- Australia

- /

- Diversified Financial

- /

- ASX:SOL

Don't Buy Washington H. Soul Pattinson and Company Limited (ASX:SOL) For Its Next Dividend Without Doing These Checks

Washington H. Soul Pattinson and Company Limited (ASX:SOL) stock is about to trade ex-dividend in 3 days time. This means that investors who purchase shares on or after the 22nd of April will not receive the dividend, which will be paid on the 14th of May.

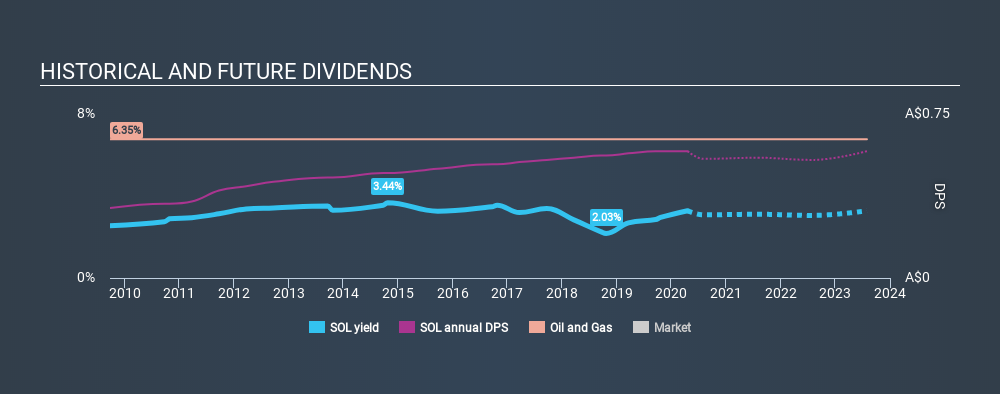

Washington H. Soul Pattinson's next dividend payment will be AU$0.25 per share, on the back of last year when the company paid a total of AU$0.58 to shareholders. Last year's total dividend payments show that Washington H. Soul Pattinson has a trailing yield of 3.1% on the current share price of A$18.87. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! We need to see whether the dividend is covered by earnings and if it's growing.

Check out our latest analysis for Washington H. Soul Pattinson

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Washington H. Soul Pattinson paid out 118% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flows are even more important than profits for assessing a dividend, so we need to see if the company generated enough cash to pay its distribution. Washington H. Soul Pattinson paid out more free cash flow than it generated - 182%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

Cash is slightly more important than profit from a dividend perspective, but given Washington H. Soul Pattinson's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Stocks with flat earnings can still be attractive dividend payers, but it is important to be more conservative with your approach and demand a greater margin for safety when it comes to dividend sustainability. If earnings fall far enough, the company could be forced to cut its dividend. That explains why we're not overly excited about Washington H. Soul Pattinson's flat earnings over the past five years. We'd take that over an earnings decline any day, but in the long run, the best dividend stocks all grow their earnings per share.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. Washington H. Soul Pattinson has delivered an average of 6.1% per year annual increase in its dividend, based on the past ten years of dividend payments.

To Sum It Up

Has Washington H. Soul Pattinson got what it takes to maintain its dividend payments? It's been unable to generate earnings growth, yet is paying out an uncomfortably high percentage of both its profits (118%) and cash flow (182%) as dividends. With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Washington H. Soul Pattinson.

Although, if you're still interested in Washington H. Soul Pattinson and want to know more, you'll find it very useful to know what risks this stock faces. Every company has risks, and we've spotted 3 warning signs for Washington H. Soul Pattinson you should know about.

A common investment mistake is buying the first interesting stock you see. Here you can find a list of promising dividend stocks with a greater than 2% yield and an upcoming dividend.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About ASX:SOL

Washington H. Soul Pattinson

An investment company, engages in investing various industries and asset classes in Australia.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives