- Australia

- /

- Metals and Mining

- /

- ASX:GMD

Charter Hall Group And 2 Other ASX Stocks Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

The Australian market has been experiencing a rollercoaster of activity, with the ASX200 index seeing significant fluctuations due to factors like profit-taking and global uncertainty. As investors navigate these turbulent times, identifying stocks that are trading below their intrinsic value can present compelling opportunities for those looking to capitalize on potential market inefficiencies. In this article, we will explore Charter Hall Group and two other ASX stocks that are currently estimated to be undervalued.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Praemium (ASX:PPS) | A$0.695 | A$1.16 | 39.9% |

| Catalyst Metals (ASX:CYL) | A$7.22 | A$12.56 | 42.5% |

| Lynas Rare Earths (ASX:LYC) | A$7.97 | A$13.83 | 42.4% |

| Fenix Resources (ASX:FEX) | A$0.28 | A$0.47 | 40.6% |

| Polymetals Resources (ASX:POL) | A$0.865 | A$1.56 | 44.5% |

| Charter Hall Group (ASX:CHC) | A$18.87 | A$33.88 | 44.3% |

| Integral Diagnostics (ASX:IDX) | A$2.42 | A$4.27 | 43.4% |

| ReadyTech Holdings (ASX:RDY) | A$2.36 | A$4.69 | 49.7% |

| PointsBet Holdings (ASX:PBH) | A$1.085 | A$2.05 | 47.1% |

| Superloop (ASX:SLC) | A$2.73 | A$4.92 | 44.5% |

Here we highlight a subset of our preferred stocks from the screener.

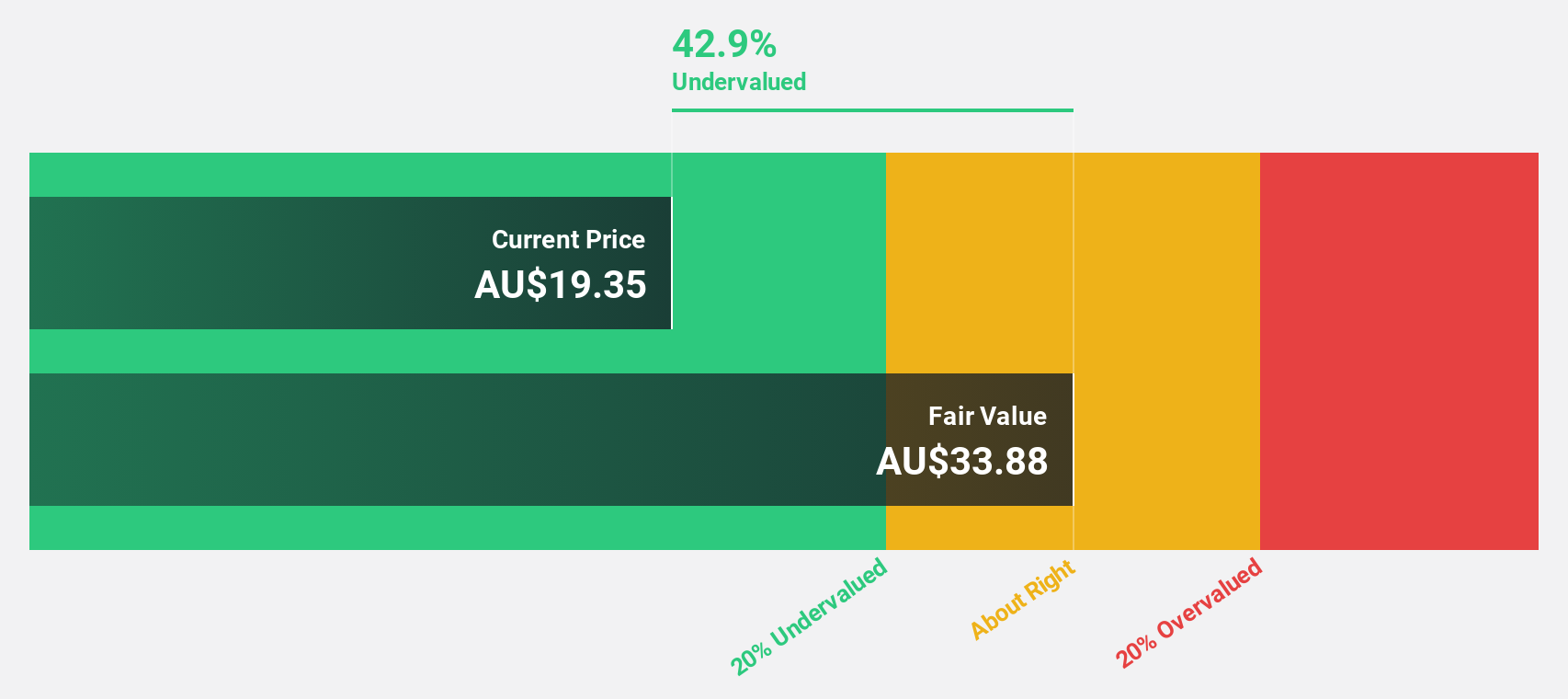

Charter Hall Group (ASX:CHC)

Overview: Charter Hall Group (ASX:CHC) is Australia’s leading fully integrated diversified property investment and funds management group, with a market cap of A$8.93 billion.

Operations: The company's revenue is derived from three main segments: Funds Management (A$441.60 million), Property Investments (A$332.50 million), and Development Investments (A$45.30 million).

Estimated Discount To Fair Value: 44.3%

Charter Hall Group is trading at A$18.87, significantly below its estimated fair value of A$33.88, suggesting it may be undervalued based on discounted cash flow analysis. Despite low forecasted return on equity (14.1%), expected annual profit and revenue growth rates of 30.45% and 13.6% respectively exceed market averages, indicating potential for above-market performance over the next three years. Recent M&A discussions highlight Charter Hall's strategic interest in expanding its portfolio but also underscore competitive pressures in the sector.

- According our earnings growth report, there's an indication that Charter Hall Group might be ready to expand.

- Dive into the specifics of Charter Hall Group here with our thorough financial health report.

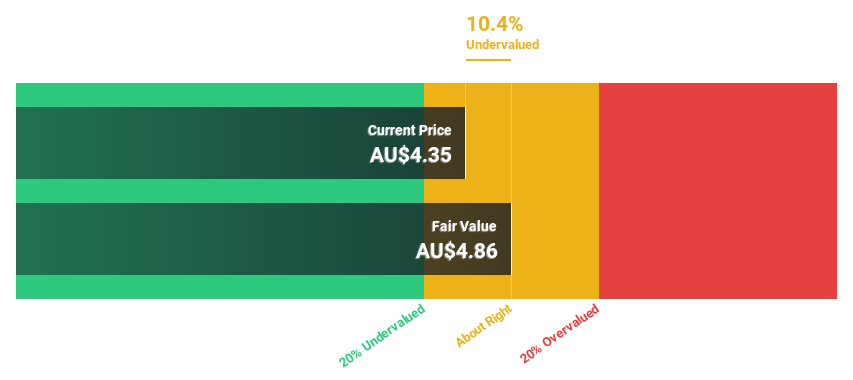

Catalyst Metals (ASX:CYL)

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties in Australia, with a market cap of A$1.82 billion.

Operations: The company's revenue segments include A$93.77 million from Tasmania and A$315.38 million from Western Australia.

Estimated Discount To Fair Value: 42.5%

Catalyst Metals, trading at A$7.22, is valued significantly below its estimated fair value of A$12.56, highlighting potential undervaluation based on cash flow analysis. With earnings expected to grow 33.1% annually—outpacing the Australian market—and revenue projected to rise 20.9% per year, Catalyst demonstrates strong growth prospects. The recent A$150 million equity offering bolsters financial flexibility for projects like the Trident Gold Project, which is poised to generate positive net cash flows and reduce upfront capital requirements.

- The growth report we've compiled suggests that Catalyst Metals' future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Catalyst Metals.

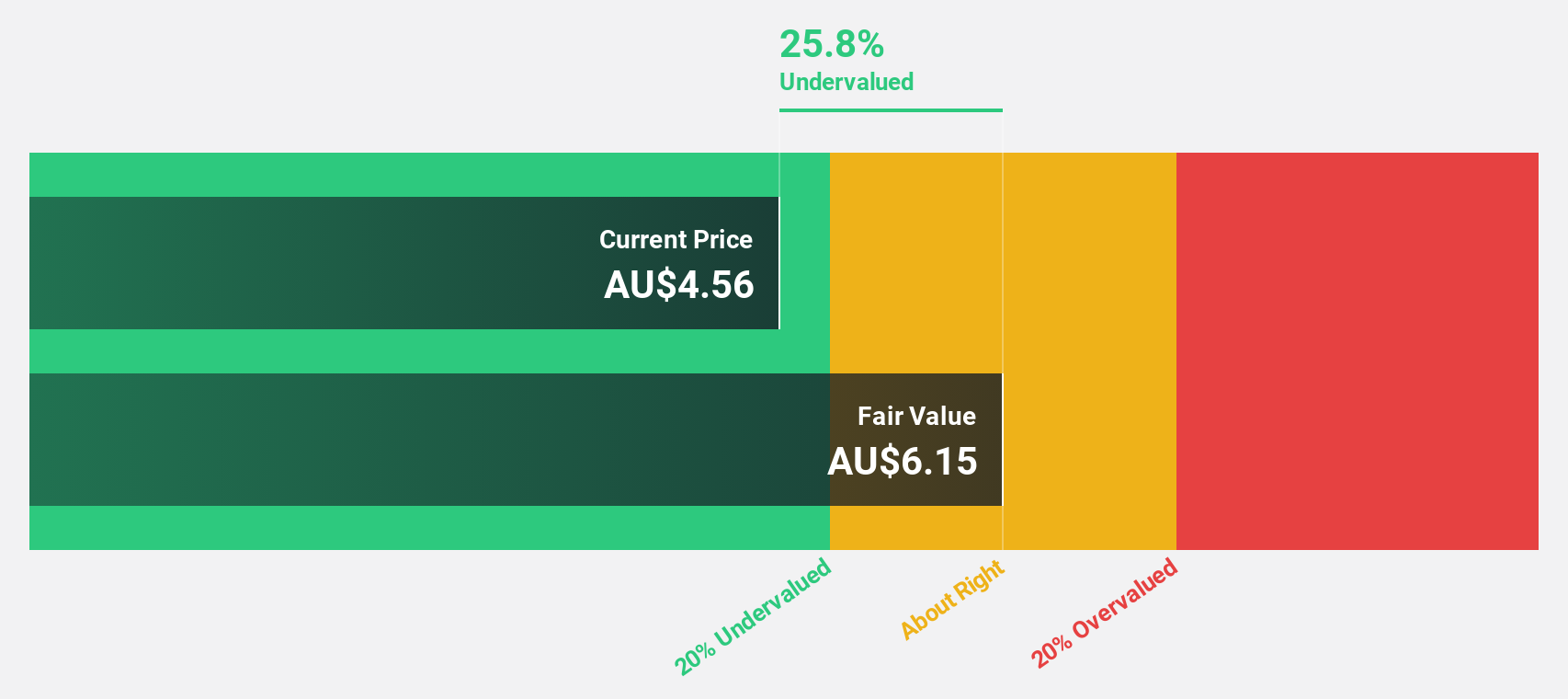

Genesis Minerals (ASX:GMD)

Overview: Genesis Minerals Limited focuses on the exploration, production, and development of gold deposits in Western Australia and has a market cap of A$5.63 billion.

Operations: The company generates revenue of A$561.40 million from its activities in mineral production, exploration, and development.

Estimated Discount To Fair Value: 20.1%

Genesis Minerals, trading at A$4.98, is significantly undervalued with an estimated fair value of A$6.23, driven by strong cash flow potential. Recent profitability and forecasted earnings growth of 23.34% annually outpace the Australian market's average growth rate. The company's ASPIRE 400 strategy is supported by updated Mineral Resources and Ore Reserves estimates, emphasizing high-grade deposits like Gwalia and Tower Hill, which underpin future production expansion and cash flow generation capabilities.

- Insights from our recent growth report point to a promising forecast for Genesis Minerals' business outlook.

- Navigate through the intricacies of Genesis Minerals with our comprehensive financial health report here.

Next Steps

- Unlock more gems! Our Undervalued ASX Stocks Based On Cash Flows screener has unearthed 31 more companies for you to explore.Click here to unveil our expertly curated list of 34 Undervalued ASX Stocks Based On Cash Flows.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:GMD

Genesis Minerals

Engages in the exploration, production, and development of gold deposits in Western Australia.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives