Don't Buy Zuari Global Limited (NSE:ZUARIGLOB) For Its Next Dividend Without Doing These Checks

It looks like Zuari Global Limited (NSE:ZUARIGLOB) is about to go ex-dividend in the next 3 days. You will need to purchase shares before the 4th of September to receive the dividend, which will be paid on the 14th of October.

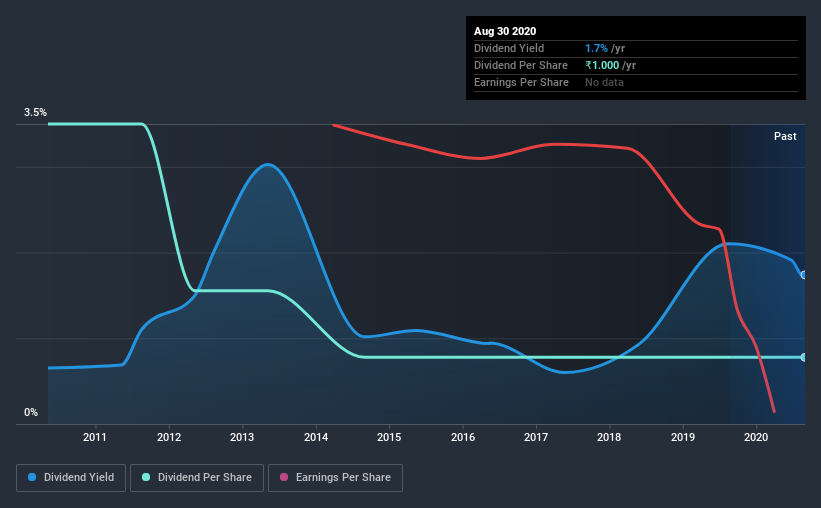

Zuari Global's next dividend payment will be ₹1.00 per share, and in the last 12 months, the company paid a total of ₹1.00 per share. Calculating the last year's worth of payments shows that Zuari Global has a trailing yield of 1.7% on the current share price of ₹57.55. If you buy this business for its dividend, you should have an idea of whether Zuari Global's dividend is reliable and sustainable. As a result, readers should always check whether Zuari Global has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Zuari Global

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Zuari Global reported a loss after tax last year, which means it's paying a dividend despite being unprofitable. While this might be a one-off event, this is unlikely to be sustainable in the long term. Considering the lack of profitability, we also need to check if the company generated enough cash flow to cover the dividend payment. If Zuari Global didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. What's good is that dividends were well covered by free cash flow, with the company paying out 9.1% of its cash flow last year.

Click here to see how much of its profit Zuari Global paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. Zuari Global was unprofitable last year and, unfortunately, the general trend suggests its earnings have been in decline over the last five years, making us wonder if the dividend is sustainable at all.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Zuari Global has seen its dividend decline 14% per annum on average over the past 10 years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

Remember, you can always get a snapshot of Zuari Global's financial health, by checking our visualisation of its financial health, here.

The Bottom Line

From a dividend perspective, should investors buy or avoid Zuari Global? It's hard to get used to Zuari Global paying a dividend despite reporting a loss over the past year. At least the dividend was covered by free cash flow, however. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

So if you're still interested in Zuari Global despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. To that end, you should learn about the 4 warning signs we've spotted with Zuari Global (including 1 which is a bit unpleasant).

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Zuari Global, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Zuari Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:ZUARIIND

Zuari Industries

Engages in agriculture, heavy engineering, infrastructure, lifestyle, and services businesses in India and internationally.

Proven track record low.

Market Insights

Community Narratives