- United Kingdom

- /

- Water Utilities

- /

- LSE:PNN

Does Pennon Group Plc's (LON:PNN) CEO Pay Reflect Performance?

Chris Loughlin has been the CEO of Pennon Group Plc (LON:PNN) since 2016. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Pennon Group

How Does Chris Loughlin's Compensation Compare With Similar Sized Companies?

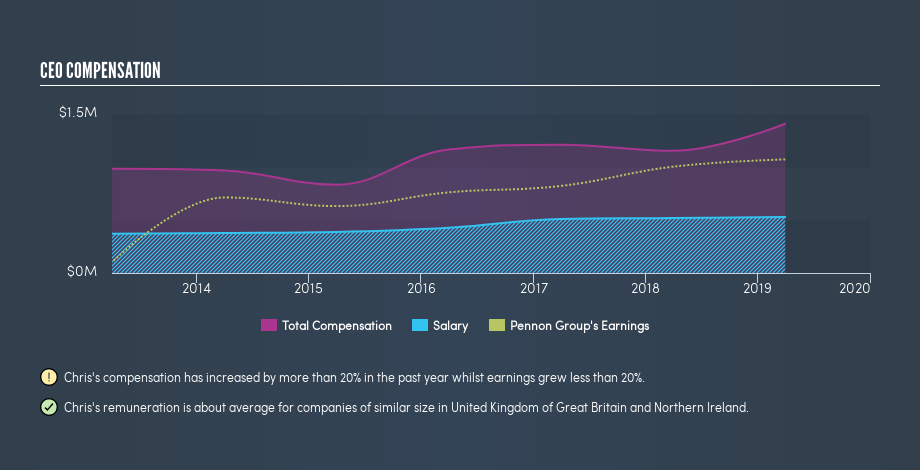

At the time of writing our data says that Pennon Group Plc has a market cap of UK£3.2b, and is paying total annual CEO compensation of UK£1.4m. (This figure is for the year to March 2019). That's a notable increase of 22% on last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£528k. When we examined a selection of companies with market caps ranging from UK£1.7b to UK£5.3b, we found the median CEO total compensation was UK£1.9m.

So Chris Loughlin is paid around the average of the companies we looked at. While this data point isn't particularly informative alone, it gains more meaning when considered with business performance.

The graphic below shows how CEO compensation at Pennon Group has changed from year to year.

Is Pennon Group Plc Growing?

Pennon Group Plc has increased its earnings per share (EPS) by an average of 13% a year, over the last three years (using a line of best fit). In the last year, its revenue is up 5.9%.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions.

Has Pennon Group Plc Been A Good Investment?

Since shareholders would have lost about 1.2% over three years, some Pennon Group Plc shareholders would surely be feeling negative emotions. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Remuneration for Chris Loughlin is close enough to the median pay for a CEO of a similar sized company .

We like that the company is growing EPS, but we find the returns over the last three years to be lacking. Considering the improvement in earnings per share, one could argue that the CEO pay is appropriate, albeit not too low. Whatever your view on compensation, you might want to check if insiders are buying or selling Pennon Group shares (free trial).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:PNN

Pennon Group

Provides water and wastewater services in the United Kingdom.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

An Undervalued 3.3Moz Gold Project in Canada

SoFi Technologies: The Apex Aggregator and the Infrastructure of the Modern Financial System

CSL: The Dip Is the Opportunity

DHT Holdings, inc: Strait of Hormuz Risk Amidst US-Israel vs Iran Tensions Spikes VLCC Rates.

Recently Updated Narratives

Vafseo and the Future of Renal Anemia Treatment – Akebia’s Vision for a $5B Kidney Disease Portfolio

Butler National (Buks) outperforms.

eToro: A High-Risk, Top-Tier Opportunity in the Future of Social Investing

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks