- United States

- /

- Food and Staples Retail

- /

- NasdaqGS:COST

Costco Wholesale (NasdaqGS:COST) Announces Leadership Change With New Senior VP Appointment

Reviewed by Simply Wall St

Costco Wholesale (NasdaqGS:COST) recently underwent significant executive changes, with Dan Hines retiring and Tiffany Barbre stepping up to his role. Over the last quarter, the company's stock price increased by 8.7%, reflecting market confidence amid positive corporate developments and robust earnings. Despite an overall market positivity with the Nasdaq and S&P 500 both experiencing gains, Costco's strong quarterly earnings performance and increased dividend announcement further bolstered investor sentiment. Additionally, their expanding product partnerships, including AG1, underscored growth strategies. These factors collectively aligned with the market's upward trend, supporting Costco's stock performance as broader economic optimism persisted.

You should learn about the 1 possible red flag we've spotted with Costco Wholesale.

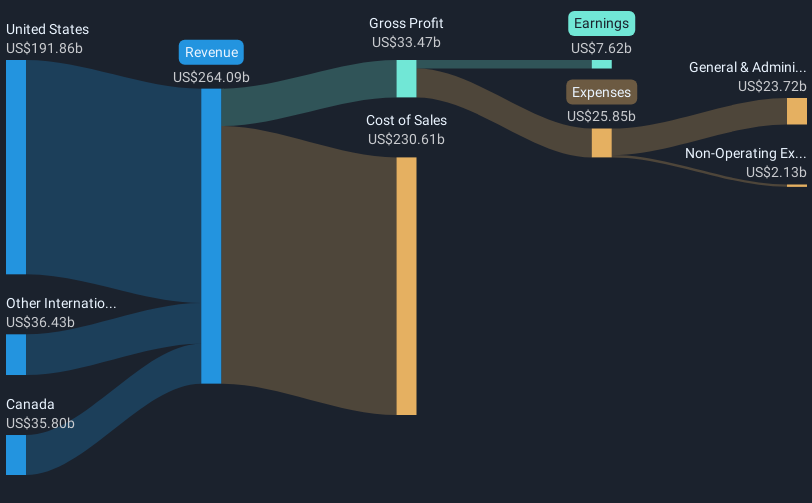

The recent executive changes at Costco, with Dan Hines retiring and Tiffany Barbre stepping in, could potentially influence the company's strategic initiatives highlighted in their expansion narrative. This leadership transition is likely to reinforce Costco’s growth strategies, particularly in expanding warehouse locations, enhancing e-commerce capabilities, and pushing into international markets. Over the last five years, Costco's total shareholder return, including share price appreciation and dividends, was a very large 262.97%, reflecting a strong long-term performance.

In contrast to its impressive five-year performance, Costco's shares outperformed the US market's 12.8% return over the past year, though it lagged behind the 27.2% return of the US Consumer Retailing industry. The new executive team and positive short-term stock reactions may drive revenue and earnings growth forecasts, though increasing labor and supply chain costs remain key considerations for future margins. With current shares trading close to the analyst consensus price target of US$1,075.04, the market appears to largely agree with these growth assumptions, indicating that the stock might be fairly priced given current expectations.

Learn about Costco Wholesale's historical performance here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COST

Costco Wholesale

Engages in the operation of membership warehouses in the United States, Puerto Rico, Canada, Mexico, Japan, the United Kingdom, Korea, Australia, Taiwan, China, Spain, France, Iceland, New Zealand, and Sweden.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives