- United States

- /

- Oil and Gas

- /

- NYSE:LNG

Cheniere Energy (LNG) Completes US$6 Billion Buyback As Earnings Improve

Reviewed by Simply Wall St

Cheniere Energy (LNG) recently completed a share buyback of 1% of its outstanding shares, aligning with the broader market's upward trend. During the same period, the company announced a surge in its earnings, with net income climbing to $1,626 million from last year's $880 million, underscoring robust operational performance. Despite these developments, the company's share price movement remained largely flat for the quarter, mirroring the slight shifts in major indexes like the Dow Jones and S&P 500. The company's actions, along with a solid dividend, provided some positive reinforcement, although they did not distinctly influence the stock's trajectory amid other broader market activities.

Cheniere Energy has 3 risks we think you should know about.

Cheniere Energy's recent share buyback of 1% seems intended to enhance shareholder returns alongside its substantial earnings boost, yet its share price remained largely unchanged in the short term. However, over a five-year span, Cheniere's total shareholder return, including dividends, was a very large 356.78%, indicating robust performance over the long term. It's worth noting that Cheniere's one-year return outperformed the US Oil and Gas industry, which had a 2.4% decline in the same period. These figures suggest that while the short-term stock movement was flat, the long-term trajectory has been impressive for investors.

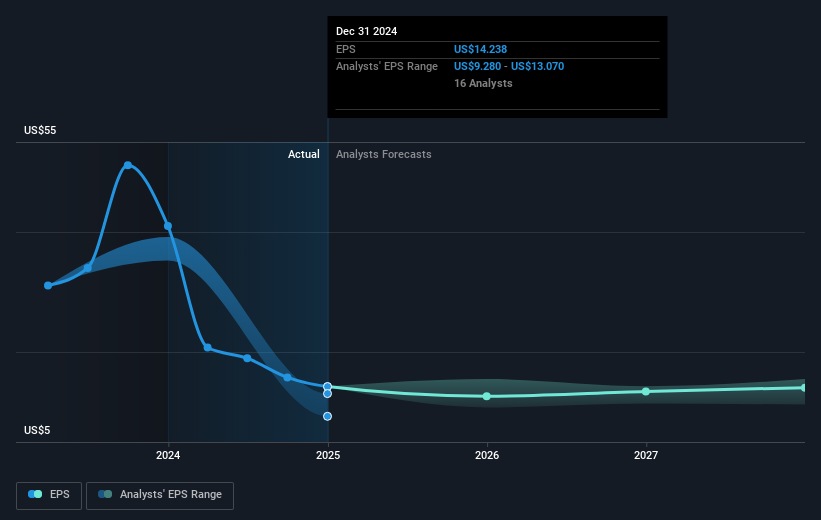

The potential for increased revenue and earnings could be influenced by the company's ongoing capacity expansions at Corpus Christi, although these are not without regulatory and market risks. Analysts forecast annual revenue growth of 11.1% in the next three years, yet a shrinkage in profit margins from 18.5% to 12.9% is anticipated, which could temper earnings growth. With the current share price standing at US$235.27 and analysts setting a consensus price target of US$267.67, the stock is trading at a 13.77% discount to this target. The disconnect between the price target and current trading levels suggests that investors may have differing views on future prospects compared to consensus expectations.

Review our growth performance report to gain insights into Cheniere Energy's future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNG

Cheniere Energy

An energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives