- United States

- /

- Chemicals

- /

- NYSE:CTVA

Corteva (NYSE:CTVA) Partners With FMC To Expand Fluindapyr Fungicide In U.S. Markets

Reviewed by Simply Wall St

Corteva (NYSE:CTVA) recently entered a partnership with FMC Corporation to expand the use of FMC's fluindapyr fungicide technology in key markets, potentially enhancing its competitive edge. Over the last quarter, Corteva's stock saw a 16% increase, influenced by strong Q1 earnings and the approval of a cash dividend. The company also maintained its earnings guidance, suggesting stability and resilience, alongside its ongoing share repurchase program. These factors likely added weight to the stock's performance, aligning with the general upward market trend of 13% over the past year.

Be aware that Corteva is showing 1 risk in our investment analysis.

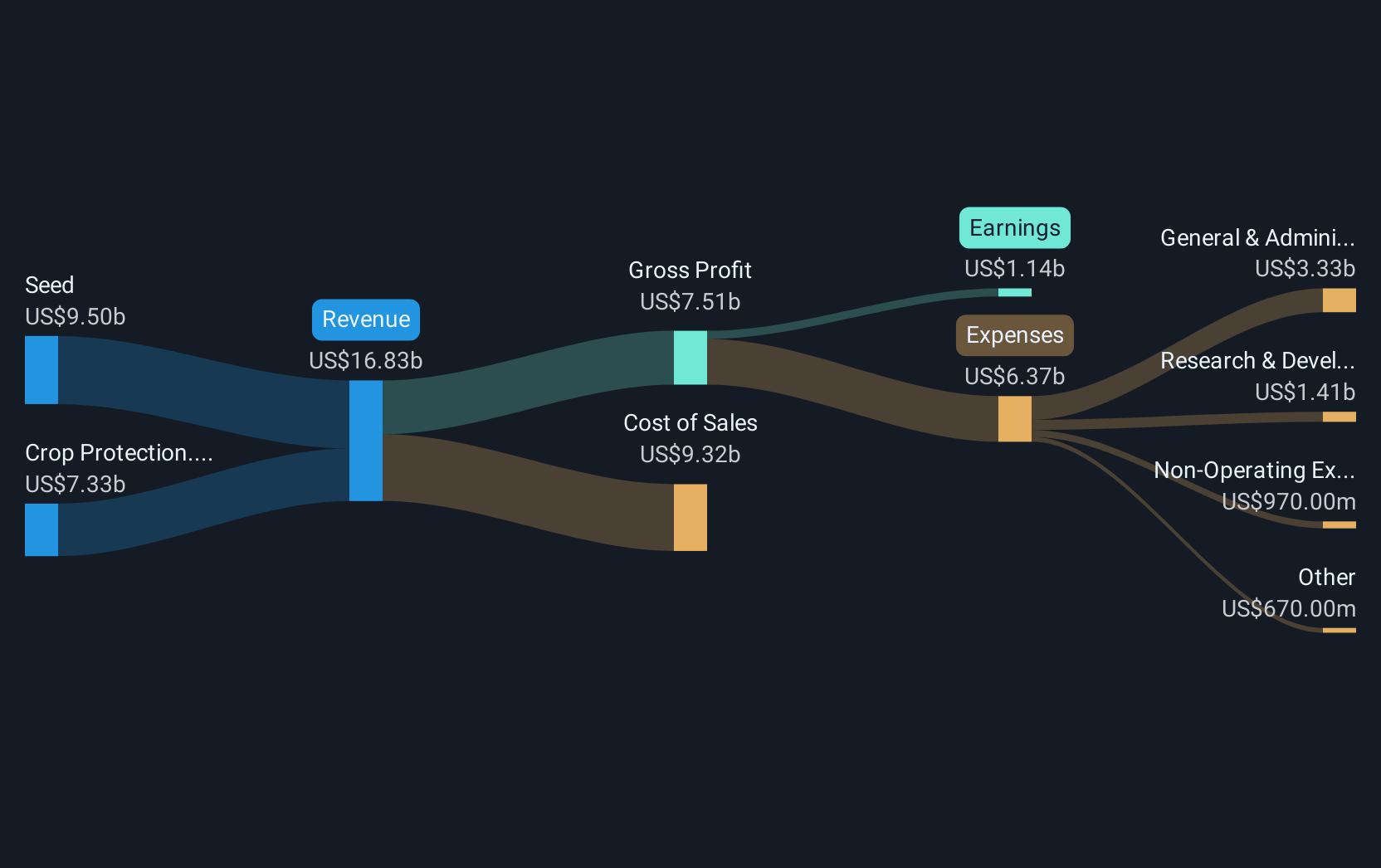

The recent partnership between Corteva and FMC Corporation to expand fluindapyr fungicide technology usage could bolster Corteva's competitive standing by enhancing its product offerings. This development aligns with Corteva's ongoing efforts to grow its market share, particularly in key regions like Brazil. Such initiatives contribute to anticipated revenue growth driven by strong demand for advanced seed technologies. Despite potential currency and pricing pressures, the company's strategic focus on cost initiatives and productivity enhancements may support improved earnings outcomes. Analysts project steady growth, with revenue expected to rise 2.9% annually over three years, and a potential increase in profit margins. These forecasts may reflect the positive effect of this collaboration on Corteva's financial future.

Over the past five years, Corteva's total shareholder return, inclusive of share price movements and dividends, reached 155.14%. In contrast, a one-year comparison shows Corteva outperforming the US market return of 11.9% and significantly exceeding the US Chemicals industry's negative return. This longer-term performance showcases Corteva's resilience and investor appeal, although current share price movements indicate a 0.019% discount to the consensus price target of $72.56. As revenue and earnings forecasts factor in potential partnership gains, Corteva's share price trajectory could more closely align with analyst expectations. The consensus target suggests a 9.7% upside from the current price of $62.45, and the company's commitment to share repurchases and improving operating free cash flow further supports potential future returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CTVA

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives