- India

- /

- Consumer Finance

- /

- NSEI:CAPTRUST

Capital Trust Limited (NSE:CAPTRUST) Not Doing Enough For Some Investors

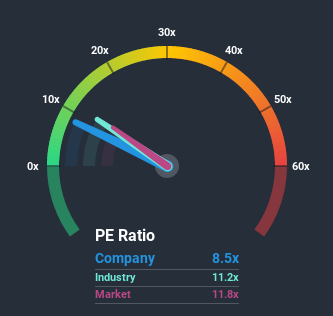

Capital Trust Limited's (NSE:CAPTRUST) price-to-earnings (or "P/E") ratio of 8.5x might make it look like a buy right now compared to the market in India, where around half of the companies have P/E ratios above 12x and even P/E's above 27x are quite common. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

For example, consider that Capital Trust's financial performance has been pretty ordinary lately as earnings growth is non-existent. One possibility is that the P/E is low because investors think this benign earnings growth rate will likely underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Capital Trust

Does Growth Match The Low P/E?

In order to justify its P/E ratio, Capital Trust would need to produce sluggish growth that's trailing the market.

Taking a look back first, we see that there was hardly any earnings per share growth to speak of for the company over the past year. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 58% drop in EPS. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to decline by 2.8% over the next year, or less than the company's recent medium-term annualised earnings decline.

With this information, it's not too hard to see why Capital Trust is trading at a lower P/E in comparison. However, when earnings shrink rapidly P/E often shrinks too, which could set up shareholders for future disappointment regardless. Even just maintaining these prices will be difficult to achieve as recent earnings trends are already weighing down the shares heavily.

What We Can Learn From Capital Trust's P/E?

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Capital Trust maintains its low P/E on the weakness of its recentthree-year earnings being even worse than the forecasts for a struggling market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Although, we would be concerned whether the company can even maintain its medium-term level of performance under these tough market conditions. In the meantime, unless the company's relative performance improves, the share price will hit a barrier around these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Capital Trust (1 can't be ignored!) that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

If you decide to trade Capital Trust, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account.Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:CAPTRUST

Capital Trust

A non-banking finance company, provides capital magic, micro business, and digital loans primarily in India.

Moderate with mediocre balance sheet.

Market Insights

Community Narratives