- United States

- /

- Oil and Gas

- /

- NYSE:COP

ConocoPhillips (NYSE:COP) Expands Board with Sustainability Expert Ms. McGinty Appointment

Reviewed by Simply Wall St

ConocoPhillips (NYSE:COP) recently appointed Ms. Kathleen McGinty to its board, enhancing focus on sustainability. The company experienced a 7.78% rise in share price over the last month, a period marked by the removal from two Russell indices, which may have slightly countered broader favorable market trends. Meanwhile, the market generally trended upwards with the S&P 500 and Nasdaq registering gains. Developments in trade talks and economic data influenced investor sentiment. With this backdrop, ConocoPhillips' stock performance aligned moderately against these broad market movements, reflecting mixed investor reactions to corporate and external influences.

You should learn about the 1 weakness we've spotted with ConocoPhillips.

The recent appointment of Ms. Kathleen McGinty to ConocoPhillips' board could signify an increased emphasis on sustainability initiatives, potentially influencing investor sentiment and possibly driving long-term shareholder value. While the short-term share price rose in the past month amid mixed market reactions, the company's shares have yielded a significant 172.34% total return over the past five years, illustrating robust long-term performance. In comparison, the company underperformed both the US Market, which saw gains of 13.9%, and the U.S. Oil and Gas industry, which experienced a 3.6% decline over the past year. This longer-term growth trajectory might provide context to short-term market fluctuations.

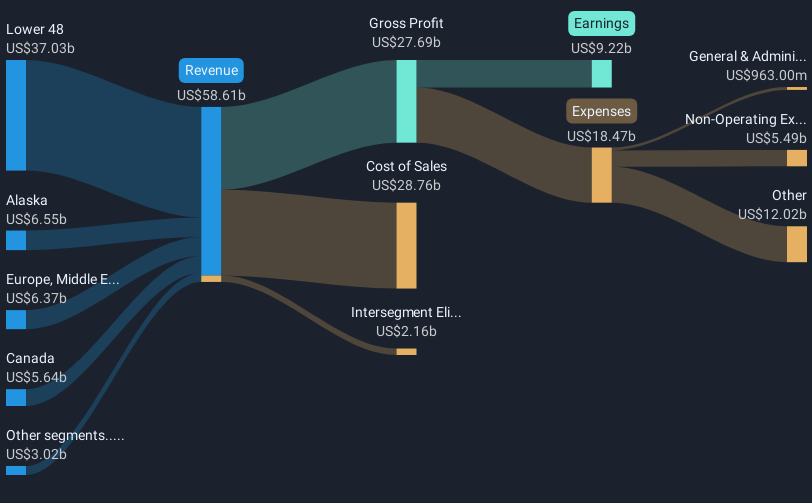

Furthermore, the emphasis on sustainability might enhance operational efficiencies and play a role in anticipated revenue and earnings growth, particularly as ConocoPhillips embarks on new projects like Willow and Port Arthur. Analysts project a steady annual revenue growth of 1.2%, driven by acquisition synergies and strategic investments. However, unforeseen geopolitical and commodity price fluctuations remain potential disruptors. The current share price stands at US$87.63, which is discounted against the analysts' price target of US$117.47. This 25.4% difference suggests potential for price appreciation, contingent on the company's successful execution of its strategies and market conditions aligning favorably.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives