- United States

- /

- Specialty Stores

- /

- NYSE:CHWY

Chewy (NYSE:CHWY) Reports Q1 Earnings With US$3M Sales and Flat EPS

Reviewed by Simply Wall St

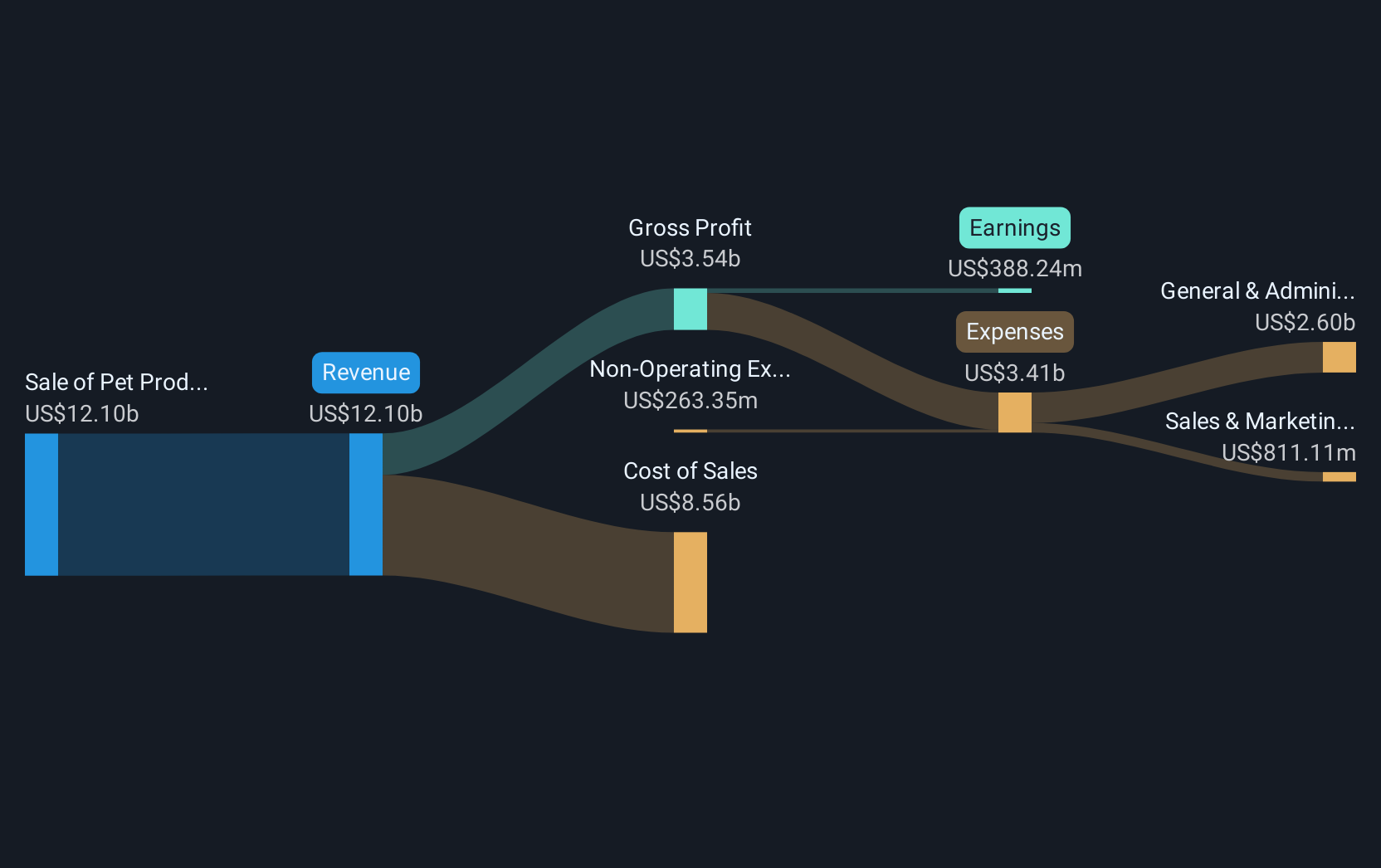

Chewy (NYSE:CHWY) recently reported earnings results showing increased sales to USD 3.1 million, but a slight decline in net income, which could have influenced its 38% price rise over the last quarter. During this time, executive transitions, such as CFO David Reeder's departure, and an extended credit agreement provided broader strategic context. The market backdrop of easing trade tensions and positive economic signals likely supported this upward trend. The backdrop of strong market conditions may have outweighed any reservations arising from Chewy's static earnings per share, indicating that broader market optimism played a critical role in the company's share price movement.

Buy, Hold or Sell Chewy? View our complete analysis and fair value estimate and you decide.

The recent developments at Chewy, including a significant executive transition and a new credit agreement, are expected to influence its growth strategy by potentially enhancing financial flexibility and operational focus. These shifts, alongside the easing trade tensions and positive economic signals, might have contributed to the company's impressive 38% share price rise last quarter. Long-term shareholders have seen substantial gains, with a total return of 100.39% over the past year, indicating a robust recovery in its stock despite earnings challenges.

The strategic initiatives aimed at expanding vet care clinics and enhancing the ad platform are anticipated to drive future revenue growth. However, the slight decline in net income despite rising sales could cast some uncertainty on future earnings, as analysts forecast earnings to reach US$435.7 million by 2028. Potential risks such as reliance on the Autoship program and slow customer acquisition could affect these projections. Though Chewy's current share price of US$38.17 shows an upward trend, it remains below the consensus price target of US$42.13, suggesting potential room for future growth if earnings align with expectations. However, given the company's higher-than-average PE ratio, its valuation continues to be a point of consideration.

Our valuation report here indicates Chewy may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CHWY

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives