- United Kingdom

- /

- Water Utilities

- /

- LSE:PNN

Does Pennon Group Plc's (LON:PNN) CEO Pay Reflect Performance?

Chris Loughlin has been the CEO of Pennon Group Plc (LON:PNN) since 2016. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Pennon Group

How Does Chris Loughlin's Compensation Compare With Similar Sized Companies?

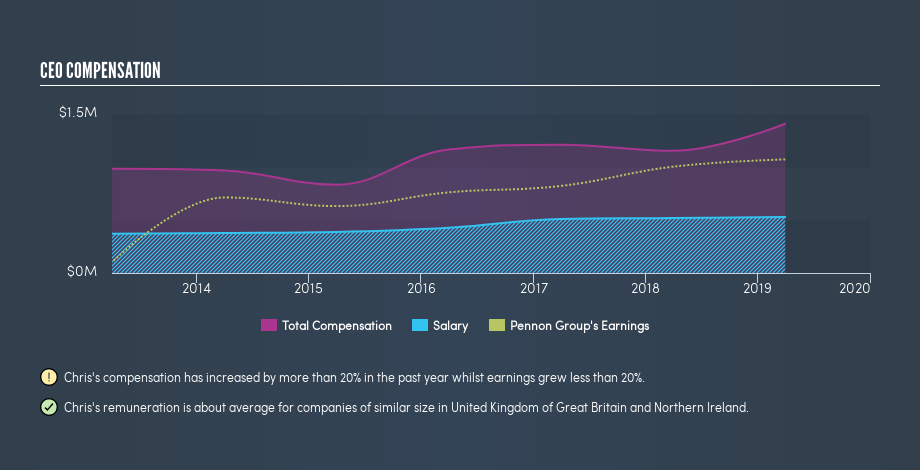

At the time of writing our data says that Pennon Group Plc has a market cap of UK£3.2b, and is paying total annual CEO compensation of UK£1.4m. (This figure is for the year to March 2019). That's a notable increase of 22% on last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£528k. When we examined a selection of companies with market caps ranging from UK£1.7b to UK£5.3b, we found the median CEO total compensation was UK£1.9m.

So Chris Loughlin is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

The graphic below shows how CEO compensation at Pennon Group has changed from year to year.

Is Pennon Group Plc Growing?

Pennon Group Plc has increased its earnings per share (EPS) by an average of 13% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 5.9%.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions.

Has Pennon Group Plc Been A Good Investment?

Since shareholders would have lost about 1.2% over three years, some Pennon Group Plc shareholders would surely be feeling negative emotions. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Remuneration for Chris Loughlin is close enough to the median pay for a CEO of a similar sized company .

We like that the company is growing EPS, but we find the returns over the last three years to be lacking. Considering the improvement in earnings per share, one could argue that the CEO pay is appropriate, albeit not too low. Whatever your view on compensation, you might want to check if insiders are buying or selling Pennon Group shares (free trial).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:PNN

Pennon Group

Provides water and wastewater services in the United Kingdom.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Inotiv NAMs Test Center

Delta loses shine after warning of falling travel demand, but still industry leader

Project Ixian Accelerated Rollout will Drive Valuation Expansion to £0.0150.

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

The Strategic Revaluation of Adobe: A Critical Analysis of Market Sentiment

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.