Discovering Asian Market Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As global markets experience a wave of optimism following positive trade developments between the U.S. and China, Asian stock markets have shown resilience with notable gains in key indices such as Japan's Nikkei 225 and China's CSI 300. In this environment, identifying stocks that may be trading below their estimated value becomes crucial for investors looking to capitalize on potential opportunities within these vibrant markets.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wenzhou Yihua Connector (SZSE:002897) | CN¥38.31 | CN¥75.85 | 49.5% |

| T'Way Air (KOSE:A091810) | ₩2010.00 | ₩3992.32 | 49.7% |

| Taiwan Union Technology (TPEX:6274) | NT$232.50 | NT$460.32 | 49.5% |

| SIGMAXYZ Holdings (TSE:6088) | ¥1222.00 | ¥2443.74 | 50% |

| Renesas Electronics (TSE:6723) | ¥1772.00 | ¥3535.56 | 49.9% |

| Prospect Logistics and Industrial Freehold and Leasehold Real Estate Investment Trust (SET:PROSPECT) | THB7.20 | THB14.38 | 49.9% |

| Hibino (TSE:2469) | ¥2396.00 | ¥4771.44 | 49.8% |

| Good Will Instrument (TWSE:2423) | NT$43.75 | NT$86.66 | 49.5% |

| Forum Engineering (TSE:7088) | ¥1200.00 | ¥2376.34 | 49.5% |

| Ficont Industry (Beijing) (SHSE:605305) | CN¥27.86 | CN¥55.72 | 50% |

We'll examine a selection from our screener results.

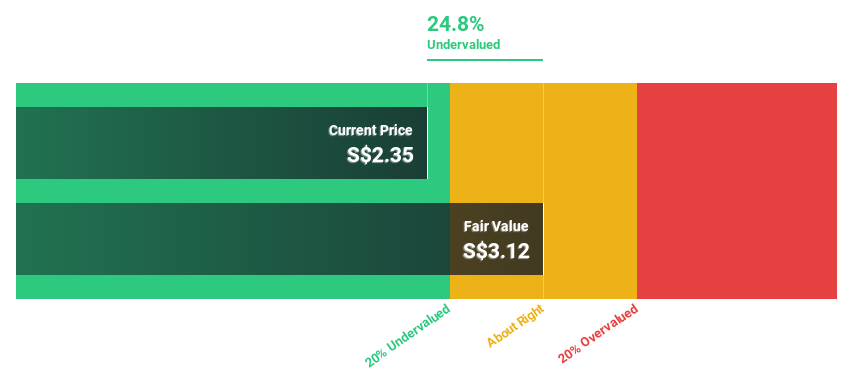

Yangzijiang Shipbuilding (Holdings) (SGX:BS6)

Overview: Yangzijiang Shipbuilding (Holdings) Ltd. is an investment holding company involved in shipbuilding activities across Greater China and various international markets, with a market cap of SGD8.86 billion.

Operations: The company's revenue is primarily derived from its shipbuilding segment, which generated CN¥25.22 billion, followed by the shipping segment with CN¥1.24 billion.

Estimated Discount To Fair Value: 39.9%

Yangzijiang Shipbuilding (Holdings) is trading 39.9% below its estimated fair value of S$3.75, suggesting it may be undervalued based on cash flows. It offers a reliable dividend yield of 5.24% and has shown strong earnings growth of 61.7% over the past year, with future earnings expected to grow at 12.8% annually, outpacing the Singapore market's average growth rate. Recent approvals for share buybacks and dividend increases further enhance its investment appeal.

- Upon reviewing our latest growth report, Yangzijiang Shipbuilding (Holdings)'s projected financial performance appears quite optimistic.

- Click here to discover the nuances of Yangzijiang Shipbuilding (Holdings) with our detailed financial health report.

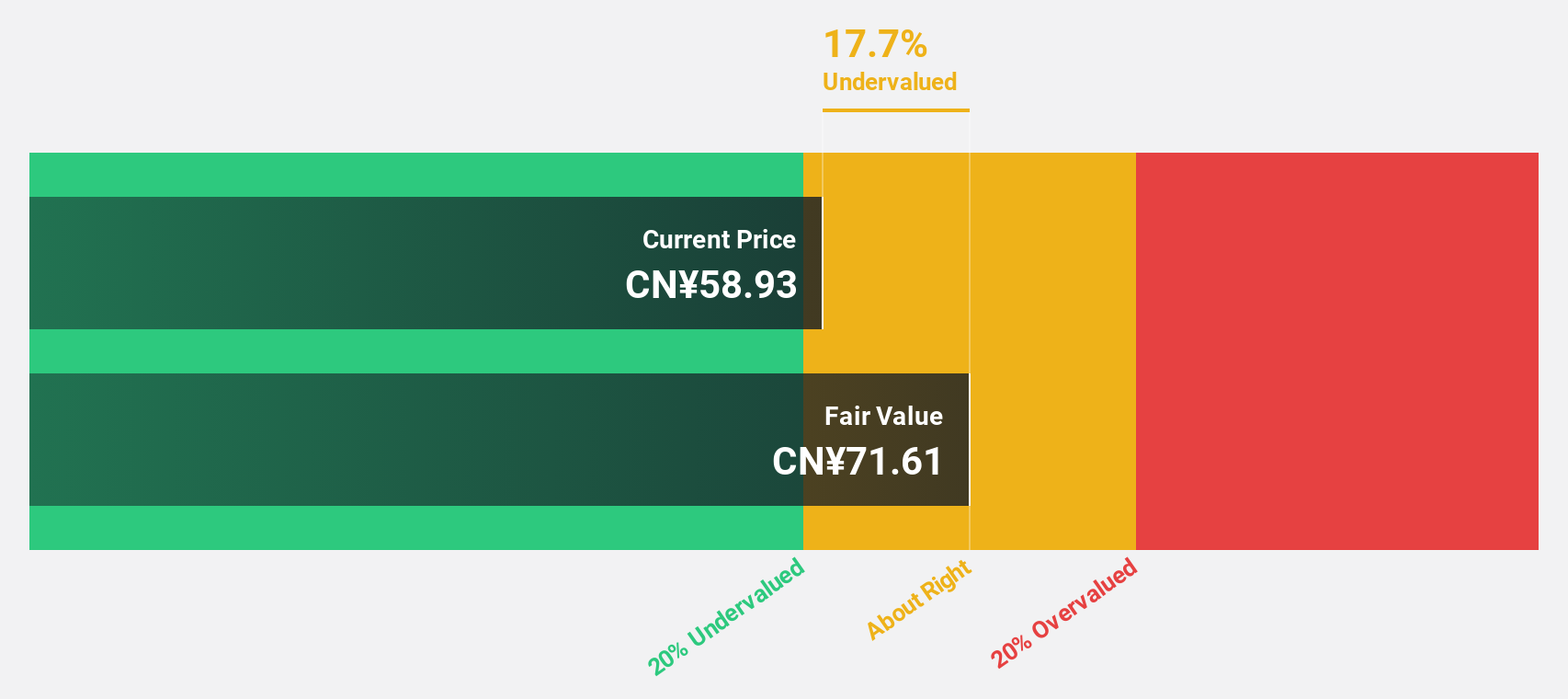

CSPC Innovation Pharmaceutical (SZSE:300765)

Overview: CSPC Innovation Pharmaceutical Co., Ltd. is involved in the research, development, production, and sales of biopharmaceuticals, APIs, and functional foods both in China and internationally, with a market cap of CN¥76.73 billion.

Operations: The company's revenue segments include biopharmaceuticals, APIs, and functional foods, serving both domestic and international markets.

Estimated Discount To Fair Value: 28.6%

CSPC Innovation Pharmaceutical is trading 28.6% below its estimated fair value of CN¥77.13, highlighting potential undervaluation based on cash flows. Despite recent earnings challenges, with a net loss of CN¥26.9 million in Q1 2025, revenue is forecast to grow at an impressive rate of 39% annually, outpacing the broader Chinese market's growth expectations. Strategic alliances and restructuring terminations may influence future performance but do not materially affect current financial metrics or shareholder structure.

- In light of our recent growth report, it seems possible that CSPC Innovation Pharmaceutical's financial performance will exceed current levels.

- Dive into the specifics of CSPC Innovation Pharmaceutical here with our thorough financial health report.

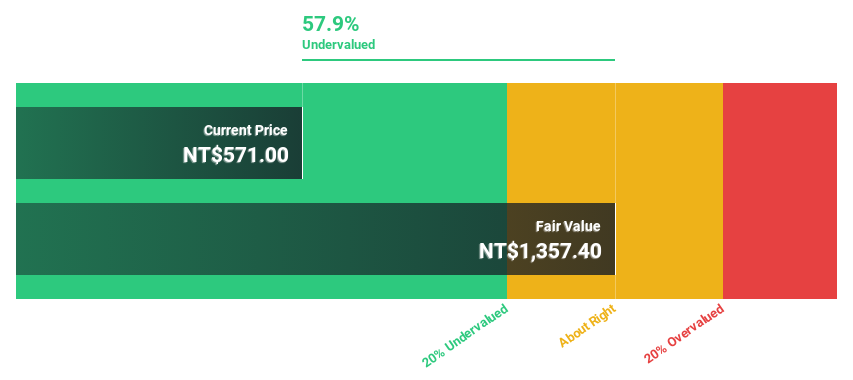

Elite Material (TWSE:2383)

Overview: Elite Material Co., Ltd. produces and sells copper clad laminates, electronic-industrial specialty chemicals and raw materials, and electronic components across Taiwan, China, and internationally, with a market cap of NT$312.10 billion.

Operations: The company's revenue is divided into NT$16.17 billion from domestic operations and NT$69.60 billion from international departments.

Estimated Discount To Fair Value: 25.6%

Elite Material Co., Ltd. is trading at NT$900, which is 25.6% below its fair value estimate of NT$1209.97, indicating potential undervaluation based on cash flows. Despite a highly volatile share price recently, earnings grew by 58.4% over the past year and are expected to grow annually by 19.5%, surpassing Taiwan's market average growth rate of 13.9%. Recent board changes and factory expansions highlight ongoing strategic developments without significantly affecting current valuations or financial stability.

- Our growth report here indicates Elite Material may be poised for an improving outlook.

- Take a closer look at Elite Material's balance sheet health here in our report.

Taking Advantage

- Unlock our comprehensive list of 274 Undervalued Asian Stocks Based On Cash Flows by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300765

CSPC Innovation Pharmaceutical

Engages in the research and development, production, and sales of biopharmaceuticals, APIs, and functional foods in China and internationally.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives