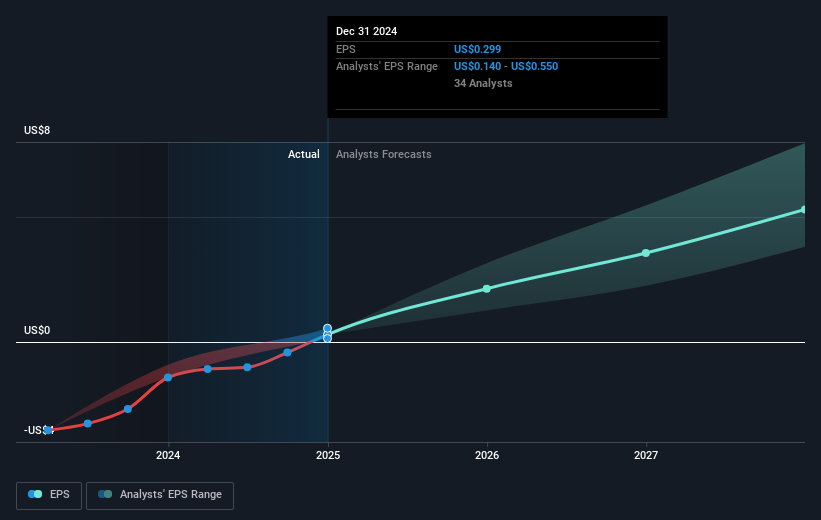

Furthermore, the current share price of US$254.20, while elevated due to recent news, is still positioned below the consensus analyst price target of US$290.77, indicating potential upside based on current market expectations. By focusing on operational advancements, DoorDash could continue its trajectory of increasing its revenue streams and expanding profit margins, which are critical as analysts project a robust growth in earnings and revenue. However, this also necessitates mindful navigation of competitive and regulatory landscapes to maintain and possibly exceed these growth forecasts.

Examine DoorDash's past performance report to understand how it has performed in prior years.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:DASH

DoorDash

Operates a commerce platform that connects merchants, consumers, and independent contractors in the United States and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives