- United Kingdom

- /

- Metals and Mining

- /

- AIM:KOD

Discovering UK Penny Stocks: Cora Gold And 2 Other Compelling Picks

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining due to weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, certain investment opportunities continue to capture attention. Penny stocks, though sometimes seen as an outdated term, still hold potential for investors when backed by strong financials and growth prospects. In this article, we explore three compelling UK penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.17 | £290.22M | ✅ 5 ⚠️ 0 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.00 | £449.8M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.04 | £326.38M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.49 | £189.76M | ✅ 5 ⚠️ 2 View Analysis > |

| Ultimate Products (LSE:ULTP) | £0.768 | £64.61M | ✅ 4 ⚠️ 3 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.385 | £41.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.39 | £423.25M | ✅ 2 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.07 | £170.7M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.33 | £72.73M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 410 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Cora Gold (AIM:CORA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Cora Gold Limited, with a market cap of £35.15 million, explores and develops mineral projects in West Africa.

Operations: Currently, there are no reported revenue segments for the company.

Market Cap: £35.15M

Cora Gold Limited, with a market cap of £35.15 million, is pre-revenue and focuses on mineral projects in West Africa. Recent metallurgical tests at its Sanankoro Gold Project have identified a two-stage processing strategy that could enhance project economics by reducing power requirements and optimizing gold recovery. Despite being unprofitable with a net loss of US$1.1 million for 2024, the company has no debt and sufficient short-term assets to cover liabilities. It recently raised £1.55 million through an equity offering, extending its cash runway amid ongoing efforts to update the 2022 Definitive Feasibility Study for Sanankoro.

- Click here to discover the nuances of Cora Gold with our detailed analytical financial health report.

- Learn about Cora Gold's historical performance here.

Kodal Minerals (AIM:KOD)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Kodal Minerals PLC, with a market cap of £53.66 million, is involved in the exploration and evaluation of mineral resources in the United Kingdom and West Africa through its subsidiaries.

Operations: Kodal Minerals PLC does not report any specific revenue segments.

Market Cap: £53.66M

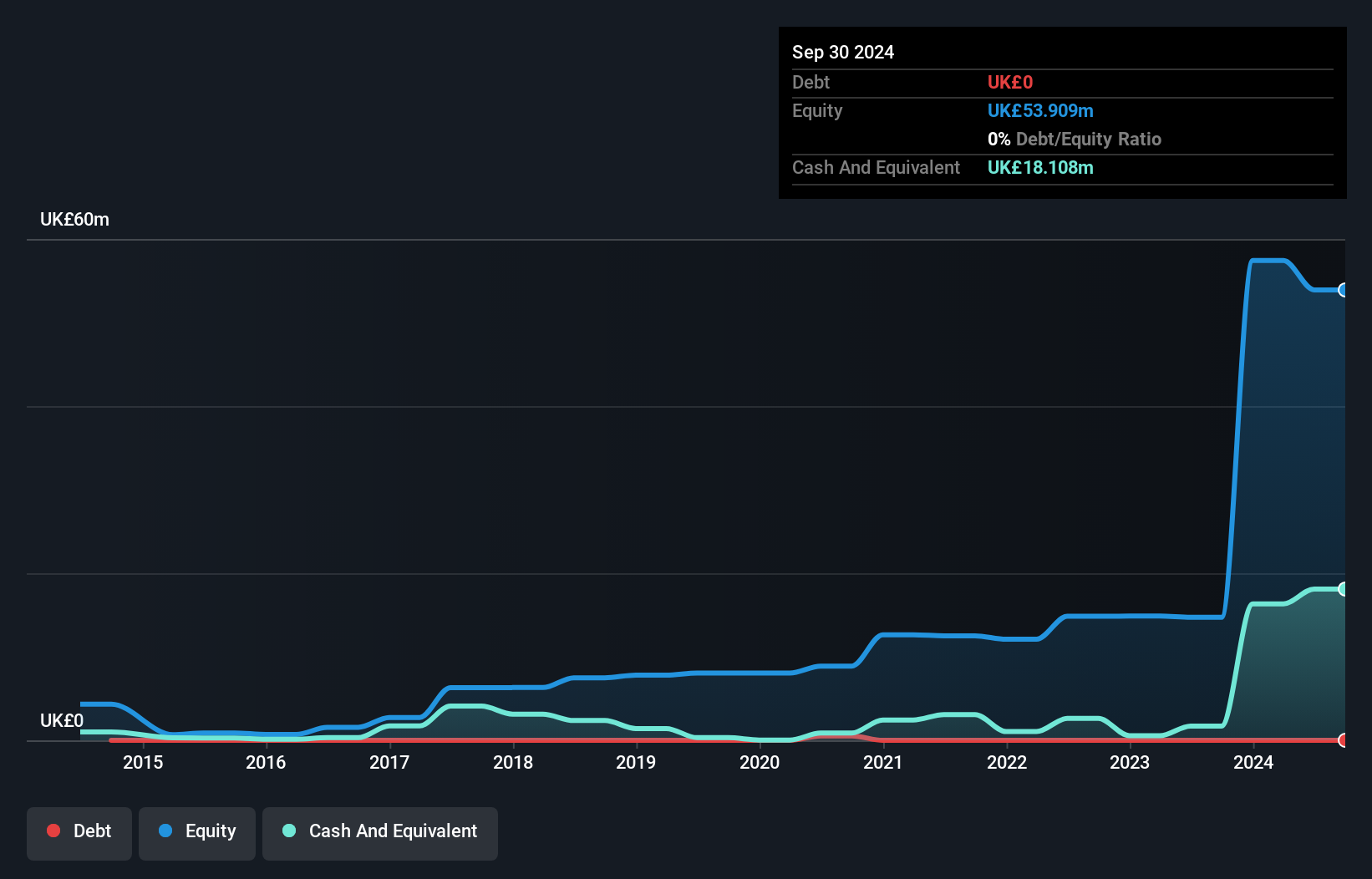

Kodal Minerals PLC, with a market cap of £53.66 million, is pre-revenue and focuses on mineral exploration in the UK and West Africa. The company recently reported significant progress at its Bougouni Lithium Project in Mali, producing over 11,000 tonnes of spodumene concentrate as it approaches commercial production. Despite delays in transferring the mining licence and pending government approvals for export permits, Kodal remains debt-free with short-term assets exceeding liabilities. The board and management are experienced, contributing to stable operations despite high share price volatility. Kodal's return on equity is outstanding at 48.6%.

- Click to explore a detailed breakdown of our findings in Kodal Minerals' financial health report.

- Review our historical performance report to gain insights into Kodal Minerals' track record.

Staffline Group (AIM:STAF)

Simply Wall St Financial Health Rating: ★★★★★☆

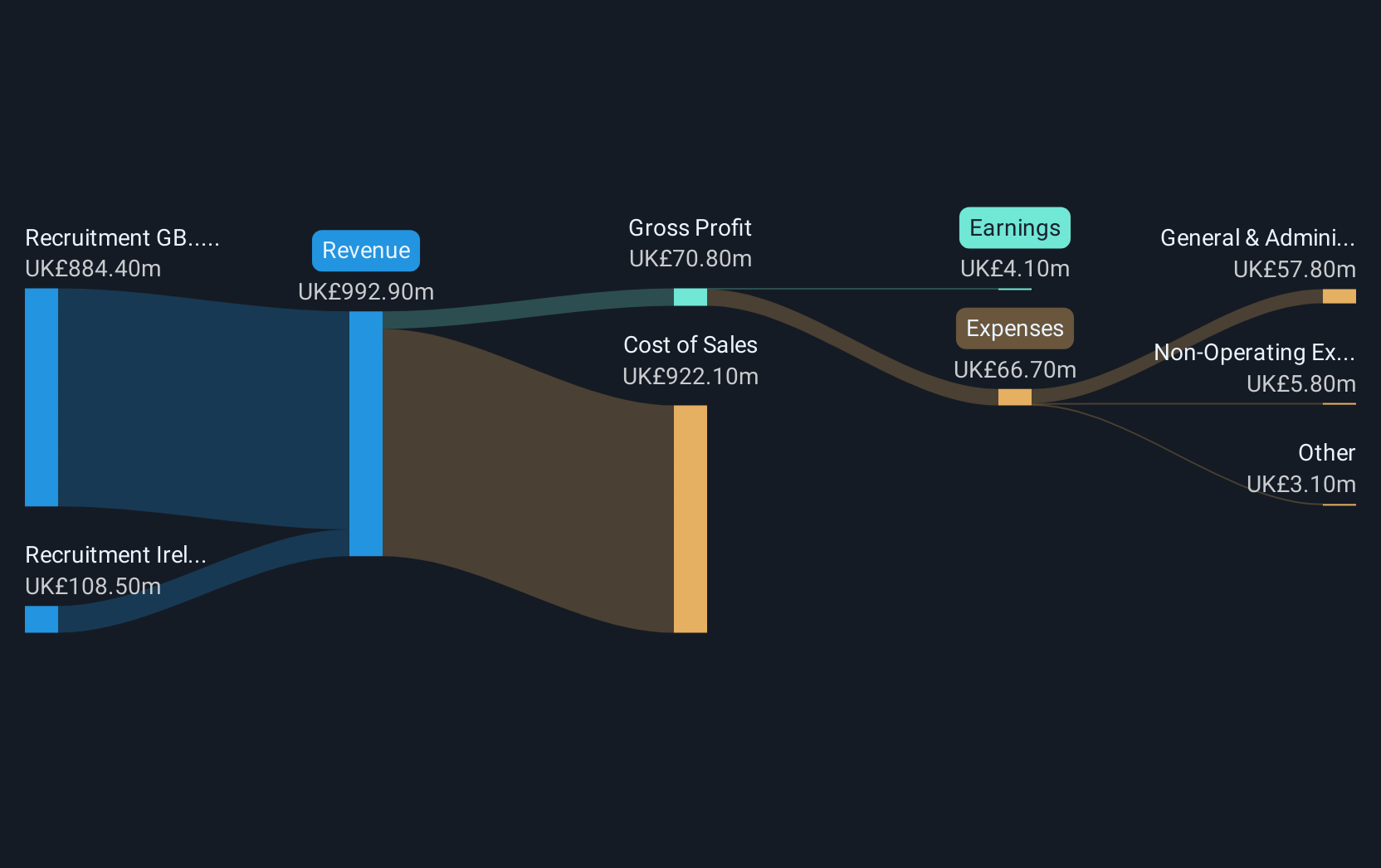

Overview: Staffline Group PLC, with a market cap of £57.01 million, operates in the United Kingdom and the Republic of Ireland providing recruitment and outsourced human resource services through its subsidiaries.

Operations: The company generates revenue primarily from the United Kingdom (£967.1 million) and the Republic of Ireland (£25.8 million).

Market Cap: £57.01M

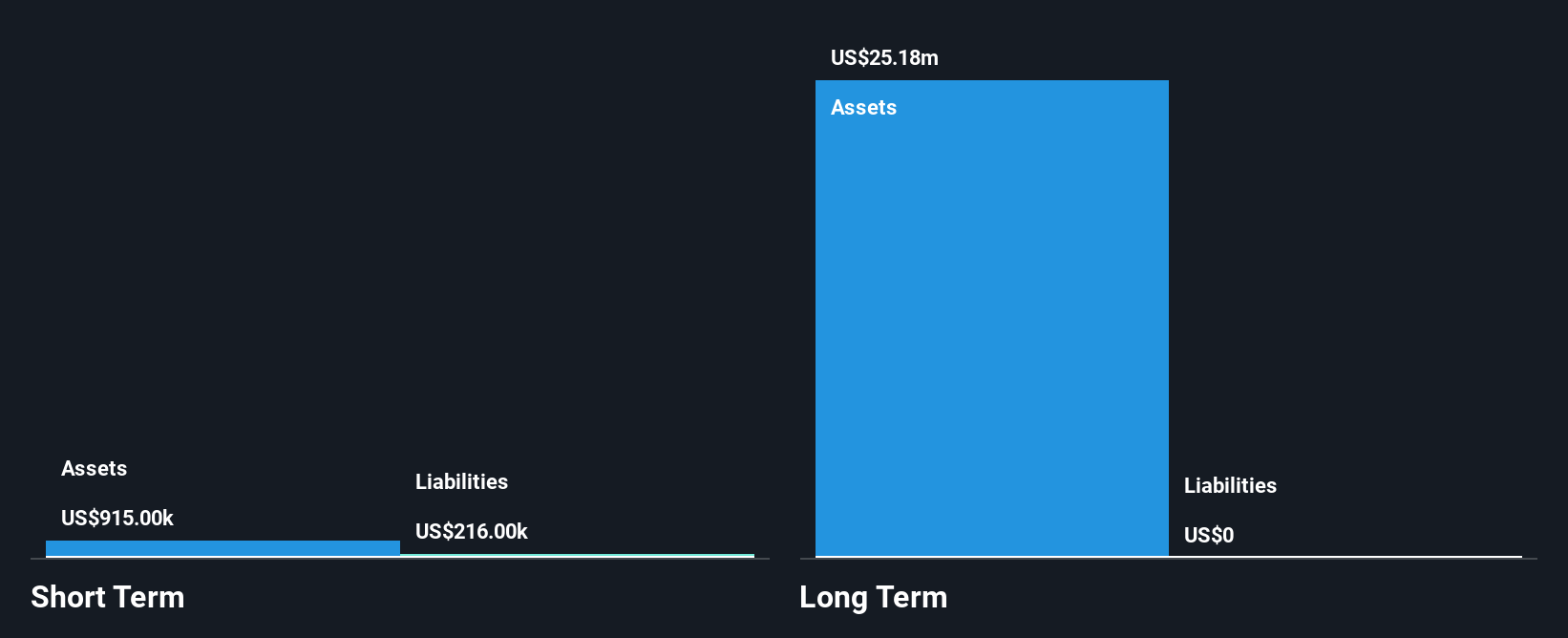

Staffline Group PLC, with a market cap of £57.01 million, has demonstrated financial stability by covering its short and long-term liabilities with assets totaling £175.8 million. The company has reduced its debt to equity ratio significantly over the past five years from 111.5% to 12.1%, while maintaining more cash than total debt, indicating strong financial management. Recent strategic partnerships in the logistics sector are expected to bolster its market position and revenue streams further. Although it reported a net loss of £8.3 million for 2024, Staffline's earnings per share have improved year-on-year, reflecting operational progress amidst high share price volatility.

- Navigate through the intricacies of Staffline Group with our comprehensive balance sheet health report here.

- Gain insights into Staffline Group's outlook and expected performance with our report on the company's earnings estimates.

Next Steps

- Click this link to deep-dive into the 410 companies within our UK Penny Stocks screener.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kodal Minerals might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:KOD

Kodal Minerals

Engages in the exploration and evaluation of mineral resources in the United Kingdom and West Africa.

Flawless balance sheet slight.

Market Insights

Community Narratives