Did Changing Sentiment Drive Grupo Security's (SNSE:SECURITY) Share Price Down By 40%?

Grupo Security S.A. (SNSE:SECURITY) shareholders should be happy to see the share price up 12% in the last month. But that doesn't change the fact that the returns over the last year have been less than pleasing. The cold reality is that the stock has dropped 40% in one year, under-performing the market.

View our latest analysis for Grupo Security

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Even though the Grupo Security share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped.

It seems quite likely that the market was expecting higher growth from the stock. But other metrics might shed some light on why the share price is down.

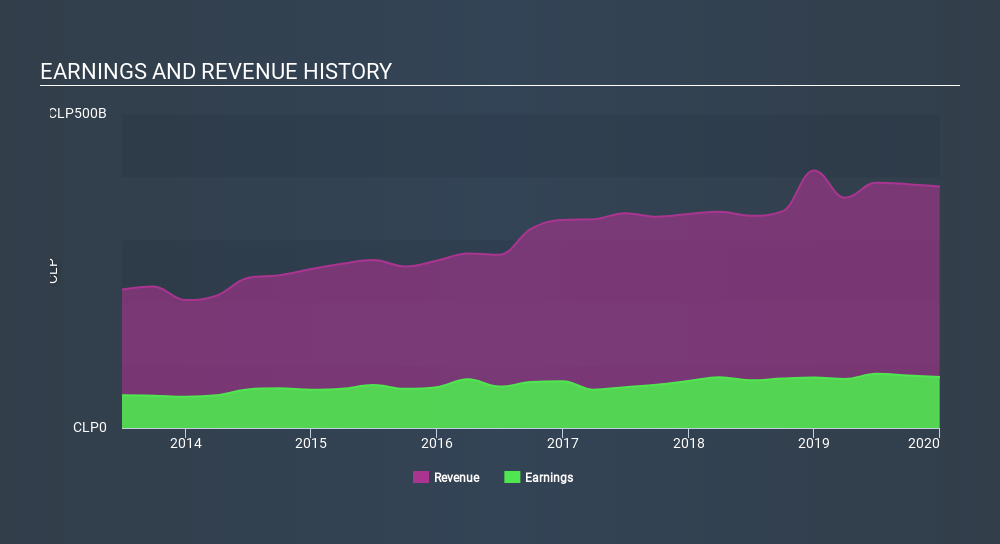

Grupo Security's dividend seems healthy to us, so we doubt that the yield is a concern for the market. In fact, it seems more likely that the revenue fall of 6.2% in the last year is the worry. So it seems likely that the weak revenue is making the market more cautious about the stock.

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Grupo Security the TSR over the last year was -36%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While the broader market lost about 26% in the twelve months, Grupo Security shareholders did even worse, losing 36% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 0.9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Grupo Security you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CL exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About SNSE:SECURITY

Grupo Security

A diversified financial holding company, provides commercial and retail banking, insurance, factoring, asset management, and other products and services to large and medium-sized companies, and high-income individuals in Chile.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives