- United States

- /

- Hospitality

- /

- NYSE:CCL

Carnival Corporation & (NYSE:CCL) Announces €1 Billion Note Offering to Refinance Debt

Reviewed by Simply Wall St

Carnival Corporation & (NYSE:CCL) recently announced a private offering of €1 billion in senior unsecured notes, a strategic move to manage its debt and enhance financial flexibility by extending maturities. This announcement coincides with a 41% increase in the company's share price over the last quarter. The broader market has seen significant gains, with indices like the S&P 500 and Nasdaq reaching new highs. Carnival's inclusion in multiple indices and strong Q2 earnings, showing remarkable growth in net income and sales, likely provided additional momentum to its stock price during this rally.

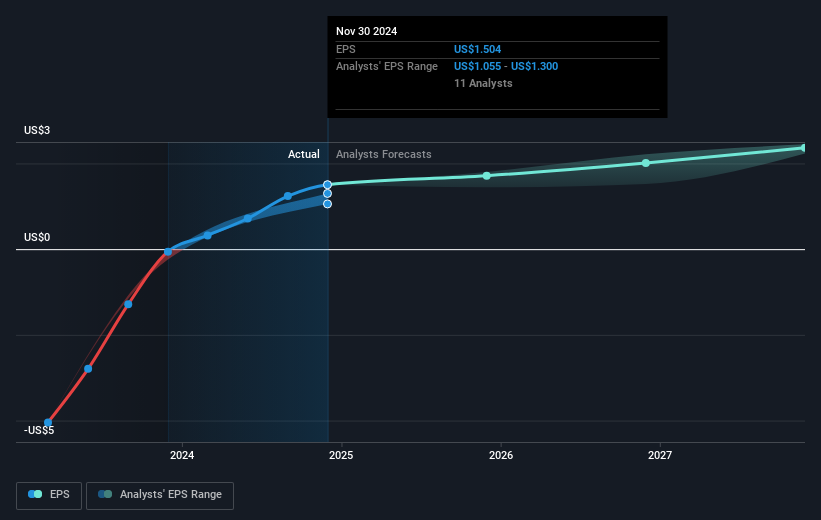

Carnival Corporation's recent move to issue €1 billion in senior unsecured notes mirrors its efforts to manage debt and bolster financial flexibility, which dovetails with its strategy of fleet modernization and expansion into private destinations. This initiative is poised to support a strengthened guest experience, facilitating sustained revenue and margin growth as outlined in the narrative. Analysts forecast that revenue will grow by 3.3% annually over the coming three years, with anticipated earnings rising from US$2.5 billion currently to US$3.6 billion by mid-2028. Such maneuvers are crucial, considering analysts believe these actions are necessary to meet a consensus price target of US$30.60, whereas the current share price stands at US$25.70.

Over the past three years, Carnival's total shareholder return was 209.07%, reflecting a recovery from the sector's previous challenges. While the company has outperformed the broader US Hospitality industry, which saw a 21.5% return over the past year, its significant longer-term gains highlight robust business performance and market sentiment recovery. Within this context, the company's share price remains at a discount to the analyst price target, suggesting potential upside if Carnival achieves its projected earnings growth and margin expansion. Yet, investors should remain aware of geopolitical and economic factors that could impact the forecasts and their assumptions.

Explore Carnival Corporation &'s analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CCL

Carnival Corporation &

A cruise company, provides leisure travel services in North America, Australia, Europe, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives