- United States

- /

- Tobacco

- /

- NasdaqCM:ISPR

Discover 3 Promising Penny Stocks With Market Caps As Low As $100M

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 2.9%, and over the past year, it has climbed 14%, with earnings forecasted to grow by 15% annually. In this context of growth, penny stocks—though an outdated term—still capture interest as they often represent smaller or newer companies that can offer unique opportunities at lower price points. By focusing on those with strong balance sheets and solid fundamentals, investors can uncover promising penny stocks that may provide both stability and potential upside in a thriving market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Waterdrop (WDH) | $1.35 | $488.24M | ✅ 4 ⚠️ 0 View Analysis > |

| WM Technology (MAPS) | $0.8956 | $150.69M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.40 | $234.25M | ✅ 3 ⚠️ 0 View Analysis > |

| Talkspace (TALK) | $2.70 | $465.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Tuniu (TOUR) | $0.9326 | $97.69M | ✅ 3 ⚠️ 2 View Analysis > |

| Sequans Communications (SQNS) | $1.45 | $37.51M | ✅ 4 ⚠️ 4 View Analysis > |

| Flexible Solutions International (FSI) | $4.91 | $61.34M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84 | $6.15M | ✅ 2 ⚠️ 3 View Analysis > |

| North European Oil Royalty Trust (NRT) | $4.95 | $46.04M | ✅ 2 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.37 | $448.46M | ✅ 4 ⚠️ 3 View Analysis > |

Click here to see the full list of 430 stocks from our US Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Ispire Technology (ISPR)

Simply Wall St Financial Health Rating: ★★★★☆☆

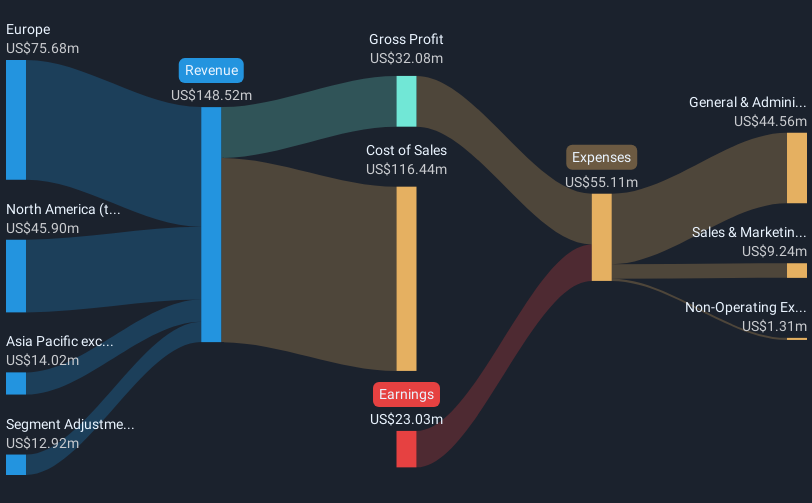

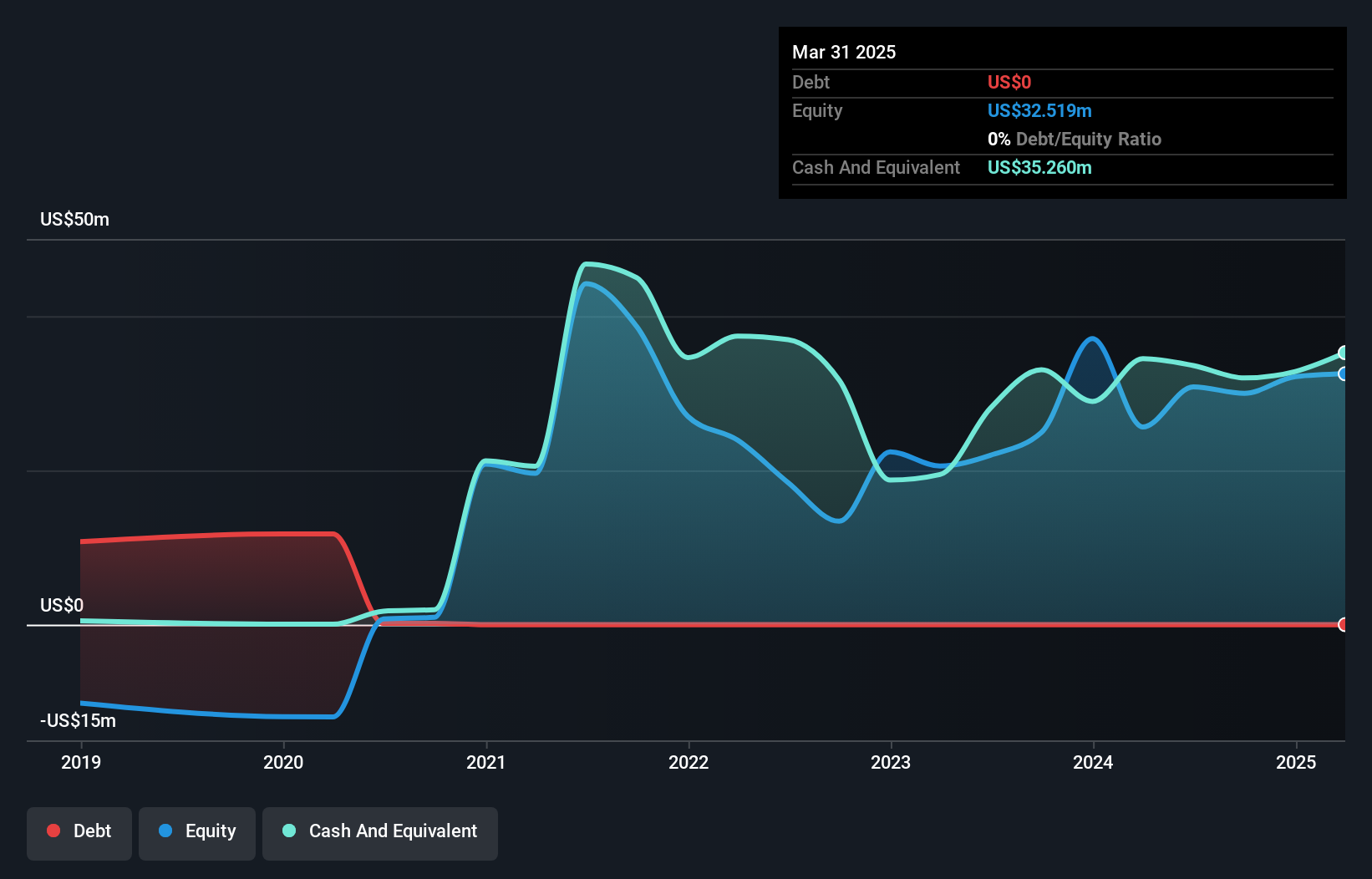

Overview: Ispire Technology Inc. engages in the research, development, design, commercialization, sales, marketing, and distribution of e-cigarettes and cannabis vaping products globally with a market cap of approximately $146.12 million.

Operations: The company generates its revenue primarily from cigarette manufacturers, amounting to $144.70 million.

Market Cap: $146.12M

Ispire Technology Inc. is navigating the challenges typical of penny stocks, with a market cap of US$146.12 million and a focus on e-cigarettes and cannabis vaping products. Despite revenue generation primarily from cigarette manufacturers, the company reported declining earnings and increased net losses over recent periods. The firm's financial position shows short-term assets slightly below short-term liabilities, but it maintains more cash than total debt, providing some financial flexibility. Recent strategic moves include securing an interim nicotine manufacturing license in Malaysia and filing a PMTA for innovative age-verification technology with the FDA, indicating potential growth avenues despite current unprofitability.

- Click here and access our complete financial health analysis report to understand the dynamics of Ispire Technology.

- Assess Ispire Technology's future earnings estimates with our detailed growth reports.

Real Brokerage (REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of $929.96 million.

Operations: The company's revenue is primarily derived from its North American Brokerage segment, which generated $1.41 billion.

Market Cap: $929.96M

Real Brokerage Inc. demonstrates characteristics common to penny stocks, with a market cap of US$929.96 million and ongoing unprofitability. Despite generating substantial revenue of US$1.41 billion from its North American Brokerage segment, the company has faced increasing losses over five years but maintains a positive cash flow, ensuring a cash runway exceeding three years without debt burdens. Recent strategic actions include announcing a share repurchase program worth up to US$150 million and filing for a shelf registration of US$209.5 million, reflecting efforts to manage capital structure amidst insider selling concerns and executive changes in financial leadership.

- Dive into the specifics of Real Brokerage here with our thorough balance sheet health report.

- Gain insights into Real Brokerage's future direction by reviewing our growth report.

Conduent (CNDT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Conduent Incorporated offers digital business solutions and services across the commercial, government, and transportation sectors globally, with a market cap of $427.23 million.

Operations: The company's revenue is derived from three main segments: Commercial ($1.59 billion), Government ($942 million), and Transportation ($575 million).

Market Cap: $427.23M

Conduent Incorporated, with a market cap of US$427.23 million, operates across commercial, government, and transportation sectors. Despite recent profitability challenges—reporting a net loss of US$51 million in Q1 2025—the company has reduced its debt-to-equity ratio significantly over five years to 64.5%, indicating improved financial health. Its short-term assets exceed both short- and long-term liabilities, providing a stable liquidity position. Recent executive changes include the appointment of Harsha V. Agadi as Chairman from August 2025. Conduent's innovative transit solutions have gained traction with major agencies like NJ TRANSIT and SEPTA, enhancing revenue potential through technological advancements in fare collection systems.

- Take a closer look at Conduent's potential here in our financial health report.

- Learn about Conduent's future growth trajectory here.

Where To Now?

- Reveal the 430 hidden gems among our US Penny Stocks screener with a single click here.

- Seeking Other Investments? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ISPR

Ispire Technology

Researches, develops, designs, commercializes, sales, markets, and distributes e-cigarettes and cannabis vaping products worldwide.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives