- United States

- /

- Semiconductors

- /

- NasdaqGS:SYNA

Did Synaptics's (NASDAQ:SYNA) Share Price Deserve to Gain 62%?

The simplest way to invest in stocks is to buy exchange traded funds. But one can do better than that by picking better than average stocks (as part of a diversified portfolio). To wit, the Synaptics Incorporated (NASDAQ:SYNA) share price is 62% higher than it was a year ago, much better than the market return of around 8.1% (not including dividends) in the same period. So that should have shareholders smiling. Also impressive, the stock is up 38% over three years, making long term shareholders happy, too.

Check out our latest analysis for Synaptics

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last twelve months Synaptics went from profitable to unprofitable. While some may see this as temporary, we're a skeptical bunch, and so we're a little surprised to see the share price go up. We might get a clue to explain the share price move by looking to other metrics.

Synaptics's revenue actually dropped 17% over last year. So using a snapshot of key business metrics doesn't give us a good picture of why the market is bidding up the stock.

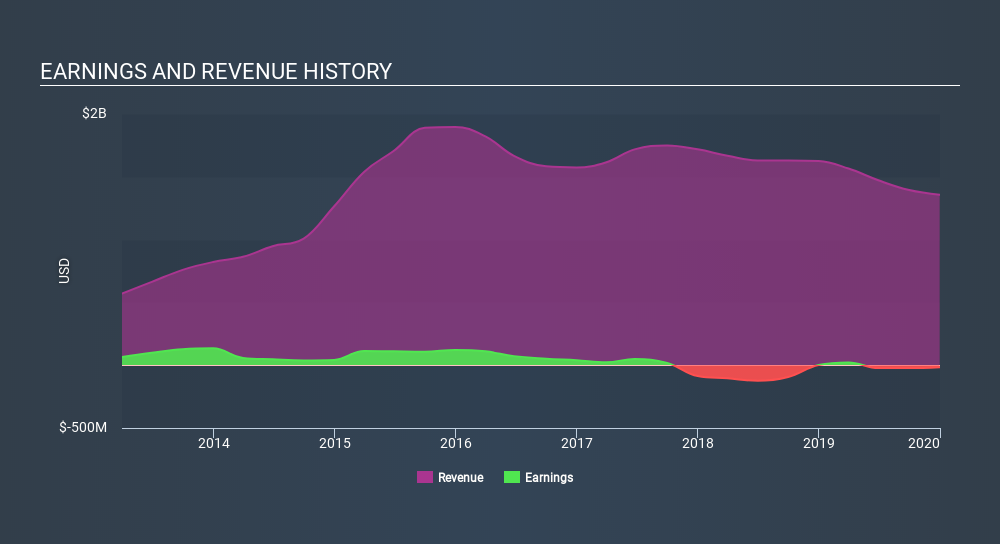

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Synaptics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Synaptics stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

We're pleased to report that Synaptics shareholders have received a total shareholder return of 62% over one year. Notably the five-year annualised TSR loss of 2.9% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. To that end, you should be aware of the 1 warning sign we've spotted with Synaptics .

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:SYNA

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives