Does Dollarama Inc.'s (TSE:DOL) CEO Pay Matter?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Neil Rossy became the CEO of Dollarama Inc. (TSE:DOL) in 2016. This analysis aims first to contrast CEO compensation with other large companies. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Dollarama

How Does Neil Rossy's Compensation Compare With Similar Sized Companies?

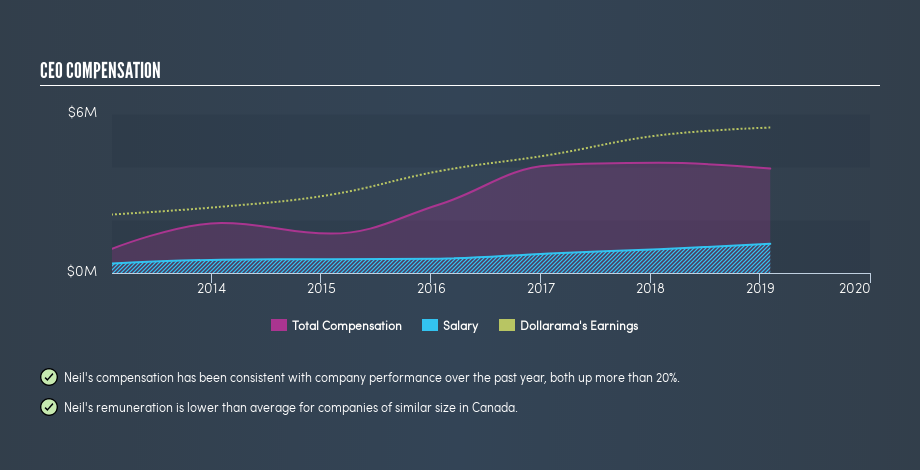

Our data indicates that Dollarama Inc. is worth CA$15b, and total annual CEO compensation is CA$3.9m. (This figure is for the year to February 2019). That's actually a decrease on the year before. While we always look at total compensation first, we note that the salary component is less, at CA$1.1m. We looked at a group of companies with market capitalizations over CA$10b and the median CEO total compensation was CA$9.1m. (We took a wide range because the CEOs of massive companies tend to be paid similar amounts - even though some are quite a bit bigger than others).

Most shareholders would consider it a positive that Neil Rossy takes less in total compensation than the CEOs of most other large companies, leaving more for shareholders. While this is a good thing, you'll need to understand the business better before you can form an opinion.

You can see a visual representation of the CEO compensation at Dollarama, below.

Is Dollarama Inc. Growing?

Dollarama Inc. has increased its earnings per share (EPS) by an average of 16% a year, over the last three years (using a line of best fit). Its revenue is up 9.0% over last year.

This demonstrates that the company has been improving recently. A good result. It's nice to see a little revenue growth, as this is consistent with healthy business conditions.

Has Dollarama Inc. Been A Good Investment?

I think that the total shareholder return of 52%, over three years, would leave most Dollarama Inc. shareholders smiling. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

Dollarama Inc. is currently paying its CEO below what is normal for large companies. Many would consider this to indicate that the pay is modest since the business is growing. The strong history of shareholder returns might even have some thinking that Neil Rossy deserves a raise!

It's not often we see shareholders do so well, and yet the CEO is paid modestly. It would be even more positive if company insiders are buying shares. Shareholders may want to check for free if Dollarama insiders are buying or selling shares.

Important note: Dollarama may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:DOL

Dollarama

Operates a chain of stores and provides related logistical and administrative support activities.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Physical AI" Monopoly – A New Industrial Revolution

Czechoslovak Group - is it really so hot?

The Compound Effect: From Acquisition to Integration

Recently Updated Narratives

Spectral AI: First of Its Kind Automated Wound Healing Prediction

Why EnSilica is Worth Possibly 13x its Current Price

SoFi Technologies will ride a 33% revenue growth wave in the next 5 years

Popular Narratives

Is Ubisoft the Market’s Biggest Pricing Error? Why Forensic Value Points to €33 Per Share

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Analyst Commentary Highlights Microsoft AI Momentum and Upward Valuation Amid Growth and Competitive Risks

Trending Discussion

When was the last time that Tesla delivered on its promises? Lets go through the list! The last successful would be the Tesla Model 3 which was 2019 with first deliveries 2017. Roadster not shipped. Tesla Cybertruck global roll out failed. They might have a bunch of prototypes (that are being controlled remotely) And you think they'll be able to ship something as complicated as a robot? It's a pure speculation buy.

This article completely disregards (ignores, forgets) how far China is in this field. If Tesla continues on this path, they will be fighting for their lives trying to sell $40000 dollar robots that can do less than a $10000 dollar one from China will do. Fair value of Tesla? It has always been a hype stock with a valuation completely unbased in reality. Your guess is as good as mine, but especially after the carbon credit scheme got canned, it is downwards of $150.