- United States

- /

- Oil and Gas

- /

- NYSE:COP

ConocoPhillips (COP) Extends Water Agreement With Aris to 2040 Enhancing Supplier Partnership

Reviewed by Simply Wall St

ConocoPhillips (COP) recently saw a 7.72% price increase over the past month, which coincides with a recent extension of its Water Gathering and Disposal Agreement with Aris Water Solutions, Inc. This extension signals a stronger long-term partnership and operational stability. Discussions regarding the potential sale of the Oklahoma assets and the appointment of Ms. Kathleen McGinty to the board may have also supported investor confidence. The performance occurred alongside generally strong corporate earnings and market resilience, highlighted by positive earnings from major tech companies like Microsoft and Meta, although the broader market remained relatively flat during this period.

Every company has risks, and we've spotted 1 weakness for ConocoPhillips you should know about.

The recent developments surrounding ConocoPhillips, including the extension of its Water Gathering and Disposal Agreement with Aris Water Solutions and potential asset sales, could significantly influence its operational strategy and long-term stability. Such agreements may bolster ConocoPhillips's cash flow and earnings, creating a more resilient business environment supportive of its upcoming projects like Willow and Port Arthur. These extensions and board appointments might uplift investor sentiment, potentially enhancing revenue and earnings forecasts as the company aims to optimize its operations and reduce costs.

Over the past five years, ConocoPhillips has delivered a total return of 202.83%, reflecting robust growth. This achievement underscores stronger long-term performance compared to a more volatile recent year, where it lagged behind the U.S. Oil and Gas industry, declining 9.8% while the industry decreased 9.7%. This historical performance puts into context the recent 7.72% share price increase over the past month, contributing to positive momentum.

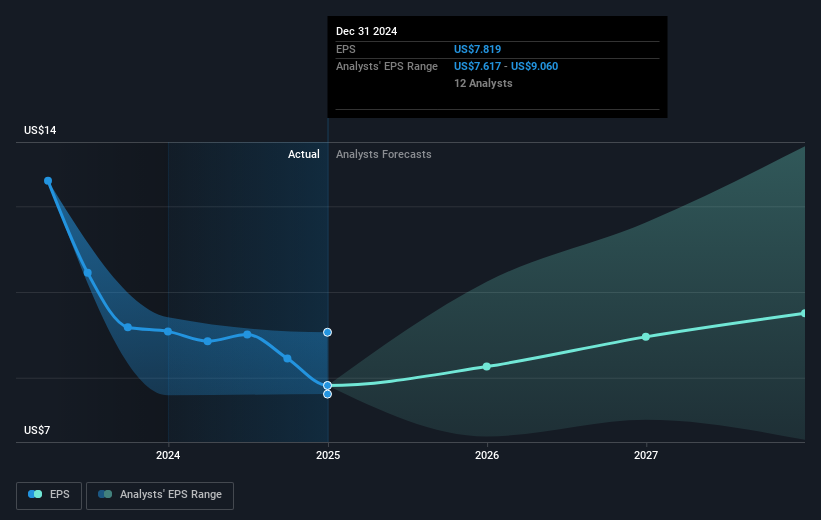

With a current share price of US$96.67, the stock is trading at a discount to the consensus analyst price target of US$116.74, suggesting a potential 20.8% increase. While this opportunity aligns with analysts' expectations for revenue and earnings growth, fueled by project start-ups and efficiency gains, capturing this gap will require navigating broader market forces and operational challenges stipulated in long-cycle projects and geopolitical factors.

Review our historical performance report to gain insights into ConocoPhillips' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:COP

ConocoPhillips

Explores for, produces, transports, and markets crude oil, bitumen, natural gas, liquefied natural gas (LNG), and natural gas liquids.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives