Does Punjab Chemicals and Crop Protection (NSE:PUNJABCHEM) Have A Healthy Balance Sheet?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Punjab Chemicals and Crop Protection Limited (NSE:PUNJABCHEM) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Punjab Chemicals and Crop Protection

What Is Punjab Chemicals and Crop Protection's Debt?

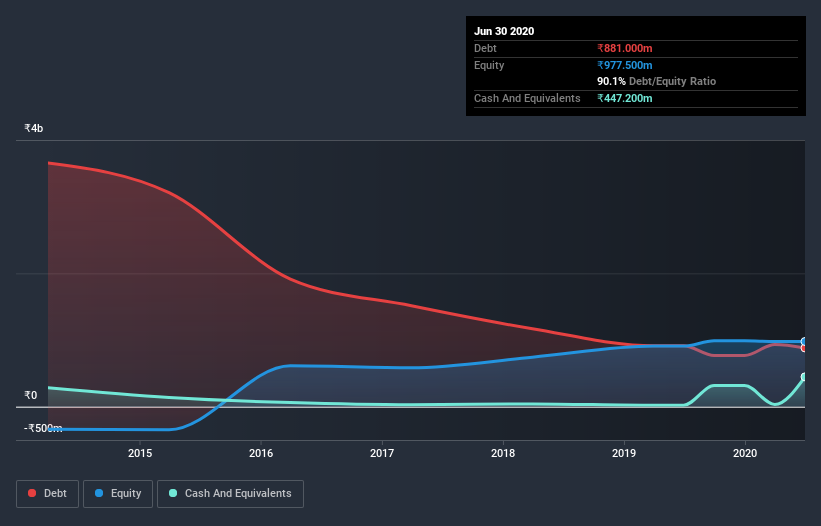

You can click the graphic below for the historical numbers, but it shows that Punjab Chemicals and Crop Protection had ₹807.7m of debt in March 2020, down from ₹914.3m, one year before. On the flip side, it has ₹447.2m in cash leading to net debt of about ₹360.5m.

How Healthy Is Punjab Chemicals and Crop Protection's Balance Sheet?

The latest balance sheet data shows that Punjab Chemicals and Crop Protection had liabilities of ₹2.27b due within a year, and liabilities of ₹688.8m falling due after that. Offsetting this, it had ₹447.2m in cash and ₹945.6m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by ₹1.6b.

While this might seem like a lot, it is not so bad since Punjab Chemicals and Crop Protection has a market capitalization of ₹7.62b, and so it could probably strengthen its balance sheet by raising capital if it needed to. But we definitely want to keep our eyes open to indications that its debt is bringing too much risk.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Looking at its net debt to EBITDA of 0.60 and interest cover of 2.6 times, it seems to us that Punjab Chemicals and Crop Protection is probably using debt in a pretty reasonable way. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Importantly, Punjab Chemicals and Crop Protection's EBIT fell a jaw-dropping 20% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Punjab Chemicals and Crop Protection will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So it's worth checking how much of that EBIT is backed by free cash flow. During the last three years, Punjab Chemicals and Crop Protection produced sturdy free cash flow equating to 57% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

Punjab Chemicals and Crop Protection's struggle to grow its EBIT had us second guessing its balance sheet strength, but the other data-points we considered were relatively redeeming. For example its net debt to EBITDA was refreshing. We think that Punjab Chemicals and Crop Protection's debt does make it a bit risky, after considering the aforementioned data points together. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Punjab Chemicals and Crop Protection you should be aware of, and 1 of them is significant.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Punjab Chemicals and Crop Protection or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:PUNJABCHEM

Punjab Chemicals and Crop Protection

Manufactures and sells agrochemicals, specialty chemicals, bulk drugs, and related intermediates in India, Europe, Japan, Israel, the United States, Latin America, and internationally.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives