- United States

- /

- Semiconductors

- /

- NasdaqGS:AVGO

Broadcom (NasdaqGS:AVGO) Enhances VMware Tanzu CloudHealth With AI-Powered FinOps Features

Reviewed by Simply Wall St

Broadcom (NasdaqGS:AVGO) announced significant enhancements to its VMware Tanzu CloudHealth platform, including AI-powered tools like Intelligent Assist and Smart Summary, aiming to refine cloud financial management capabilities. This aligns with the company's broader emphasis on innovation. Broadcom's third-generation optical products also mark strides in supporting AI applications. During the last quarter, its stock price increased by 29%, which could reflect broader positive market trends, including robust tech sector performance, rather than being solely attributable to the company's specific developments. The overall market conditions have shown resilience with tech stocks generally performing well amidst easing tariff concerns.

The recent enhancements to Broadcom's VMware Tanzu CloudHealth platform, including AI-powered tools, highlight the company's dedication to driving innovation. This aligns with Broadcom's ongoing investment in AI technology and hyperscale partnerships, as outlined in the narrative. These initiatives are expected to enhance technological leadership, potentially boosting future revenue and margins. However, it's crucial to consider Broadcom's reliance on a few hyperscale customers and geopolitical risks, which could affect projected AI revenues. This balanced approach to risk and innovation may increase the company's ability to achieve robust growth targets in the near term.

Over the past five years, Broadcom's total shareholder return was very large at 766.17%. In comparison, over the previous year, its performance surpassed both the US Semiconductor industry, which returned 9.8%, and the broader US market, which returned 11.5%. These figures depict Broadcom's substantial long-term growth, highlighting its ability to deliver impressive returns amidst varying market conditions.

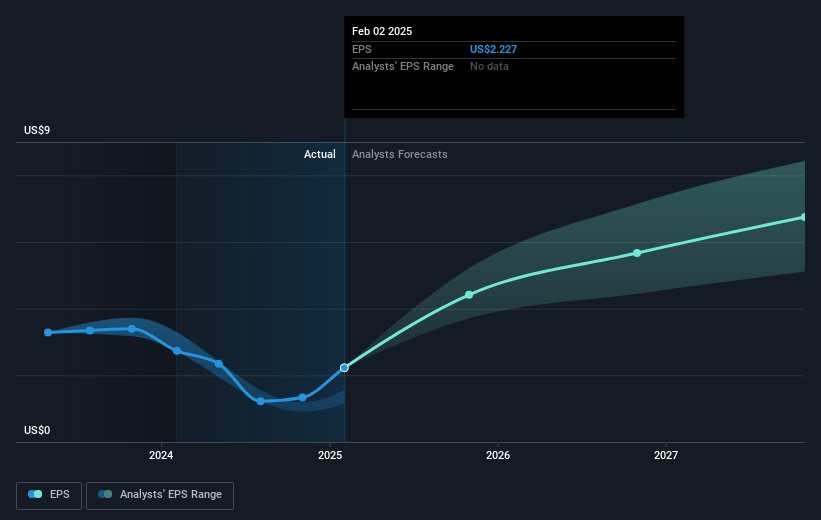

With a current stock price of US$200.09, matched against an analyst consensus price target of US$238.54, the recent price movement indicates confidence in Broadcom's strategic initiatives. The new AI-focused developments, which might enhance cloud financial management, could significantly impact revenue and earnings forecasts. Analysts anticipate revenue and earnings growth over the coming years, bolstered by Broadcom's transition toward subscription models and expanding AI customer base.

Our valuation report here indicates Broadcom may be overvalued.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Broadcom might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:AVGO

Broadcom

Designs, develops, and supplies various semiconductor devices with a focus on complex digital and mixed signal complementary metal oxide semiconductor based devices and analog III-V based products worldwide.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives