- United Kingdom

- /

- Chemicals

- /

- OFEX:SNOX

Brickability Group And 2 Other UK Penny Stocks To Watch

Reviewed by Simply Wall St

The UK stock market has recently experienced some turbulence, with the FTSE 100 index closing lower amid concerns about weak trade data from China. In such fluctuating conditions, investors often seek opportunities beyond the well-trodden paths of blue-chip stocks. Penny stocks, despite their somewhat outdated moniker, remain an intriguing area for investment; these smaller or newer companies can offer surprising value and potential returns when built on solid financial foundations.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.675 | £523.4M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.14 | £172.88M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.755 | £11.4M | ✅ 2 ⚠️ 2 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.08 | £14.86M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.40 | £30.45M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.57 | $331.36M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.54 | £260.38M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.45 | £70.04M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.09 | £173.97M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.785 | £10.81M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 297 stocks from our UK Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Brickability Group (AIM:BRCK)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Brickability Group Plc is a UK-based company that, along with its subsidiaries, distributes specialist products and services to the construction industry through its Bricks and Building Materials, Importing, Distribution, and Contracting segments, with a market cap of £182.98 million.

Operations: The company's revenue is primarily generated from its Bricks and Building Materials segment (£426.12 million), followed by Contracting (£98.59 million), Importing (£69.90 million), and Distribution (£68.75 million).

Market Cap: £182.98M

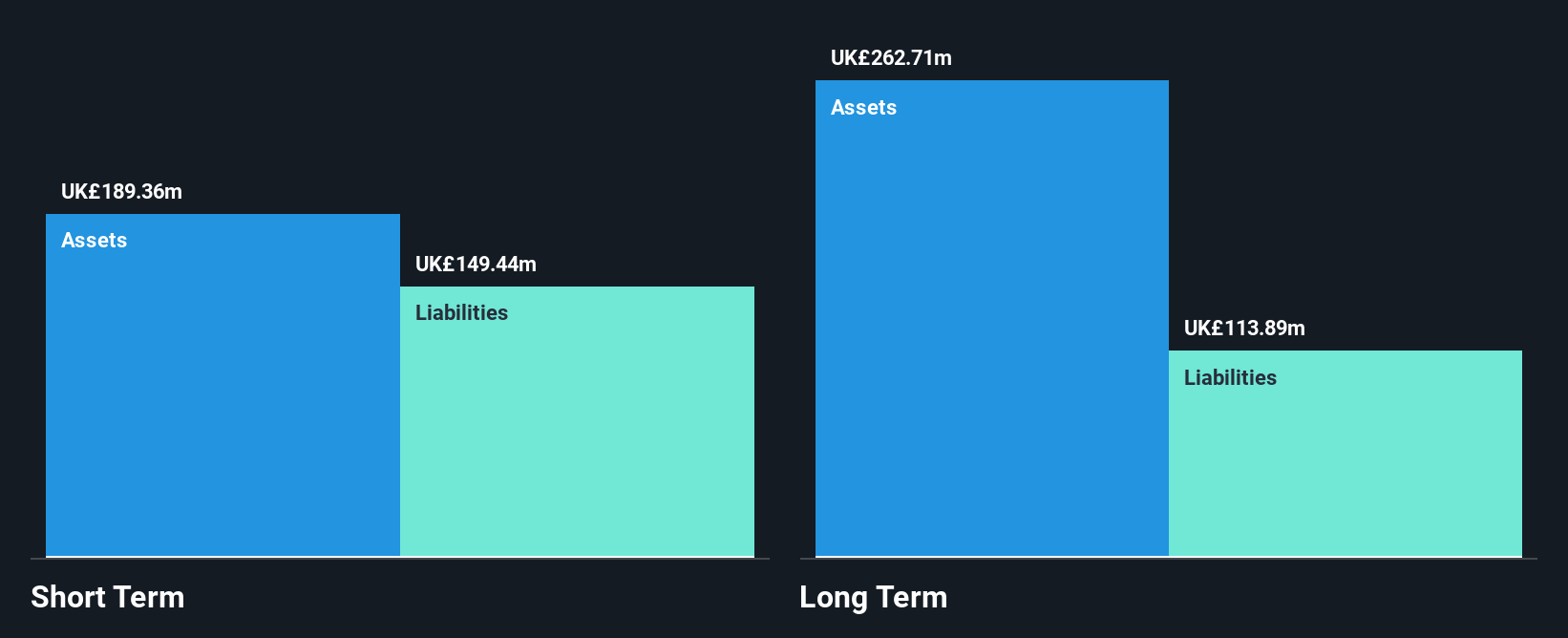

Brickability Group is currently trading at a discount, 37.9% below its estimated fair value, which may attract investors seeking undervalued opportunities. Despite its satisfactory net debt to equity ratio of 29.8%, the company faces challenges with negative earnings growth and a low return on equity of 3.5%. Recent financials were impacted by a £7.5 million one-off loss, and profit margins have decreased to 1%. While short-term assets cover both short and long-term liabilities, the management team is relatively new with an average tenure of just 1.5 years, following recent board changes in September 2025.

- Jump into the full analysis health report here for a deeper understanding of Brickability Group.

- Review our growth performance report to gain insights into Brickability Group's future.

Netcall (AIM:NET)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Netcall plc designs, develops, sells, and supports software products and services in the United Kingdom with a market cap of £198.46 million.

Operations: The company generates £47.96 million in revenue from its software products and services segment.

Market Cap: £198.46M

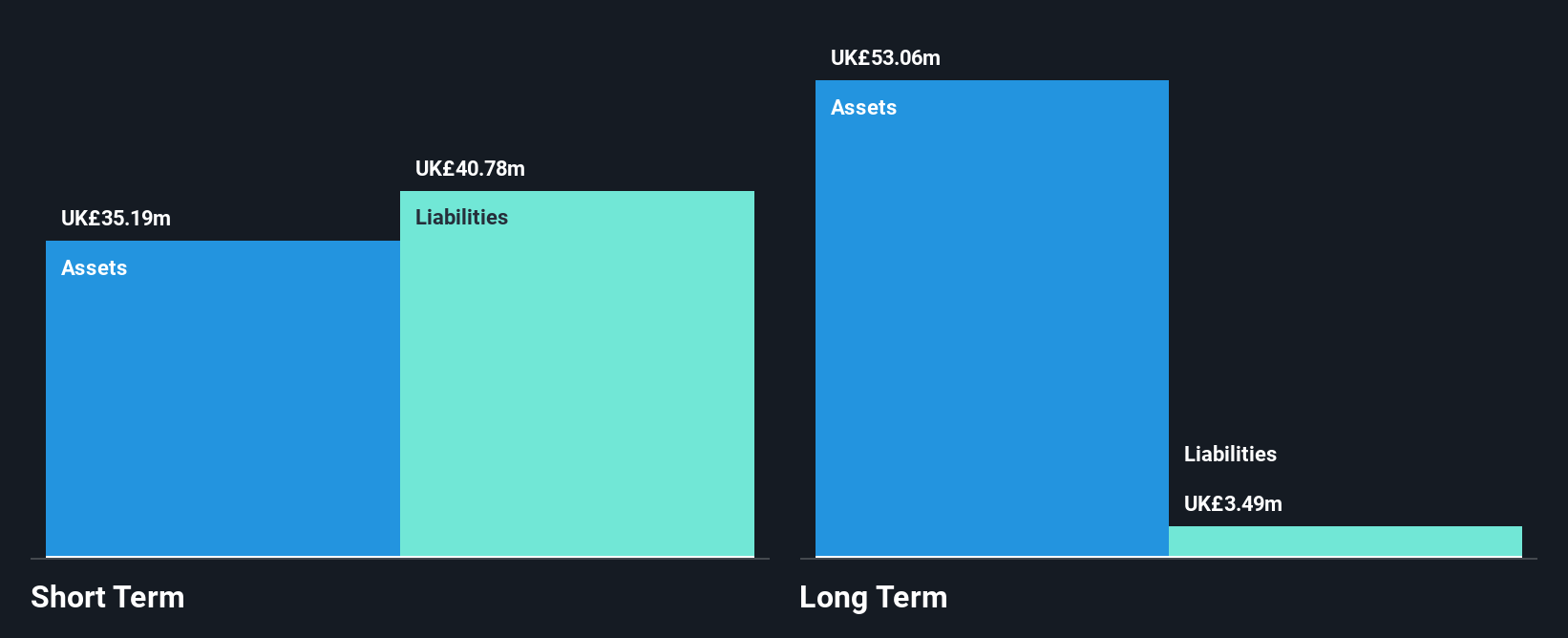

Netcall plc, with a market cap of £198.46 million, reported annual revenue of £47.96 million but experienced a decline in net income to £4.05 million from the previous year. Despite being debt-free and having seasoned management, the company faces challenges with its short-term liabilities exceeding assets and negative earnings growth over the past year. Its return on equity remains low at 9.2%. The board proposed a final dividend increase to 0.94 pence per share, reflecting stable shareholder returns despite recent financial pressures and significant insider selling over the last quarter raises concerns about internal confidence in future performance.

- Get an in-depth perspective on Netcall's performance by reading our balance sheet health report here.

- Explore Netcall's analyst forecasts in our growth report.

SulNOx Group (OFEX:SNOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SulNOx Group PLC, with a market cap of £49.18 million, produces and develops fuel emulsifier technologies in the United Kingdom and internationally.

Operations: The company generates revenue primarily from its Specialty Chemicals segment, amounting to £1.12 million.

Market Cap: £49.18M

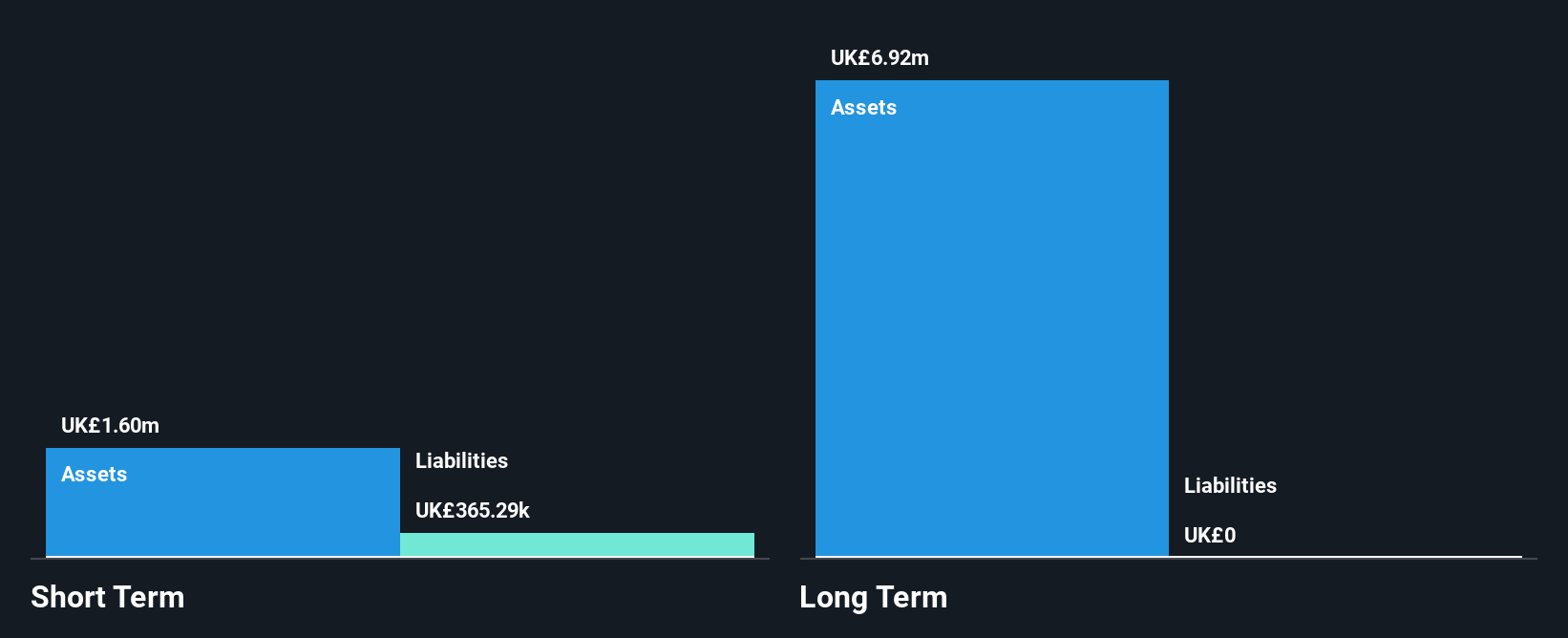

SulNOx Group PLC, with a market cap of £49.18 million, is pre-revenue, generating £1.12 million in sales primarily from its Specialty Chemicals segment. Despite being debt-free and having an experienced board, the company faces challenges with negative return on equity (-47.22%) and increasing net losses (£4.21 million). Recent auditor concerns about its ability to continue as a going concern add to the risks associated with its volatile share price and unprofitable status. However, SulNOx's agreement with C-Quip Ltd aims to expand market reach for its fuel efficiency products amidst tightening environmental regulations.

- Click here to discover the nuances of SulNOx Group with our detailed analytical financial health report.

- Learn about SulNOx Group's historical performance here.

Taking Advantage

- Click this link to deep-dive into the 297 companies within our UK Penny Stocks screener.

- Ready To Venture Into Other Investment Styles? Uncover 16 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OFEX:SNOX

SulNOx Group

Produces and develops fuel emulsifier technologies in the United Kingdom and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives