- United States

- /

- Airlines

- /

- NYSE:CPA

Copa Holdings (NYSE:CPA) Shareholders Booked A 10% Gain In The Last Three Years

Investors can buy low cost index fund if they want to receive the average market return. But in any diversified portfolio of stocks, you'll see some that fall short of the average. For example, the Copa Holdings, S.A. (NYSE:CPA) share price return of 10% over three years lags the market return in the same period. In the last year the stock has gained 6.6%.

Check out our latest analysis for Copa Holdings

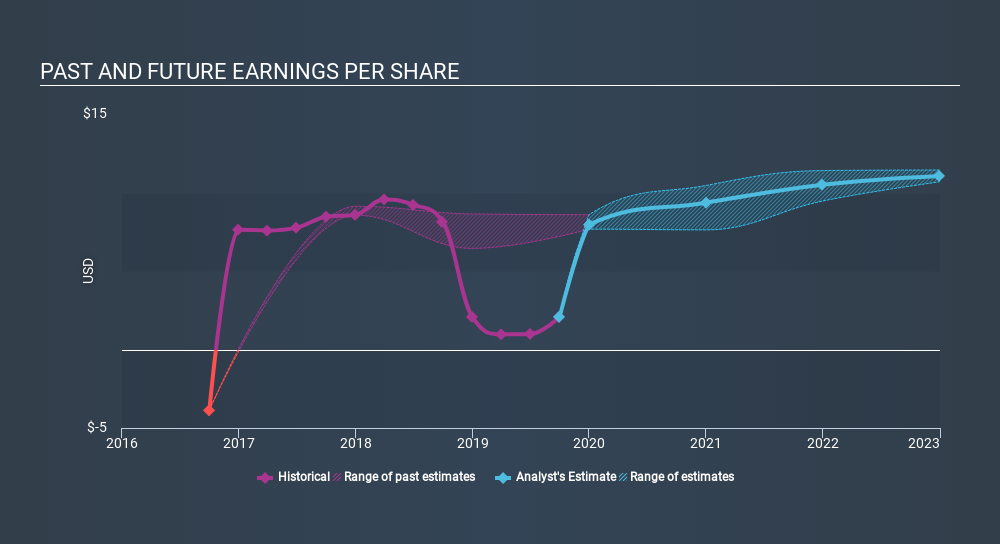

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Copa Holdings became profitable within the last three years. So we would expect a higher share price over the period.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

Dive deeper into Copa Holdings's key metrics by checking this interactive graph of Copa Holdings's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Copa Holdings the TSR over the last 3 years was 20%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Copa Holdings shareholders gained a total return of 9.5% during the year. Unfortunately this falls short of the market return. The silver lining is that the gain was actually better than the average annual return of 1.8% per year over five year. This could indicate that the company is winning over new investors, as it pursues its strategy. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Be aware that Copa Holdings is showing 4 warning signs in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:CPA

Copa Holdings

Through its subsidiaries, provides airline passenger and cargo transport services.

Established dividend payer and good value.

Similar Companies

Market Insights

Community Narratives