- United States

- /

- Beverage

- /

- NasdaqCM:CELH

Celsius Holdings (CELH) Sees Surge in Q2 Sales to US$739 Million, Income Rises

Reviewed by Simply Wall St

Celsius Holdings (CELH) recently reported a robust Q2 performance, with sales jumping to $739 million and net income rising to $100 million. These results, combined with improved EPS, could have played a role in the company's 36% price increase over the last quarter. The market also saw gains, suggesting that Celsius's performance was in line with broader market trends. The company's decision to increase authorized shares points to potential growth strategies. Meanwhile, the increase in stock price might have been bolstered by the overall positive market sentiment, as major indexes posted weekly gains amid easing economic concerns.

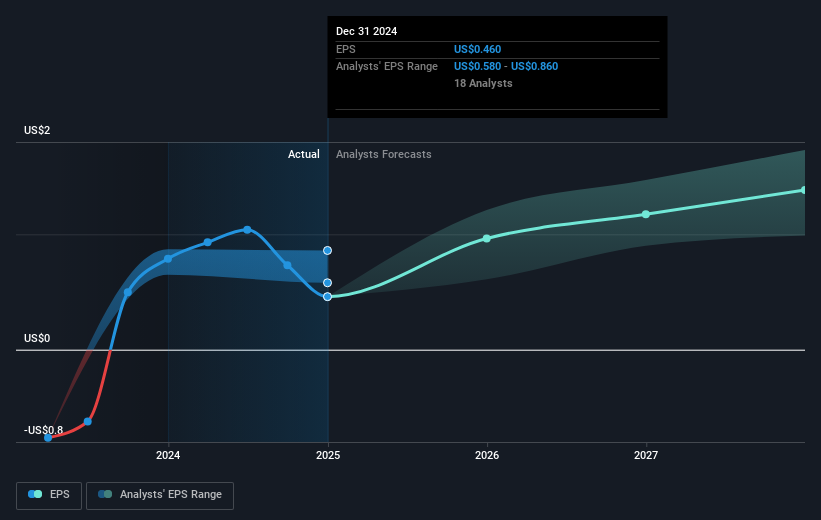

The recent positive developments at Celsius Holdings (CELH), such as an impressive Q2 sales surge and a substantial increase in net income, align with their growth strategy and could fuel further expansion initiatives. These results may influence the company’s revenue and earnings forecasts positively, especially given their increased sales target and broader market presence outlined in their recent narrative. The share price movement, which has seen a 36% increase over the last quarter, nearing the consensus price target of $50.57, highlights the market's reaction to the company's strong quarterly performance and growth outlook.

Over a longer five-year period, Celsius Holdings has achieved a very large total shareholder return of 598.70%, reflecting its robust growth and investor confidence in its expansion strategy. Relative to the US Beverage industry, CELH outperformed significantly in the past year, contrasting with the industry's decline of 4.5%. The recent share price adjustments suggest that CELH's stock is attracting significant interest in light of potential future growth, further pushed by international market expansion and improved operational efficiency, amid easing competitive pressures in the industry.

Review our historical performance report to gain insights into Celsius Holdings' track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:CELH

Celsius Holdings

Develops, processes, manufactures, markets, sells, and distributes functional energy drinks in the United States, North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives