- Russia

- /

- Electric Utilities

- /

- MISX:PMSB

Did You Miss Perm Energy Supplying's (MCX:PMSB) 87% Share Price Gain?

The main point of investing for the long term is to make money. Furthermore, you'd generally like to see the share price rise faster than the market Unfortunately for shareholders, while the Public Joint Stock Company Perm Energy Supplying Company (MCX:PMSB) share price is up 87% in the last five years, that's less than the market return. But if you include dividends then the return is market-beating. Some buyers are laughing, though, with an increase of 22% in the last year.

Check out our latest analysis for Perm Energy Supplying

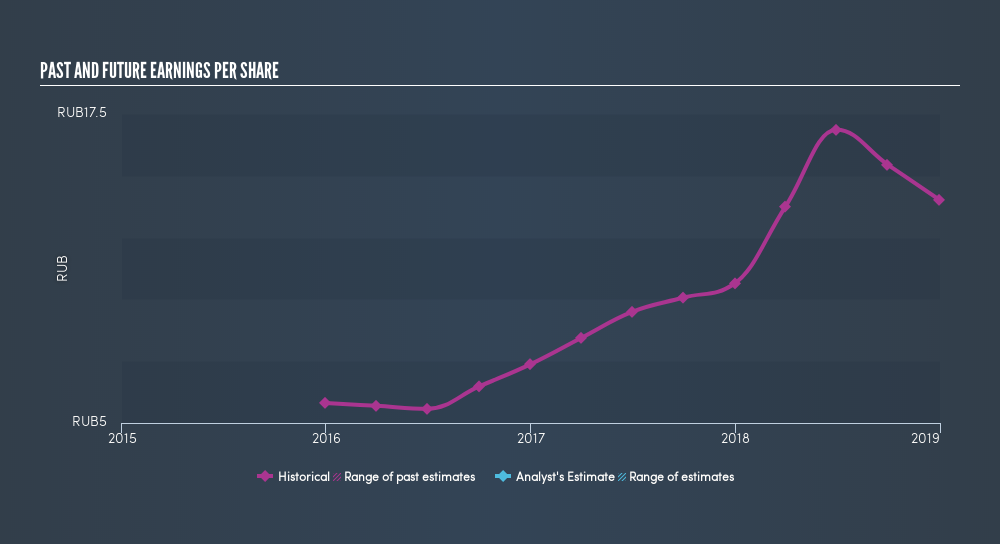

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Over half a decade, Perm Energy Supplying managed to grow its earnings per share at 17% a year. This EPS growth is higher than the 13% average annual increase in the share price. So it seems the market isn't so enthusiastic about the stock these days. This cautious sentiment is reflected in its (fairly low) P/E ratio of 6.39.

This free interactive report on Perm Energy Supplying's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 5 years, Perm Energy Supplying generated a TSR of 242%, which is, of course, better than the share price return. Although the company had to cut dividends, it has paid cash to shareholders in the past.

A Different Perspective

We're pleased to report that Perm Energy Supplying shareholders have received a total shareholder return of 36% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 28% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. Before deciding if you like the current share price, check how Perm Energy Supplying scores on these 3 valuation metrics.

Of course Perm Energy Supplying may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on RU exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About MISX:PMSB

Perm Energy Supplying

Public Joint Stock Company Perm Energy Supplying Company engages in the electricity supply to the population and organizations of the Perm Krai.

Flawless balance sheet and fair value.

Market Insights

Community Narratives