- United States

- /

- Semiconductors

- /

- NasdaqGS:CRDO

Credo Technology Group Holding (CRDO) Reports Quarterly Revenue Rise To US$170 Million

Reviewed by Simply Wall St

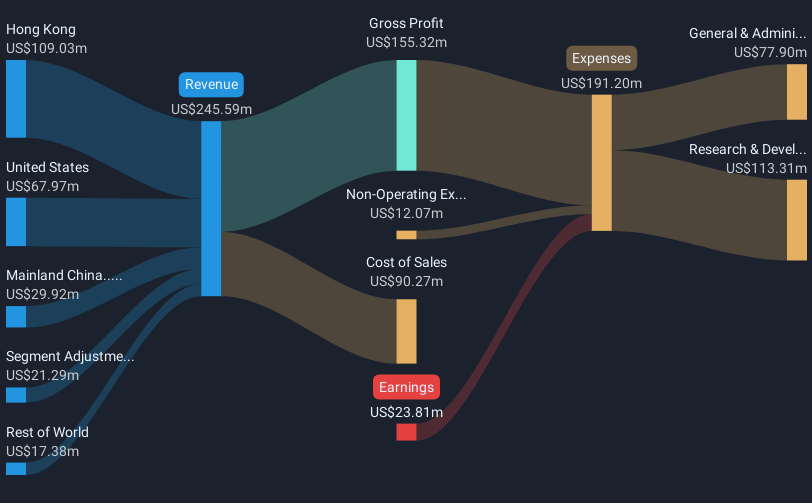

Credo Technology Group Holding (CRDO) reported a 150% price surge over the last quarter, driven by robust quarterly earnings with revenue skyrocketing to $170 million from $61 million year-on-year. The introduction of the PILOT platform on May 20 added potential future growth prospects, exciting market participants. While the broader market saw a general upward trajectory with the S&P 500 and Nasdaq setting record highs due to strong earnings and an easing of tariff concerns, Credo's announcements and future guidance surpassing $800 million added significant weight, counterbalancing any potential market headwinds during the Federal Reserve's interest rate discussions.

You should learn about the 1 weakness we've spotted with Credo Technology Group Holding.

The recent surge in Credo Technology Group Holding's share price by 150% over the last quarter reflects investor optimism following their impressive earnings and revenue growth. This price movement, based on quarterly figures, aligns with the company's broader vision of expanding into PCIe products and optical DSP, potentially impacting future revenue and earnings positively. Such initiatives could alleviate existing risks associated with high customer concentration by diversifying revenue streams.

Over the longer term, Credo's shares have achieved a very large total return of 627.43% over three years, highlighting significant performance beyond short-term volatility. For context, within the past year, Credo surpassed both the US market and the Semiconductor industry in terms of returns, reflecting strong comparative performance metrics. However, despite the recent share price increase to US$107.95, the analyst consensus price target sits at US$91.32, implying a price currently trading above this target, leading investors to consider the sustainability of recent gains.

The introduction of the PILOT platform and forecasted earnings growth could enhance Credo's future financial prospects if these translate into realized market opportunities. Analysts forecast an annual revenue growth of 33.8% and earnings expansion to US$314.5 million by 2028. These forecasts, if met, could validate higher valuations in the future, provided they are adjusted for risks associated with heavy reliance on major customers and market adoption challenges. As market participants consider these developments, careful analysis concerning current valuations versus future growth potential remains essential.

Learn about Credo Technology Group Holding's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRDO

Credo Technology Group Holding

Provides various high-speed connectivity solutions for optical and electrical Ethernet, and PCIe applications in the United States, Taiwan, Mainland China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives