- Canada

- /

- Metals and Mining

- /

- TSX:DPM

Can You Imagine How Dundee Precious Metals's (TSE:DPM) Shareholders Feel About The 43% Share Price Increase?

The simplest way to invest in stocks is to buy exchange traded funds. But you can significantly boost your returns by picking above-average stocks. For example, the Dundee Precious Metals Inc. (TSE:DPM) share price is up 43% in the last year, clearly besting than the market return of around -3.8% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Also impressive, the stock is up 30% over three years, making long term shareholders happy, too.

Check out our latest analysis for Dundee Precious Metals

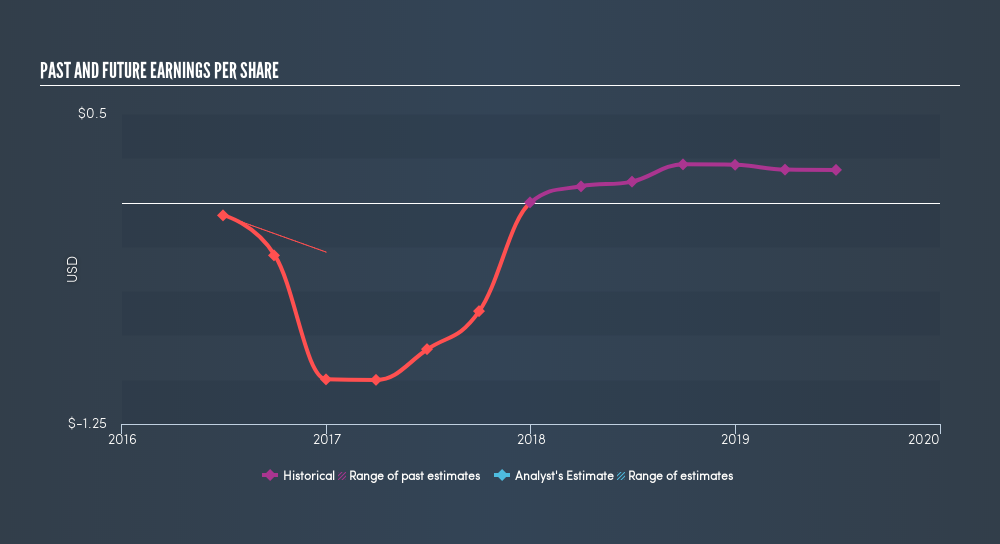

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Dundee Precious Metals was able to grow EPS by 56% in the last twelve months. This EPS growth is significantly higher than the 43% increase in the share price. Therefore, it seems the market isn't as excited about Dundee Precious Metals as it was before. This could be an opportunity.

It is of course excellent to see how Dundee Precious Metals has grown profits over the years, but the future is more important for shareholders. You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

It's nice to see that Dundee Precious Metals shareholders have received a total shareholder return of 43% over the last year. Notably the five-year annualised TSR loss of 2.3% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. Before spending more time on Dundee Precious Metals it might be wise to click here to see if insiders have been buying or selling shares.

Of course Dundee Precious Metals may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About TSX:DPM

Dundee Precious Metals

A gold mining company, engages in the acquisition, exploration, development, mining, and processing of precious metals.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives