- United States

- /

- Commercial Services

- /

- NasdaqCM:YIBO

Discovering Opportunities: Sensus Healthcare Among 3 Promising Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market experiences a rebound with major indices like the Nasdaq and S&P 500 showing gains, investors are increasingly on the lookout for opportunities beyond traditional blue-chip stocks. Penny stocks, though often seen as a relic of past trading days, continue to offer intriguing prospects due to their potential for significant returns when backed by strong financials. In this article, we explore three promising penny stocks that stand out for their balance sheet strength and growth potential, offering investors a chance to uncover hidden value in quality companies.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.76 | $381.46M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.67 | $625.68M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.9832 | $176.15M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $4.35 | $784.11M | ✅ 4 ⚠️ 2 View Analysis > |

| Global Self Storage (SELF) | $4.98 | $56.69M | ✅ 5 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.90 | $253.87M | ✅ 3 ⚠️ 2 View Analysis > |

| Performance Shipping (PSHG) | $2.03 | $26.36M | ✅ 4 ⚠️ 2 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.9125 | $6.68M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $2.98 | $68.65M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 371 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Sensus Healthcare (SRTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Sensus Healthcare, Inc. is a medical device company that manufactures and sells radiation therapy devices to healthcare providers globally, with a market cap of $50.96 million.

Operations: The company generates revenue from its Medical Laser Systems segment, amounting to $37.56 million.

Market Cap: $50.96M

Sensus Healthcare, Inc., a medical device manufacturer with a market cap of US$50.96 million, is currently unprofitable but debt-free, with short-term assets exceeding liabilities by US$45.8 million. Despite recent revenue declines to US$15.66 million for six months ending June 2025 from the previous year, analysts forecast significant earnings growth of 94.39% annually. The company’s superficial radiotherapy technology has shown promising results in treating keloids, enhancing its clinical credibility and potential market reach. However, the stock remains highly volatile and trades significantly below estimated fair value according to analyst consensus.

- Click here to discover the nuances of Sensus Healthcare with our detailed analytical financial health report.

- Explore Sensus Healthcare's analyst forecasts in our growth report.

Planet Image International (YIBO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Planet Image International Limited, with a market cap of $76.41 million, manufactures and sells compatible toner cartridges under its own brands and third-party labels across North America, Europe, and other international markets.

Operations: The company generates revenue of $147.07 million from its Printers & Related Products segment.

Market Cap: $76.41M

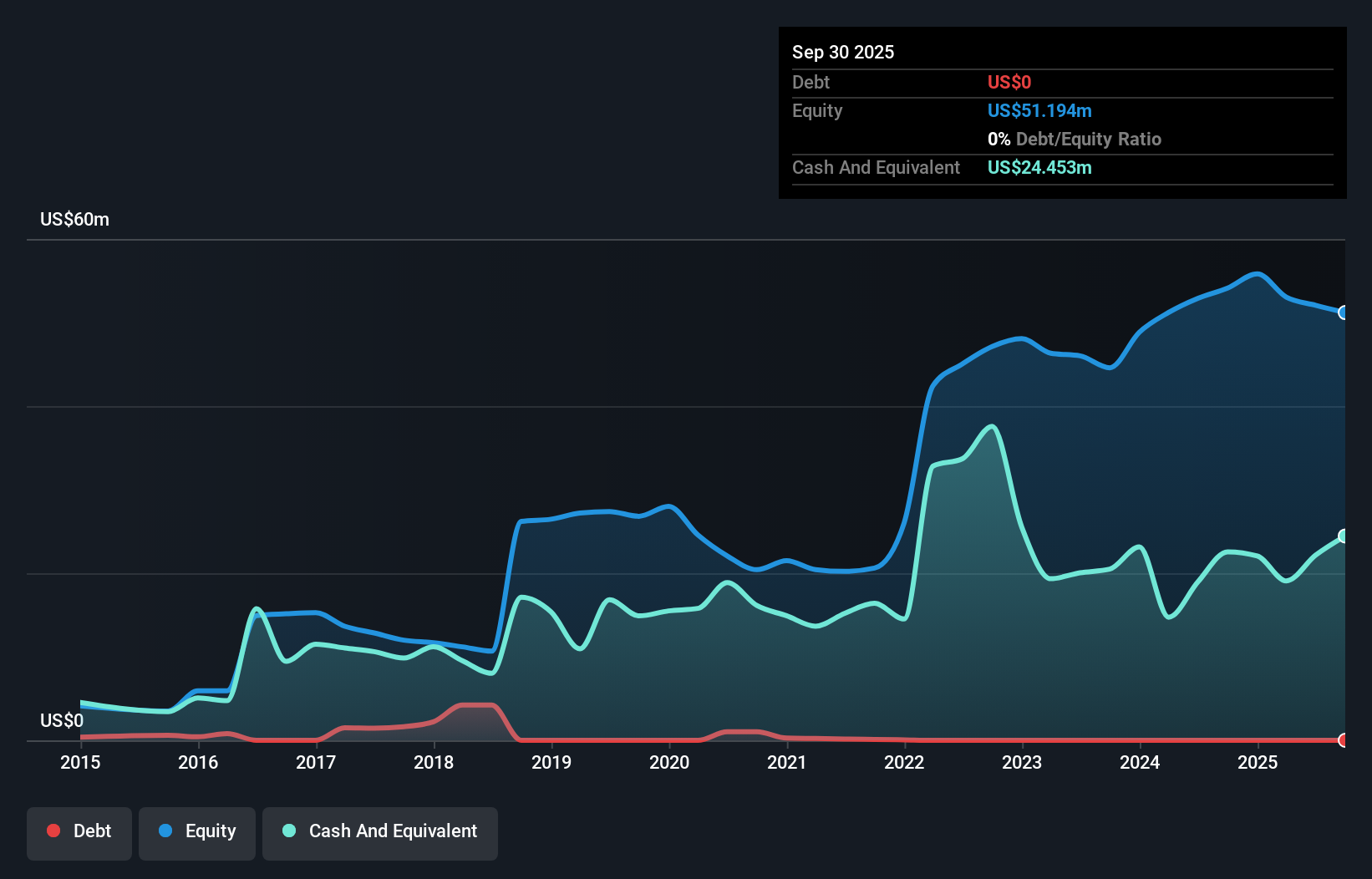

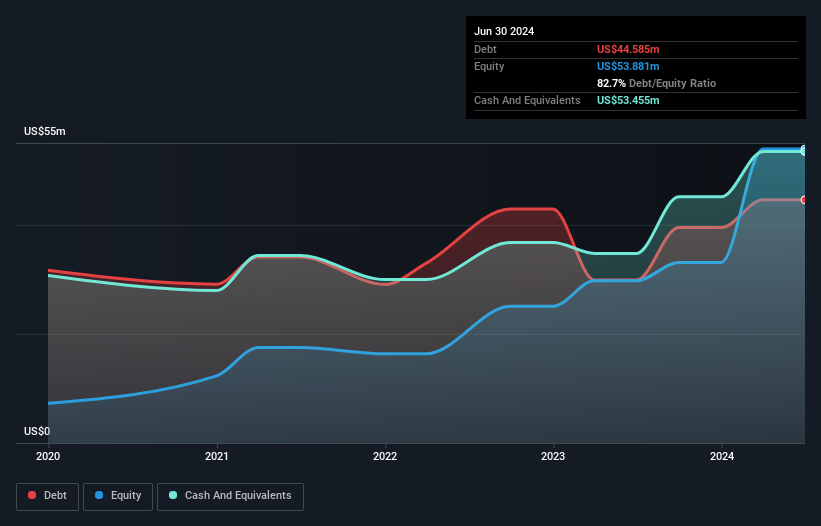

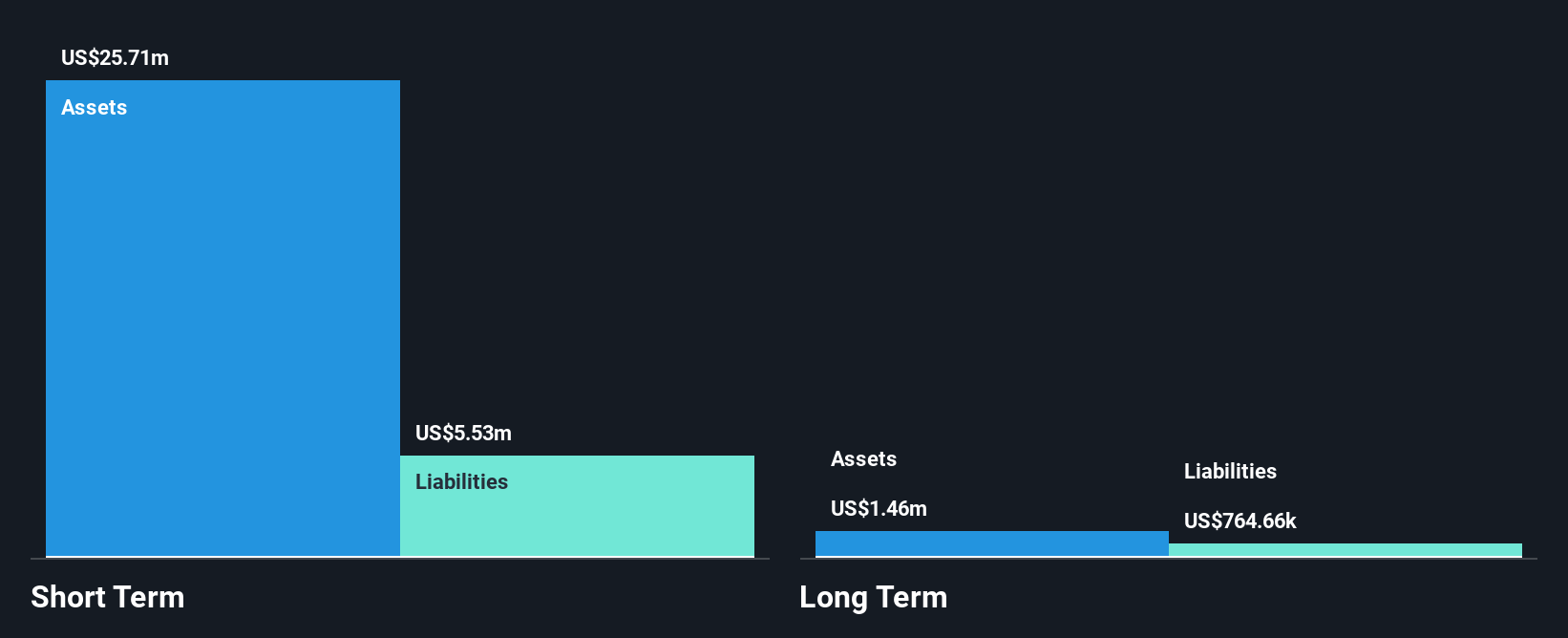

Planet Image International Limited, with a market cap of US$76.41 million, reported a net loss of US$8.04 million for the half year ended June 2025, reversing from a net income of US$4.3 million the previous year. The company has more cash than total debt and short-term assets surpass both short and long-term liabilities, indicating financial stability in asset management despite negative operating cash flow. While its debt-to-equity ratio has improved significantly over five years, volatility remains high at 11% weekly—greater than most U.S. stocks—posing risks for investors seeking stability in penny stock investments.

- Dive into the specifics of Planet Image International here with our thorough balance sheet health report.

- Understand Planet Image International's track record by examining our performance history report.

Surge Components (SPRS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Surge Components, Inc., along with its subsidiaries, supplies electronic products and components and has a market cap of $18.72 million.

Operations: The company generates revenue from its wholesale electronics segment, totaling $35.26 million.

Market Cap: $18.72M

Surge Components, Inc., with a market cap of US$18.72 million, demonstrates financial stability through its debt-free status and strong asset management, as short-term assets exceed both short- and long-term liabilities. Despite a historical decline in earnings over five years, recent performance shows improvement with an 85.3% earnings growth over the past year and increased net profit margins from 1.6% to 2.5%. The company reported third-quarter sales of US$10.27 million, up from US$7.97 million the previous year, reflecting positive revenue momentum within the electronic components sector despite low return on equity at 4.3%.

- Click here and access our complete financial health analysis report to understand the dynamics of Surge Components.

- Learn about Surge Components' historical performance here.

Summing It All Up

- Get an in-depth perspective on all 371 US Penny Stocks by using our screener here.

- Looking For Alternative Opportunities? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:YIBO

Planet Image International

Through its subsidiaries, manufactures and sells compatible toner cartridges on a white-label or third-party brand basis or under its self-owned brands in North America, Europe, and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives