- United States

- /

- Personal Products

- /

- NYSE:ELF

Don't Ignore The Fact That This Insider Just Sold Some Shares In e.l.f. Beauty, Inc. (NYSE:ELF)

We'd be surprised if e.l.f. Beauty, Inc. (NYSE:ELF) shareholders haven't noticed that the Senior VP & Chief Marketing Officer, Kory Marchisotto, recently sold US$181k worth of stock at US$15.71 per share. On the bright side, that sale was only 9.0% of their holding, so we doubt it's very meaningful, on its own.

See our latest analysis for e.l.f. Beauty

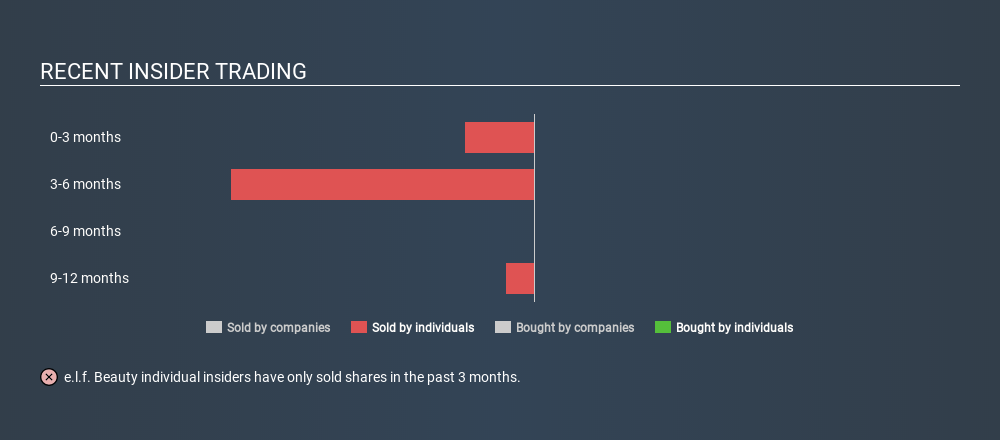

The Last 12 Months Of Insider Transactions At e.l.f. Beauty

In the last twelve months, the biggest single sale by an insider was when the Chairman, Tarang Amin, sold US$1.7m worth of shares at a price of US$17.12 per share. So what is clear is that an insider saw fit to sell at around the current price of US$15.65. While insider selling is a negative, to us, it is more negative if the shares are sold at a lower price. We note that this sale took place at around the current price, so it isn't a major concern, though it's hardly a good sign.

e.l.f. Beauty insiders didn't buy any shares over the last year. The chart below shows insider transactions (by individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

I will like e.l.f. Beauty better if I see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Does e.l.f. Beauty Boast High Insider Ownership?

For a common shareholder, it is worth checking how many shares are held by company insiders. We usually like to see fairly high levels of insider ownership. e.l.f. Beauty insiders own about US$98m worth of shares. That equates to 13% of the company. We've certainly seen higher levels of insider ownership elsewhere, but these holdings are enough to suggest alignment between insiders and the other shareholders.

What Might The Insider Transactions At e.l.f. Beauty Tell Us?

Insiders sold e.l.f. Beauty shares recently, but they didn't buy any. Looking to the last twelve months, our data doesn't show any insider buying. While insiders do own shares, they don't own a heap, and they have been selling. We're in no rush to buy! So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. In terms of investment risks, we've identified 2 warning signs with e.l.f. Beauty and understanding these should be part of your investment process.

But note: e.l.f. Beauty may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:ELF

e.l.f. Beauty

A beauty company, provides cosmetics and skin care products worldwide.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives