- United States

- /

- Software

- /

- OTCPK:CTKY.Y

Did Changing Sentiment Drive CooTek (Cayman)'s (NYSE:CTK) Share Price Down By 40%?

Investors can approximate the average market return by buying an index fund. But if you buy individual stocks, you can do both better or worse than that. For example, the CooTek (Cayman) Inc. (NYSE:CTK) share price is down 40% in the last year. That contrasts poorly with the market return of 40%. We wouldn't rush to judgement on CooTek (Cayman) because we don't have a long term history to look at. Even worse, it's down 13% in about a month, which isn't fun at all.

View 2 warning signs we detected for CooTek (Cayman)

Given that CooTek (Cayman) didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last twelve months, CooTek (Cayman) increased its revenue by 47%. That's a strong result which is better than most other loss making companies. Given the revenue growth, the share price drop of 40% seems quite harsh. Our sympathies to shareholders who are now underwater. Prima facie, revenue growth like that should be a good thing, so it's worth checking whether losses have stabilized. Our monkey brains haven't evolved to think exponentially, so humans do tend to underestimate companies that have exponential growth.

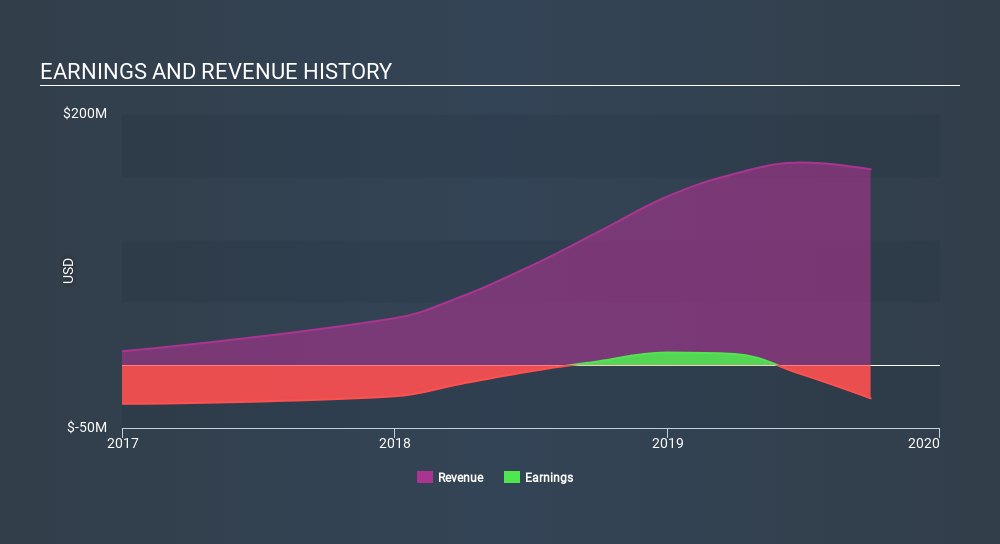

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

Given that the market gained 40% in the last year, CooTek (Cayman) shareholders might be miffed that they lost 40%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. With the stock down 0.6% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. It's always interesting to track share price performance over the longer term. But to understand CooTek (Cayman) better, we need to consider many other factors. For example, we've discovered 2 warning signs for CooTek (Cayman) (of which 1 is major) which any shareholder or potential investor should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About OTCPK:CTKY.Y

CooTek (Cayman)

Operates as a mobile internet company in the United States and the People's Republic of China.

Slight and slightly overvalued.

Market Insights

Community Narratives