- United States

- /

- Healthcare Services

- /

- NYSE:CAH

Cardinal Health (NYSE:CAH) Launches Innovative Single-Patient Monitoring System to Enhance Patient Care

Reviewed by Simply Wall St

Cardinal Health (NYSE:CAH) recently launched the Kendall DL™ Multi System, a notable advancement in patient monitoring technology aimed at improving clinical efficiency and patient safety. Accompanied by a dividend increase to $0.51 per share, the company's stock experienced a 22% rise over the last quarter. Earnings growth, with Q3 sales closely matching the previous year but net income nearly doubling, also supported this upward trajectory. The company’s stock buyback efforts and new distribution partnership with Telix Pharmaceuticals added further momentum, aligning with a generally rising market that saw a 13% gain over the past 12 months.

The introduction of the Kendall DL™ Multi System, along with recent strategic actions, aligns with Cardinal Health's long-term focus on bolstering clinical efficiency and patient safety. These steps could enhance revenue streams by tapping into high-margin markets, potentially supporting sustained earnings. The dividend increase and stock buyback, paired with the strong Q3 earnings, underscore Cardinal Health's commitment to shareholder returns, while the partnership with Telix Pharmaceuticals may drive further opportunities in specialty segments.

Over the past five years, Cardinal Health's total return, including share price appreciation and dividends, has surged by 210.48%. This performance needs to be contextualized against the company's more moderate one-year performance, surpassing both the US market's 11.9% rise and the healthcare industry's 19.6% decline. Such a pattern highlights its resilience and market positioning.

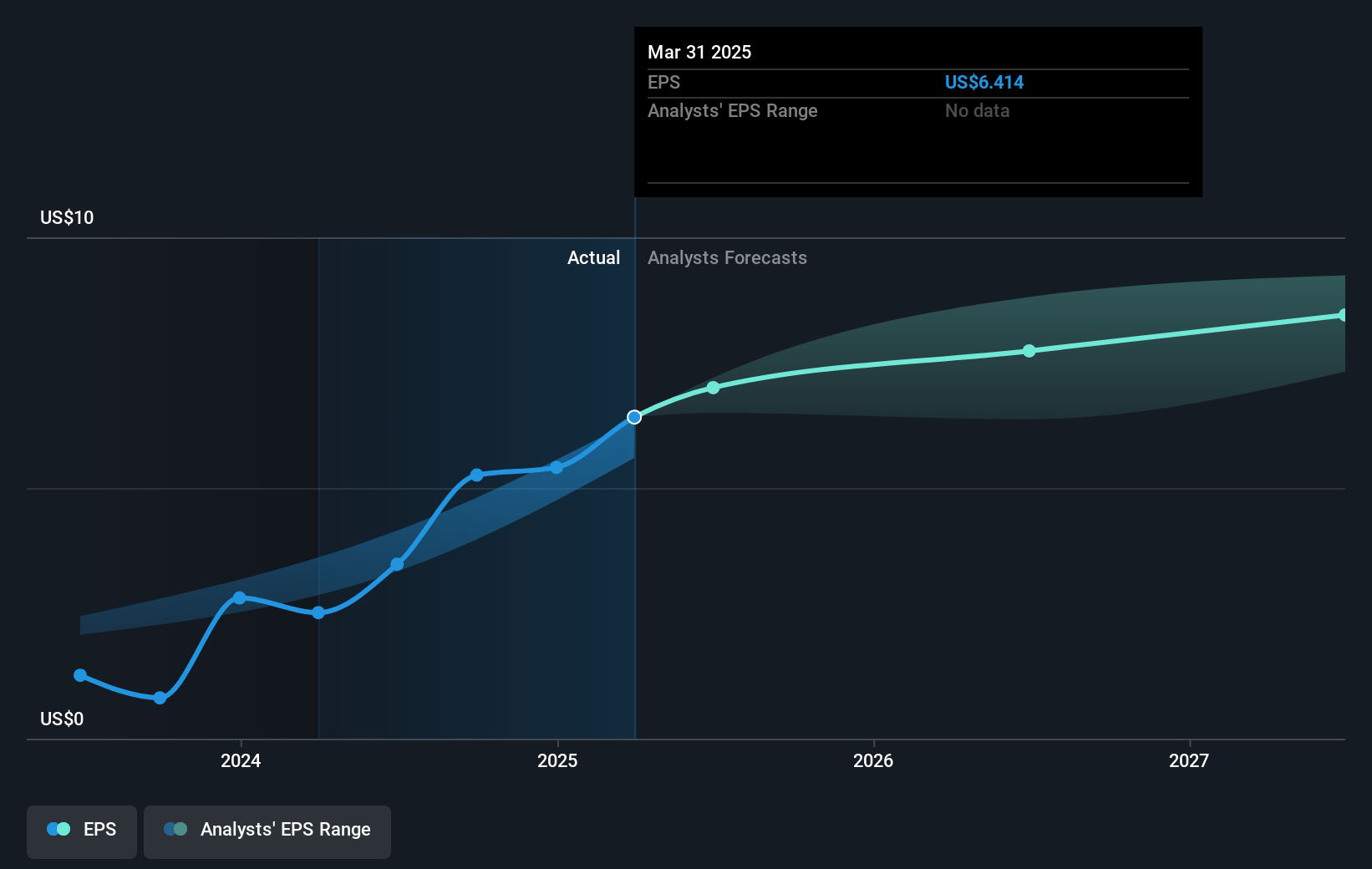

The recent news may positively impact revenue and earnings projections. The ongoing expansion into high-margin sectors and recent acquisitions could fortify future financial performance. However, analysts currently anticipate revenues to grow annually by 7.3%, with profit margins stable at 0.7%. The publication of a consensus price target of US$154.74, close to the current share price of US$151.69, suggests analysts view Cardinal Health's shares as fairly valued. This indicates limited upside in the short term, but provides a benchmark for assessing the company's strategic initiatives' effectiveness over time.

Learn about Cardinal Health's future growth trajectory here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CAH

Cardinal Health

Operates as a healthcare services and products company in the United States, Canada, Europe, Asia, and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives