- Canada

- /

- Metals and Mining

- /

- TSX:DPM

Don't Ignore The Fact That This Insider Just Sold Some Shares In Dundee Precious Metals Inc. (TSE:DPM)

Investors may wish to note that an insider of Dundee Precious Metals Inc., Thomas Claugus, recently netted CA$128k from selling stock, receiving an average price of CA$6.69. However we note that the sale only shrunk their holding by 2.0%.

See our latest analysis for Dundee Precious Metals

The Last 12 Months Of Insider Transactions At Dundee Precious Metals

Chairman of the Board Jonathan Goodman made the biggest insider purchase in the last 12 months. That single transaction was for CA$227k worth of shares at a price of CA$5.35 each. That implies that an insider found the current price of CA$6.46 per share to be enticing. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We do always like to see insider buying, but it is worth noting if those purchases were made at well below today's share price, as the discount to value may have narrowed with the rising price. Happily, the Dundee Precious Metals insiders decided to buy shares at close to current prices. We note that Jonathan Goodman was both the biggest buyer and the biggest seller.

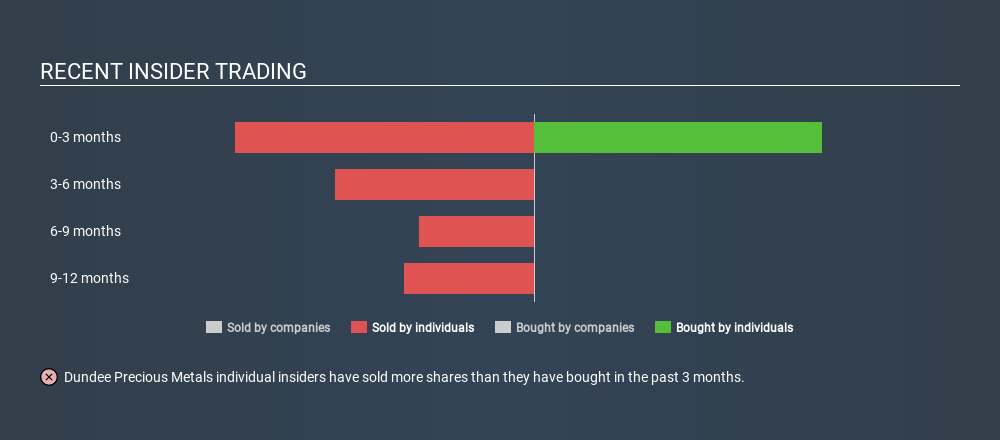

In the last twelve months insiders purchased 88.48k shares for CA$407k. But they sold 228380 shares for CA$1.3m. In total, Dundee Precious Metals insiders sold more than they bought over the last year. The average sell price was around US$5.60. It's not too encouraging to see that insiders have sold at below the current price. But we wouldn't put too much weight on the insider selling. You can see the insider transactions (by individuals) over the last year depicted in the chart below. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

If you like to buy stocks that insiders are buying, rather than selling, then you might just love this free list of companies. (Hint: insiders have been buying them).

Does Dundee Precious Metals Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. Usually, the higher the insider ownership, the more likely it is that insiders will be incentivised to build the company for the long term. Our data indicates that Dundee Precious Metals insiders own about CA$9.5m worth of shares (which is 0.8% of the company). We do note, however, it is possible insiders have an indirect interest through a private company or other corporate structure. Overall, this level of ownership isn't that impressive, but it's certainly better than nothing!

So What Does This Data Suggest About Dundee Precious Metals Insiders?

The insider sales have outweighed the insider buying, at Dundee Precious Metals, in the last three months. Zooming out, the longer term picture doesn't give us much comfort. When you consider that most companies have higher levels of insider ownership, we're a little wary. So we're not rushing to buy, to say the least. In addition to knowing about insider transactions going on, it's beneficial to identify the risks facing Dundee Precious Metals. Case in point: We've spotted 2 warning signs for Dundee Precious Metals you should be aware of.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of interesting companies, that have HIGH return on equity and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions, but not derivative transactions.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About TSX:DPM

Dundee Precious Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives